- Bitcoin’s $90 billion pullback remained minor within the face of the macro deleveraging cycle.

- The subsequent leg up might arrive earlier than the market expects.

Contrary to market consensus, Bitcoin’s path to $100k seems more and more possible within the wake of the ‘commerce dump.’

For the reason that nineteenth of February, the U.S. inventory market has shed $11 trillion in market cap, with 54.55% of that drawdown accelerating post-‘Liberation Day.’

But, this can be only the start. Gold (XAU) marked a Q2 peak at $3,143 per ounce earlier than a close to 3% retracement, erasing $520 billion in market capitalization because the 2nd of April. Bitcoin [BTC], in the meantime, has corrected 5.17% from its $1.74 trillion valuation.

A $90 billion dip is minor in comparison with the broader market flush. Consequently, Bitcoin’s growing divergence from threat belongings and macro swings is reinforcing its long-term positioning.

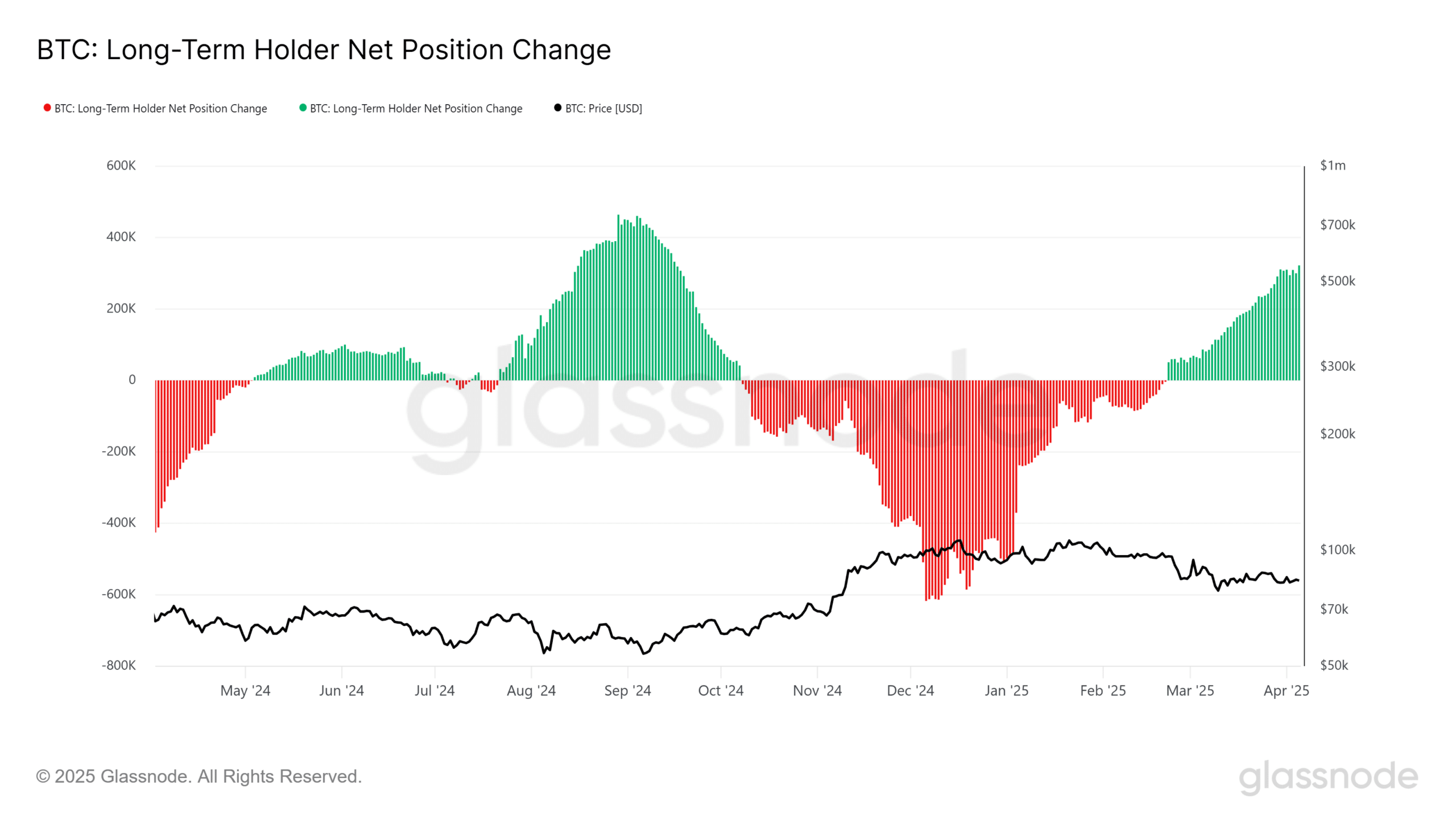

Lengthy-term holders accumulate, reinforcing conviction

Short-term holder supply (<155 days) has declined to a two-month low of three.7 million BTC, reflecting roughly 3 million BTC in realized losses amid Bitcoin’s retracement from its $109k all-time excessive.

Conversely, long-term holder (LTH) provide has expanded over the identical interval.

The Internet Place Change metrics sign aggressive accumulation at a mean value foundation of $84k per BTC, underscoring sturdy conviction.

At press time, Bitcoin remained capped beneath $85k, a crucial breakeven threshold for weak arms.

Nevertheless, persistent LTH accumulation and BTC’s widening decoupling from U.S. equities point out a crucial inflection level that would set the stage for BTC to reclaim $100k.

The important thing driver? Capital is flowing out of threat belongings – and even secure havens – into BTC.

Germany recently initiated a pullback of 1,200 tonnes of gold value $124 billion from New York reserves. If extra nations observe swimsuit, it may weaken Gold’s function as a worldwide haven.

With Bitcoin holding sturdy whereas the S&P500 sheds $4 trillion in per week – the most important drop because the COVID-19 crash – and Gold shedding steam, BTC is in a primary place to draw capital from governments, establishments, and retail buyers alike.

Bitcoin’s haven standing again in focus

Within the brief time period, to set off FOMO, Bitcoin should break resistance at $85k–$87k, a key zone the place profit-taking intensifies. It’s been a month since these ranges have been final examined.

Subsequently, establishing a robust bid wall inside this vary is crucial for bullish continuation. Nonetheless, a breakdown beneath $80k stays a low-probability occasion.

Since March 12, whale cohorts (>1K BTC) have aggressively gathered, driving holdings to a three-month-high. With deep-pocketed entities absorbing provide, a retest of the $77k assist seems more and more unlikely.

BTC’s capability to carry sturdy regardless of macro uncertainty retains fueling its case as a hedge in opposition to market turbulence.

So long as demand stays agency, Bitcoin’s path to six-figure value discovery stays well-positioned. Capital inflows may choose up much more, particularly with U.S. shares dealing with elevated draw back threat from rising tariff pressures.