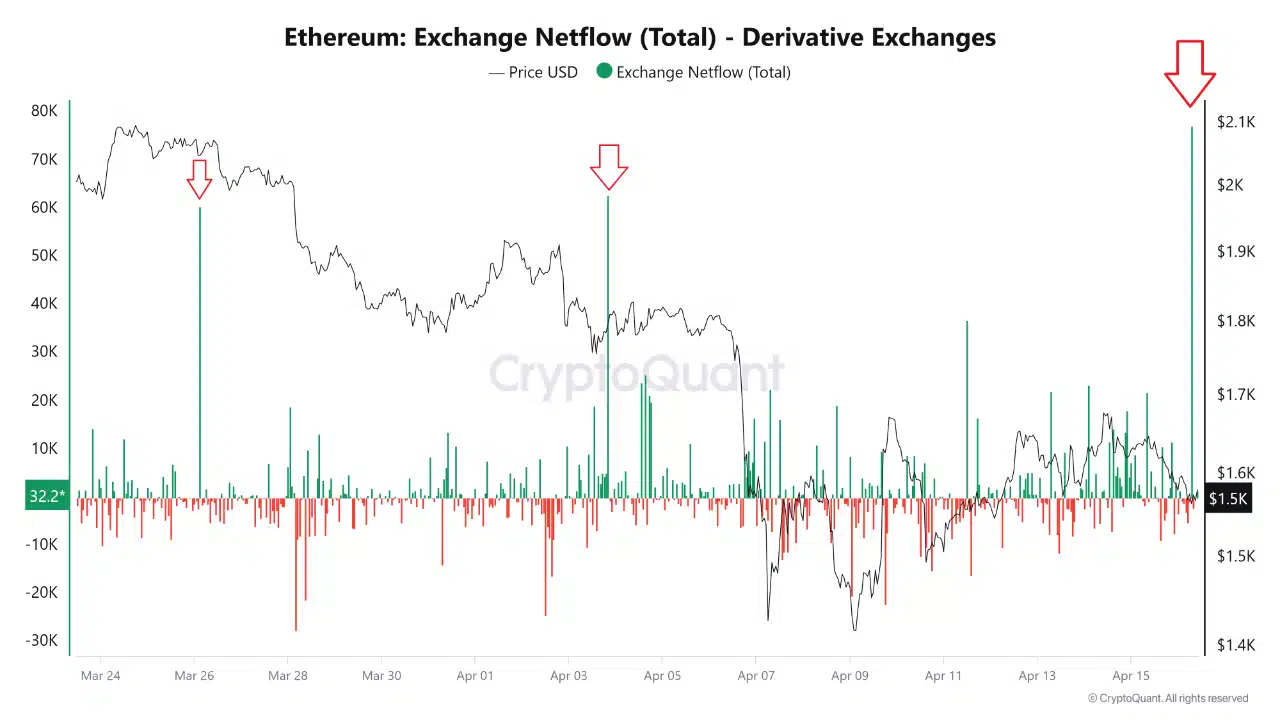

An enormous transfer: 77K ETH hits derivatives

On the sixteenth of April, over 77,000 ETH flooded into spinoff exchanges — Ethereum’s largest single-day internet influx in months.

This makes the earlier spikes of 65K ETH on the twenty sixth of March and 60K ETH on the third of April appear like chump change.

The sudden surge, proven clearly within the chart, represents a significant increase in supply coming into markets usually used for leverage, hedging, or hypothesis.

Crucially, Ethereum’s worth hovered round $1.5K throughout the influx — its lowest degree since late 2023 — indicating that this motion isn’t pushed by euphoria, however probably warning.

With markets nonetheless rattled by uncertainty, such a scale of influx suggests institutional gamers are repositioning — and probably making ready for extra draw back.

Bearish repeats

Ethereum’s newest spike in derivatives influx mirrors two prior occasions — the twenty sixth of March and the third of April — each of which preceded notable worth declines.

These inflows correlate with rising bearish sentiment, as merchants transfer ETH to spinoff platforms to open shorts or protecting hedges.

The sample is obvious: massive ETH inflows trigger market retreats. What’s totally different now’s the dimensions and context.

This week’s surge follows China’s retaliatory tariffs, which have sparked a broader risk-off sentiment throughout world markets.

If historical past repeats, ETH might see additional weak point; but when macro circumstances stabilize, this influx may mark capitulation on the backside, not a prelude to extra ache.