- Bitcoin’s unrealized losses proceed to dominate as BTC continues to consolidate.

- Regardless of rising losses, buyers are but to capitulate and stay optimistic.

Over the previous week, Bitcoin [BTC] has traded inside a parallel channel, consolidating between $82,000 and $86,000 with out clear course.

With the dearth of upward momentum, buyers who purchased Bitcoin at these ranges proceed to report important losses.

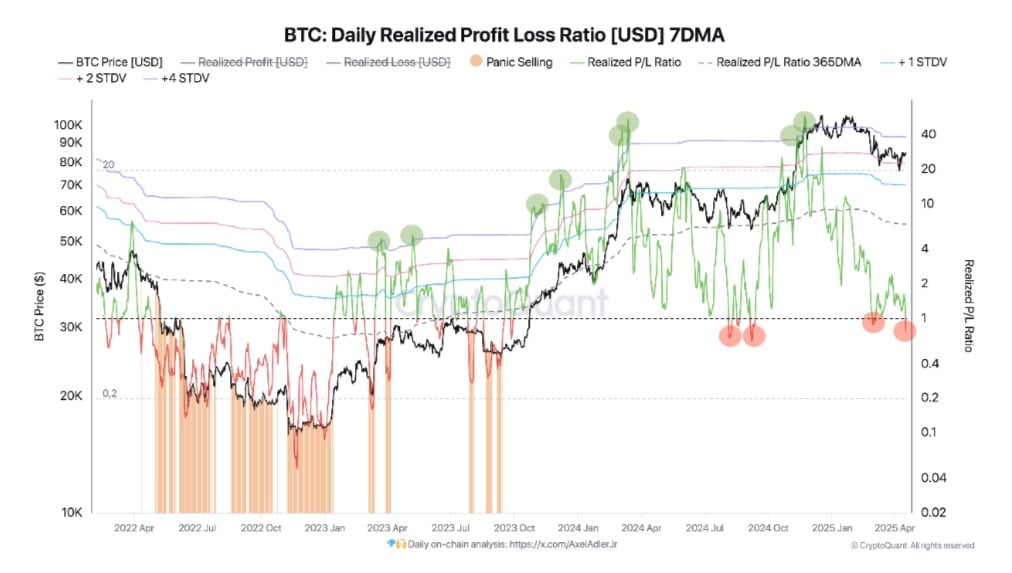

Inasmuch, in line with CryptoQuant, Bitcoin’s Realized Losses are at present dominating the market.

As such, Bitcoin’s Revenue/Loss Ratio (7DMA) has dropped under its essential stage of 1. The latest drop signifies that almost all of buyers are at present realizing losses.

These losses are mounting, particularly amongst short-term holders. In reality, Bitcoin’s Brief-term Holder SOPR has dropped under 1 to settle at 0.9 at press time.

The decline right here means that short-term holders are promoting at a loss.

On high of that, Bitbo information confirmed that STHs confronted Unrealized Losses. Their Realized Value stood at $92,174—far above present spot costs close to $84,000.

Nevertheless, it’s value noting that the drop doesn’t essentially sign a full-blown capitulation however slightly a part of doubt or potential accumulation.

Taking a look at earlier cycles, we are able to observe that at any time when the ratio reached the +4 STDV deviation from the 365DMA, a neighborhood market high persistently fashioned, adopted by a short-term correction in the course of the bull part.

With a excessive stage of uncertainty prevailing within the markets, there’s a higher likelihood {that a} capitulation part could unfold, doubtlessly driving realized losses even greater.

Is capitulation forward for BTC?

Though unrealized losses are dominating, buyers haven’t turned to promoting. Quite the opposite, buyers are optimistic and anticipate Bitcoin costs to maneuver greater within the close to workforce.

For example, Bitcoin’s Fund Stream Ratio fell from 0.13 to 0.06 over 4 days—indicating fewer alternate deposits from retail buyers.

Furthermore, whale habits echoed this restraint. The alternate whale ratio dropped from 0.51 to 0.37, implying whales have been staying put—and even accumulating.

What comes subsequent?

In conclusion, though unrealized losses proceed to rise, buyers have but to capitulate. As such, Bitcoin holders are hopeful and anticipate costs to regain greater ranges.

If these sentiments can maintain, we may see Bitcoin reclaim $86078. Nevertheless, if STH begins to promote to keep away from extra losses, BTC will retrace to the decrease boundary of the consolidation channel round $82800.