Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

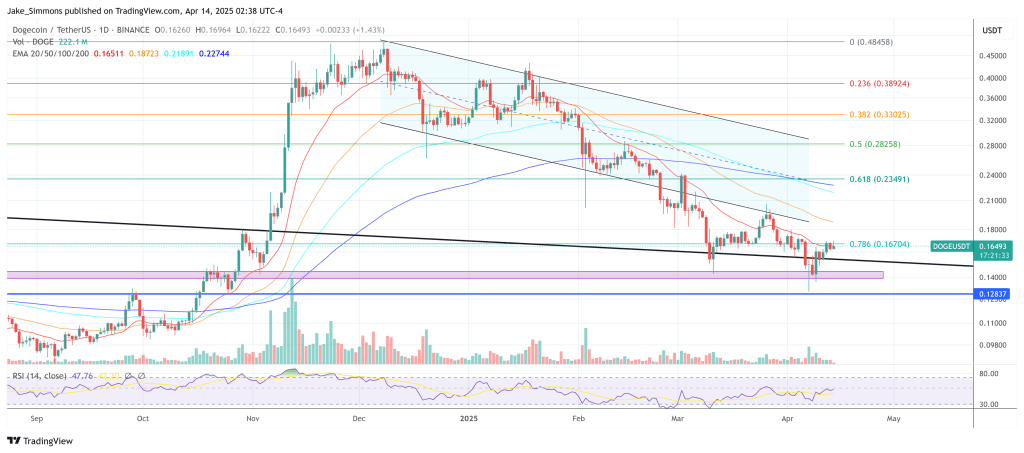

Dogecoin’s worth motion continues to honor the technical “blueprint” laid out by crypto analyst Kevin (@Kev_Capital_TA), who reaffirmed on Sunday that his strategic roadmap from March 22 stays intact. The weekly chart reveals an prolonged descending channel drawn with a number of yellow pattern strains that originated in 2021 and constricted worth motion all through 2022.

Inside that formation, essentially the most important horizontal threshold seems to be $0.139, labeled on the chart because the “Final line within the sand” and described by Kevin as essential for preserving bullish market structure. He notes that sustaining sturdy weekly closes above this zone is paramount for additional upside, whereas a decisive break beneath $0.139 would nullify the bullish thesis.

Dogecoin Follows The Blueprint

Dogecoin’s retracement from highs close to $0.45 earlier this yr has thus far been contained by a confluence of help channels and Fibonacci retracement ranges. In line with Kevin’s chart, the first Fib ranges span from roughly $0.049 on the decrease sure (0% Fib) to round $2.268 on the 1.414 extension.

Associated Studying

Nearer inspection reveals intermediate Fibonacci markers at $0.090 (0.236), $0.138 (0.382), $0.190 (0.50), $0.262 (0.618), $0.413 (0.786), $0.542 (0.88), $0.738 (1.0), $0.934 (1.0866), and $1.543 (1.272). For the reason that worth is hovering close to $0.16–$0.17 at press time, Dogecoin has remained above the 0.382 retracement close to $0.138, reinforcing Kevin’s argument that the risk-reward ratio at this stage seems “completely phenomenal.”

Kevin’s March 22 replace describes the confluence of a number of increased timeframe indicators, together with the Weekly Stochastic RSI, the 3-Day MACD, and the 2-Week Stochastic RSI, all of which he sees nearing full resets. He cites the earlier weekly demand candle, which shaped simply above $0.139, as a key signal that patrons are stepping in to defend what he calls “the Final line of bull market help.”

The Weekly Stoch RSI on his chart is already located at low ranges, whereas the 3-Day MACD and 2-Week Stoch RSI seem roughly a month away from bottoming out. In line with Kevin, these technical resets ought to function a springboard for Dogecoin’s subsequent important upward transfer, supplied that Bitcoin, which he believes should maintain above $70K in his state of affairs, stays secure sufficient to help broader market power.

Associated Studying

On Sunday, Kevin reminded his viewers that this technique, first made public on March 22, goes “precisely based on plan,” given Dogecoin’s confirmed bounce across the $0.139 area and the continuing drift towards oversold circumstances in a number of momentum gauges. He disclosed that his Patreon buying and selling portfolio holds a median entry at $0.15 for this swing and famous {that a} swift rejection of sub-$0.139 weekly closes, coupled with the bullish stance of the higher time frame indicators, corroborates his confidence in Dogecoin’s restoration potential.

Whereas he acknowledges that “numerous work” nonetheless must be completed for Dogecoin to reclaim loftier ranges close to the 0.618 Fib round $0.262 and even the 0.786 Fib at $0.413, Kevin maintains that his preliminary thesis stands so long as the meme-inspired asset preserves its foothold above $0.139. For him, the chance of a breakdown is well-defined if the pivotal support provides approach, however ought to the extent persist, he sees the upside potential extending far past the present vary. As of now, Dogecoin’s worth continues to cling to that all-important line within the sand, holding Kevin’s bullish blueprint very a lot alive.

At press time, DOGE traded at $0.16493.

Featured picture created with DALL.E, chart from TradingView.com