- 72 crypto ETF filings sign rising institutional curiosity past Bitcoin and Ethereum.

- SEC’s new management underneath Atkins could fast-track ETF approvals and regulatory readability.

Because the broader crypto market experiences renewed momentum, consideration is popping to a wave of pending ETF purposes that might reshape investor entry to digital belongings.

Eric Balchunas on pending crypto ETFs

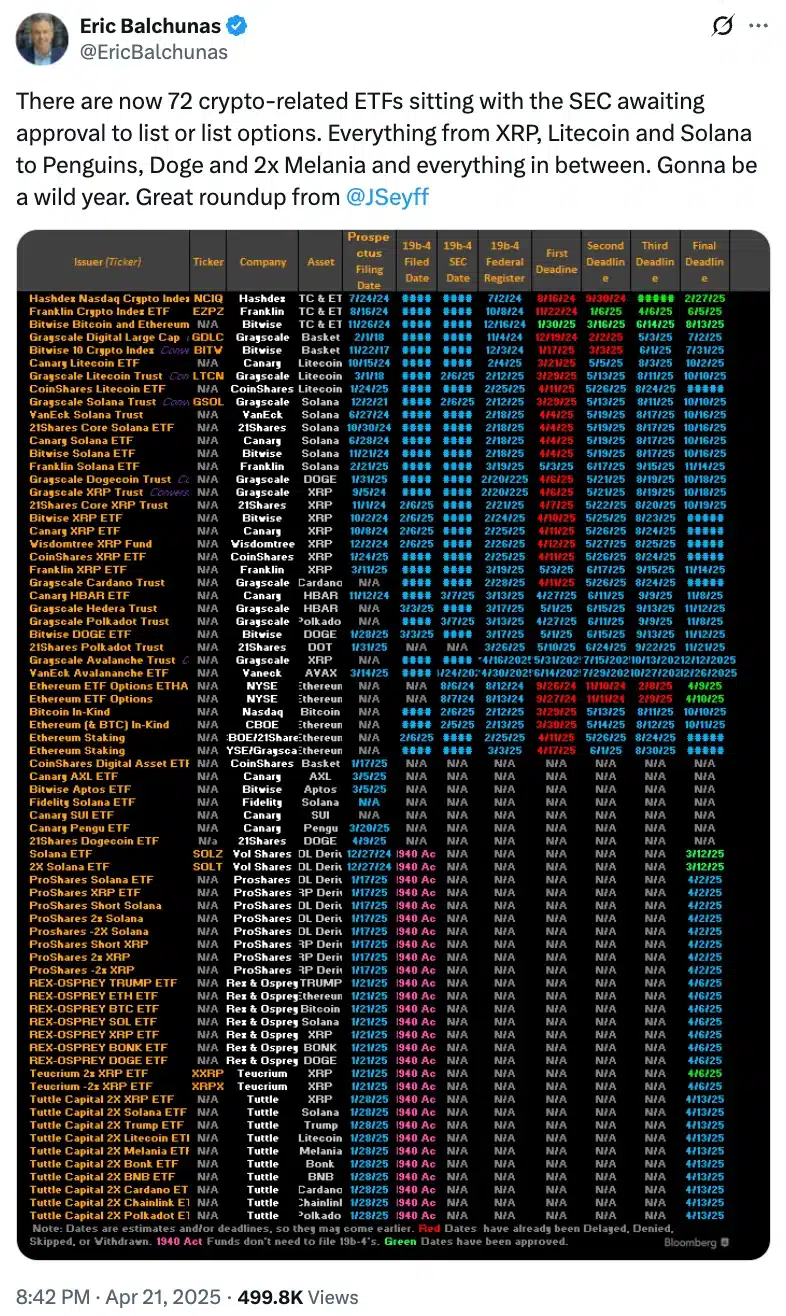

Bloomberg’s senior ETF analyst Eric Balchunas highlighted the rising variety of crypto-related ETF proposals awaiting SEC approval.

The queue at the moment stands at 72 proposals. Fellow analyst James Seyffart compiled the checklist, confirming the substantial progress in purposes.

These filings span a variety of merchandise, together with spot ETFs, options-based choices, and leveraged or inverse funds.

Notably, main belongings like Ripple [XRP], Solana [SOL], Litecoin [LTC], and Dogecoin [DOGE] are all represented.

Unexpectedly, XRP tops the checklist with 10 filings, underscoring its rising reputation amongst fund issuers amid evolving market dynamics.

Regardless of mainstream crypto ETFs different ETFs be part of the path

Whereas mainstream cryptocurrencies dominate the majority of ETF filings, there’s a noticeable shift towards merchandise impressed by web tradition and speculative tendencies.

A brand new wave of risk-heavy choices, reminiscent of leveraged and memecoin-themed ETFs, has emerged, capturing consideration for his or her daring method.

One standout is the “Melania 2x” ETF by Tuttle Capital, which exemplifies the rising urge for food for novelty-driven crypto publicity.

The filings come from a various mixture of issuers, starting from trade veterans like Bitwise, Grayscale, and VanEck to newer entrants reminiscent of Canarx, CoinShares, and Tuttle Capital.

As anticipated, the belongings featured in current ETF filings weren’t chosen arbitrarily; they mirror a mixture of sturdy market capitalization, lively person engagement, and heightened investor demand.

Solana, as an example, has drawn consideration not only for its worth efficiency but in addition for its high-speed blockchain and increasing position in NFTs and DeFi.

This evolving ETF panorama signifies that institutional curiosity is broadening past Bitcoin [BTC] and Ethereum [ETH], pointing towards a extra diversified method to digital asset publicity.

Will Paul Atkins undertake a unique technique in comparison with Gary Gensler?

That being stated, with Paul Atkins’ management, the SEC additionally seems poised to take a extra constructive method to crypto regulation, with a renewed deal with offering clearer steerage for digital asset markets.

Remarking on the identical, Atkins lately advised Congress,

“A prime precedence of my chairmanship shall be to work with my fellow commissioners and Congress to offer a agency regulatory basis for digital belongings via a rational, coherent, and principled method.”

Evidently, Atkins’ dedication to resolving longstanding trade issues marks a pointy departure from the extra inflexible stance of his predecessor, Gary Gensler.

This additionally raises optimism {that a} wave of ETF approvals might quickly speed up crypto adoption within the U.S.

In truth, whereas the U.S. steps up its crypto recreation, worldwide momentum can be increase.

South Korea, as an example, is reportedly contemplating the approval of Bitcoin ETFs ought to Japan transfer ahead with its personal regulatory easing, signaling a broader, world shift towards embracing cryptocurrency funding merchandise.