- The market reacted swiftly to tariff pause rumors, with main indices and Bitcoin surging.

- Recession fears rise, however analysts stay optimistic about crypto’s resilience over conventional markets.

The broader market has been rattled by President Donald Trump’s tariff plan, and the crypto market has felt the affect as properly.

Amidst this turbulence, latest rumors a few potential 90-day pause in tariffs sparked a glimmer of hope for market restoration.

Trump considers pause in tariffs — Faux or actual?

On the seventh of April, a (now-deleted) post on X (previously Twitter) by the “Walter Bloomberg” account sparked this hypothesis. The submit cited an interview with Kevin Hassett, an financial adviser to Trump. The submit learn:

“Hassett: Trump is contemplating a 90-day pause in tariffs for all nations besides China.”

Though the information was later confirmed false, it underscored the potential affect such a transfer may have on market sentiment. If it have been to occur, it would set off a market rebound.

How did the market react?

Unexpectedly, the markets responded swiftly to the now-debunked information of a possible 90-day tariff pause.

For these unaware, the S&P 500 surged over 8%, the Nasdaq climbed 9.5%, and the Dow Jones gained 7%, including trillions to the inventory market’s worth in mere minutes.

Bitcoin [BTC] adopted swimsuit, spiking by 6.5% and briefly topping $80,000 earlier than retreating.

Nevertheless, the thrill was short-lived, because the White Home “Fast Response” account shortly dismissed the declare as pretend information, triggering a market sell-off.

Moreover, Walter Bloomberg, the supply of the deceptive submit, later confirmed the story was false, leaving markets to recalibrate as soon as once more.

“WHITE HOUSE SAYS 90-DAY PAUSE IN TARIFFS IS ‘FAKE NEWS’ -CNBC”

How did the group react to the pretend information?

Though the rumor was shortly debunked, crypto YouTuber Lark Davis highlighted some key market insights throughout the episode.

He emphasised that the market eagerly embraces prolonged China commerce negotiations so long as a decision seems doubtless.

Davis additionally identified the market’s sensitivity, noting how even a minor 90-day tariff delay triggered a surge in shares and cryptocurrencies.

He mentioned,

“Now think about dozens of offers occurring with prime gamers like India, Canada, and the UK. Shit tons of cash are ready on the sidelines, able to ape in at a second’s discover.”

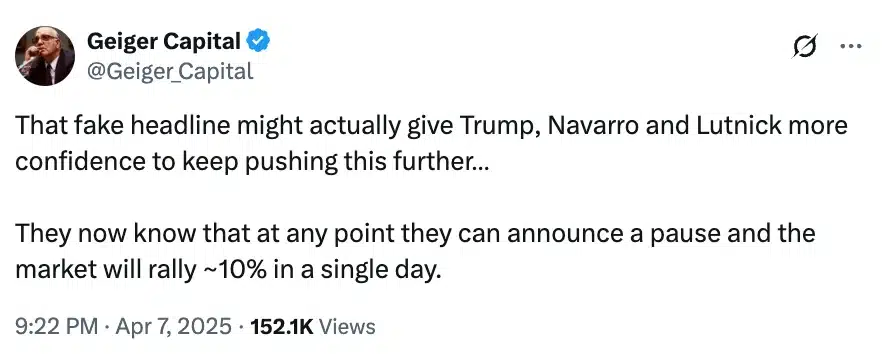

Including to the fray, one other X person, Geiger Capital, famous,

Aftermath of the pretend information

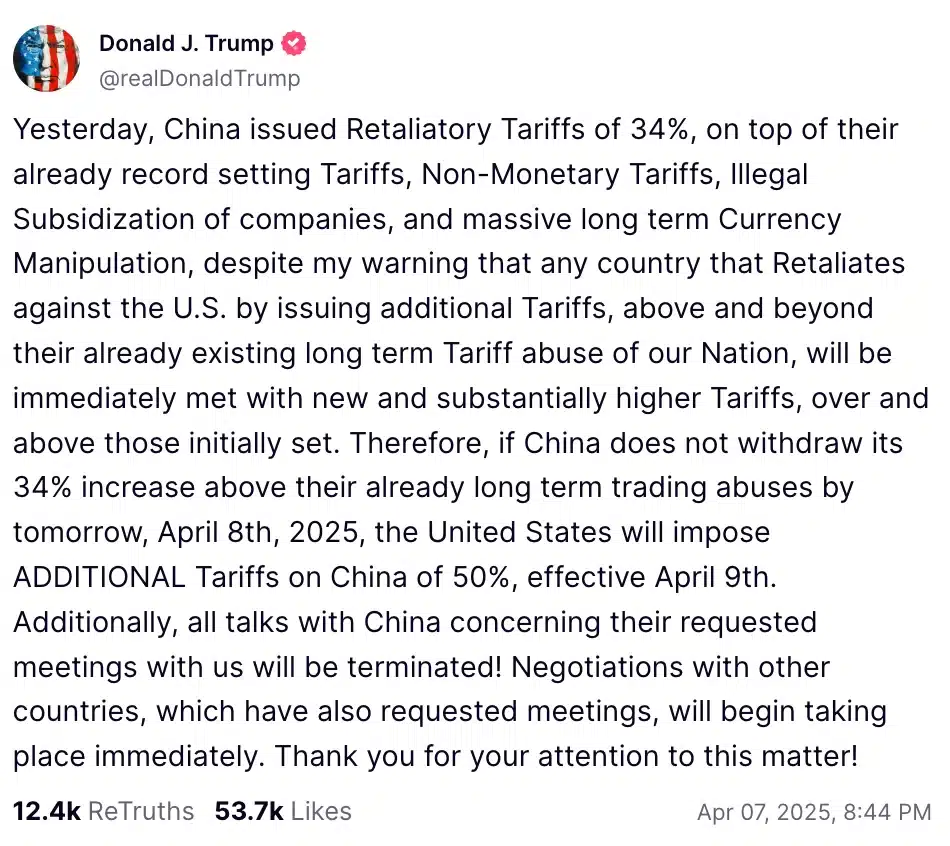

Quickly after the 90-day tariff pause rumor was retracted, Trump took to Reality Social, warning China of potential further tariffs.

He mentioned,

Amidst this, analyst Eric Weiss expressed optimism about Bitcoin, highlighting its potential regardless of the continuing uncertainty.

“Because the tariff warfare escalates and shares bleed, Wall St will finally notice there’s an alternate: Bitcoin.”

Recession fears are rising, with prediction markets exhibiting elevated considerations. The prospect of a U.S. recession in 2025 reached 64% on Kalshi and 61% on Polymarket.

These figures are a major leap from 20% earlier this yr.

Regardless of financial uncertainty and escalating commerce tensions, optimism persists. Analysts like Kevin Capital suggest the crypto market may show extra resilient than conventional equities.