- Bitcoin remains to be holding above $80k as traders search for security in unsure markets

- Metrics indicated that 77% of holders wer in revenue, with netflows backing robust sentiments

The world economic system continues to tread on shaky floor. Commerce relationships are evolving, inflation has not but been utterly eradicated, and the inventory markets are simply beginning to present cracks. And but, exhausting belongings like Gold and Bitcoin are silently stealing the highlight.

In actual fact, Gold went on to hit a brand new all-time excessive of $3,300 on the charts. Onerous on its heels, BTC stays nicely above the $80k worth degree. The 2 are transferring in sync and for good purpose – Buyers are searching for security.

With conventional belongings shedding their edge, Bitcoin appears to be making its case as a critical safe-haven contender.

Buyers are eyeing BTC in unsure occasions

Buyers look like responding to international uncertainty by transferring capital into belongings that protect worth. Gold has historically performed that position, however Bitcoin is quick catching up. Its decentralization and international liquidity are making it a sexy hedge.

With equities going through potential draw back and international monetary coverage nonetheless unsettled, BTC is now being thought of by some as “digital gold.” Its efficiency throughout current inventory sell-offs additional bolstered this sentiment.

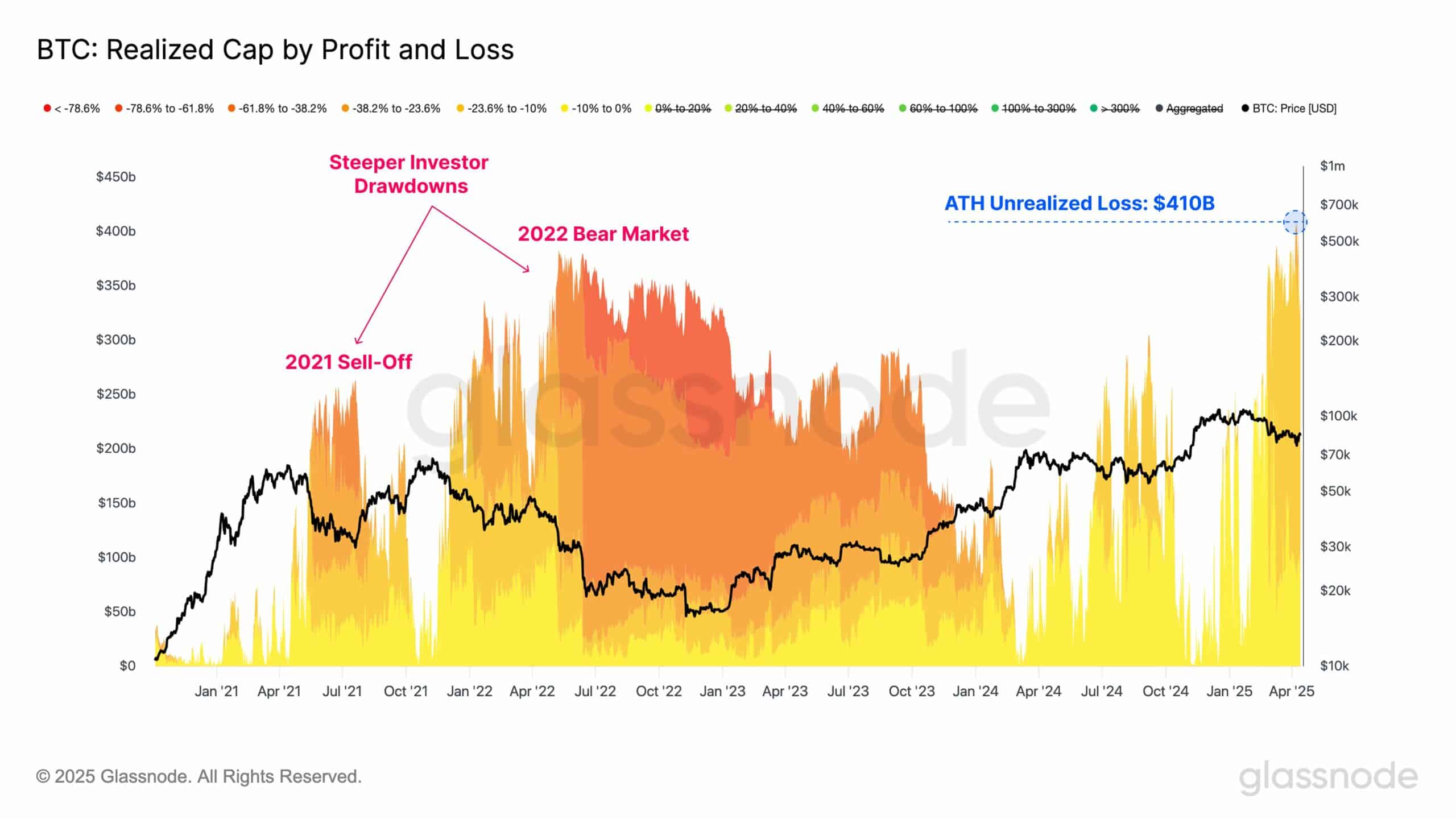

With the crypto recording all-time excessive inflows and lowered unrealized losses, the variety of massive investments on the present dip might push its costs increased. The final time Bitcoin recorded such a excessive quantity on unrealized losses was in the course of the 2021 sell-off and 2022 bear markets.

Each occasions have been adopted by a major bullish rally on the charts.

Metrics again the bullish case

Based on IntoTheBlock, on-chain metrics additionally indicated rising confidence. On the time of writing, Bitcoin’s change netflows stood at at 52%. That meant that extra BTC is being withdrawn from exchanges than deposited – A sign of investor intent to carry, reasonably than promote.

In actual fact, the information confirmed that 77% of all Bitcoin addresses could also be in revenue. This degree of profitability usually enhances holder sentiment and helps worth stability, and even additional upside momentum.

So long as there may be financial uncertainty and religion in conventional markets stays unstable, Bitcoin might proceed to reap huge. To stay above $80k isn’t just a matter of worth – It’s sentiment. Consumers merely see worth in BTC as we speak.

With Gold and Bitcoin each red-hot, the safe-haven narrative is constructing momentum. If this continues, Bitcoin cannot solely stay in step, it might hit new highs.