The cryptocurrency market was pretty steady regardless of the global macroeconomic headwind that rocked the normal markets through the previous week. The Ethereum value didn’t take pleasure in the identical aid as different large-cap belongings, starting the month of April nearly because it ended the primary quarter of 2025.

The second-largest cryptocurrency is on the verge of dropping the $1,800 degree, having declined in worth by nearly 5% previously week. Nevertheless, the newest on-chain knowledge means that the Ethereum value is likely to be near a backside and is likely to be readying for a rebound within the coming weeks.

Rising Metric Says Ethereum Value Would possibly Be Prepared For A Comeback

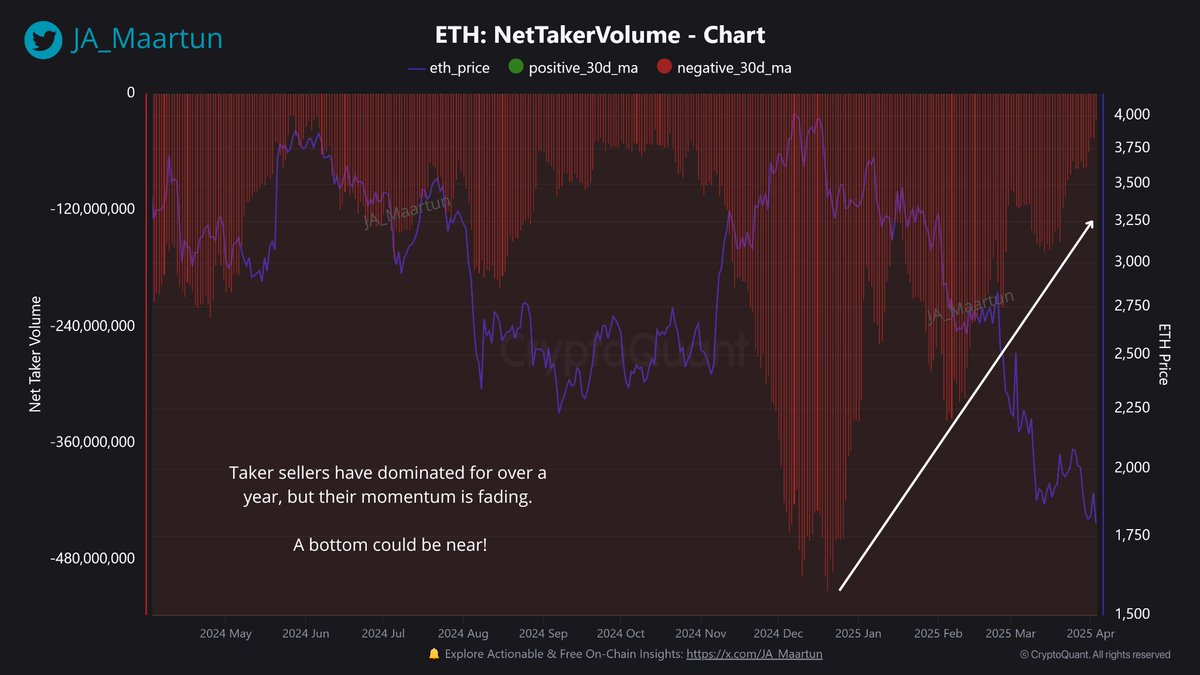

In a latest put up on the X platform, on-chain analyst Maartunn shared a recent perception into the exercise of Ethereum traders on centralized exchanges. Based on the crypto pundit, this newest on-chain shift suggests {that a} new backside might be brewing for the Ethereum value.

The related indicator right here is the Web Taker Quantity metric, which tracks the distinction between taker purchase quantity and taker promote quantity in a specific asset market (Ethereum, on this case). This on-chain indicator can be utilized to gauge the power of the promoting or shopping for stress out there.

When the Web Taker Quantity is constructive, it signifies that aggressive shopping for exercise (taker buys) is overwhelming promoting exercise (taker sells), suggesting a rising bullish sentiment. A destructive metric implies that the taker promote quantity is greater than the taker purchase quantity, which is often a bearish sign.

Maartunn famous in his put up that aggressive selling activity has been outweighing the shopping for exercise within the Ethereum marketplace for over a yr. Nevertheless, the on-chain analyst highlighted that the taker promote quantity seems to be waning and dropping some steam previously few weeks.

Supply: @JA_Maartun on X

As proven within the chart above, the Web Taker Quantity is forming greater lows, even because the Ethereum value is making new decrease lows. This traditional bullish divergence means that the altcoin might be getting ready to backside out and expertise a bullish reversal.

As of this writing, the ETH token is valued at round $1,806, reflecting a roughly 1% value leap previously 24 hours.

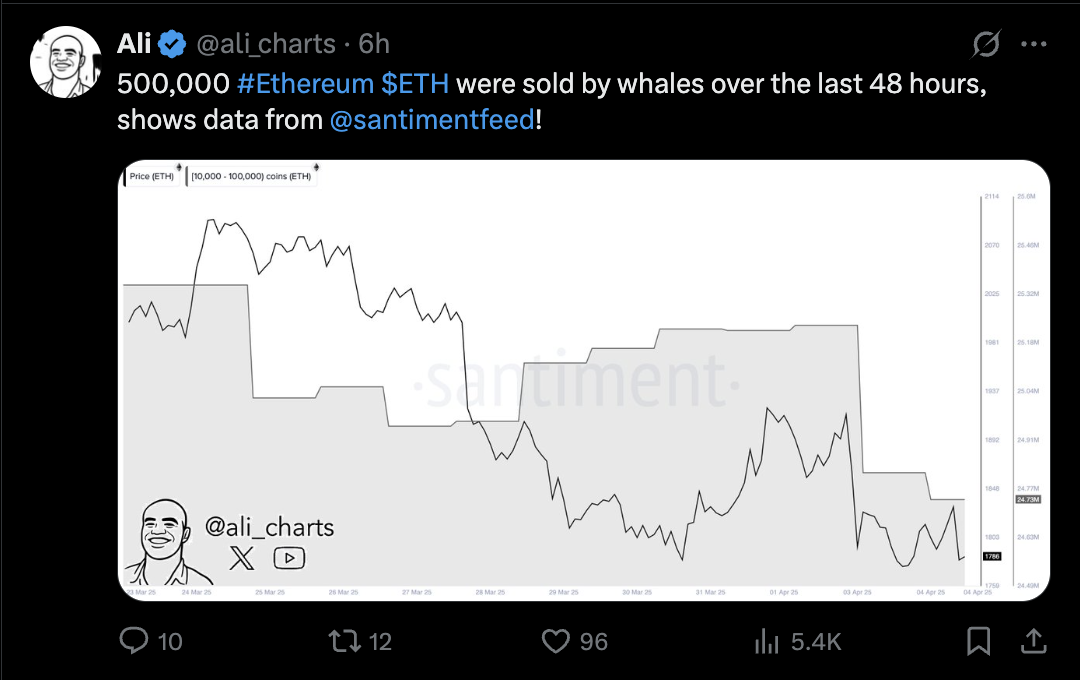

ETH Whales Trimming Their Holdings

Apparently, a conflicting piece of on-chain data has additionally emerged, exhibiting that an vital class of traders often known as whales has been offloading their belongings. This investor cohort is influential in the marketplace dynamics as a consequence of their important holdings and, as such, is often monitored by different traders.

Supply: @ali_charts on X

In a April 4 put up on X, crypto analyst Ali Martinez revealed that whales (holding between 10,000 and 100,000 cash) have bought over 500,000 ETH tokens previously 48 hours. Contemplating the scale of this sell-off and the affect of the traders, this exercise might be a bearish roadblock for a doable Ethereum value restoration.

The worth of ETH on the each day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.