- Bitcoin is at present in an undervaluation zone the place sharp sell-offs had been adopted by robust rebounds.

- Can Bitcoin repeat its historic tendencies underneath present macroeconomic circumstances?

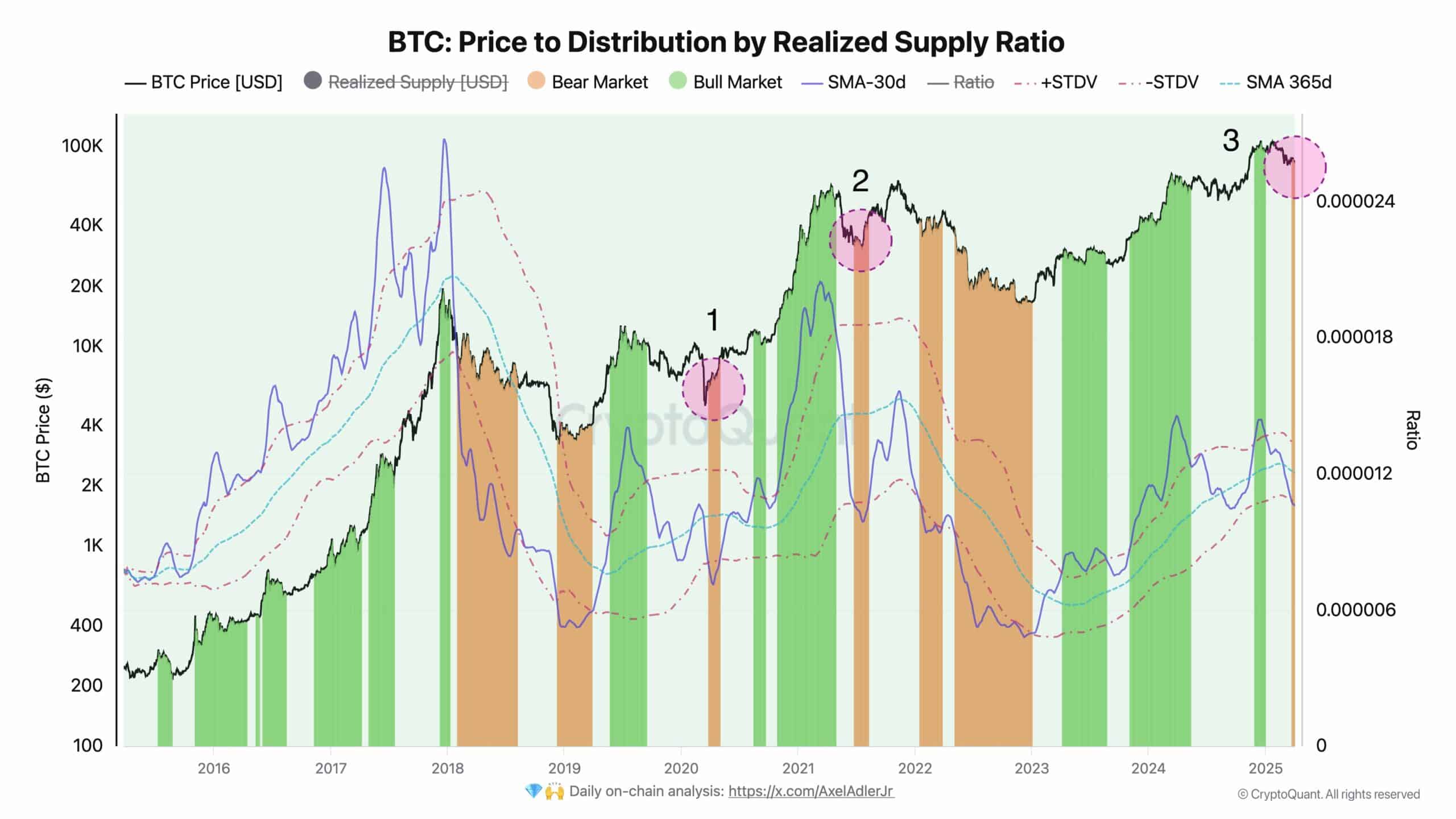

Bitcoin [BTC] is approaching an undervaluation part as indicated by its 30-day realized provide metric.

Traditionally, such circumstances have preceded important market actions, both by capitulation-driven corrections or a aid rally from a neighborhood backside.

Put merely, realized provide refers back to the whole quantity of Bitcoin that hasn’t been moved in a sure interval, giving us perception into how a lot of the availability is actively traded.

When realized provide is excessive, it suggests elevated exercise, whereas a low realized provide can point out that Bitcoin is being held by long-term buyers or dormant addresses.

As proven within the chart, throughout previous two corrections, BTC’s 30-day transferring common of realized provide (purple) dipped beneath the decrease dotted line, signaling oversold circumstances.

This sample occurred through the COVID-19 crash and post-China mining ban, each adopted by rebounds. A similar setup is rising now.

After a risky Q1 with a virtually 11% drop, BTC’s 30-day realized provide is bottoming out, signaling that Bitcoin is undervalued.

Traditionally, this has marked some extent of capitulation, the place promoting stress fades and consumers step in at decrease costs, usually sparking a rebound or aid rally.

Low liquidity: An indication of market maturation?

Sometimes, when fewer cash are actively traded, it usually indicators that extra holders – comparable to establishments and long-term buyers – are adopting a “HODL” mindset, decreasing the frequency of trades.

In the long term, such circumstances could pave the best way for Bitcoin to be seen extra as a retailer of worth or a hedge, just like gold.

Nonetheless, for a bull run to materialize, consumers must step in.

Whereas the “HODL” sentiment reduces liquidity inflow, the sell-side stress from weak palms should be absorbed to ascertain a market backside, paving the best way for a possible aid rally.

In essence, mitigating sell-side liquidity from derivative markets, the place name orders dominate sentiment, is essential. However are bulls shopping for into the undervaluation sign?

A bullish breakout for Bitcoin nonetheless in limbo?

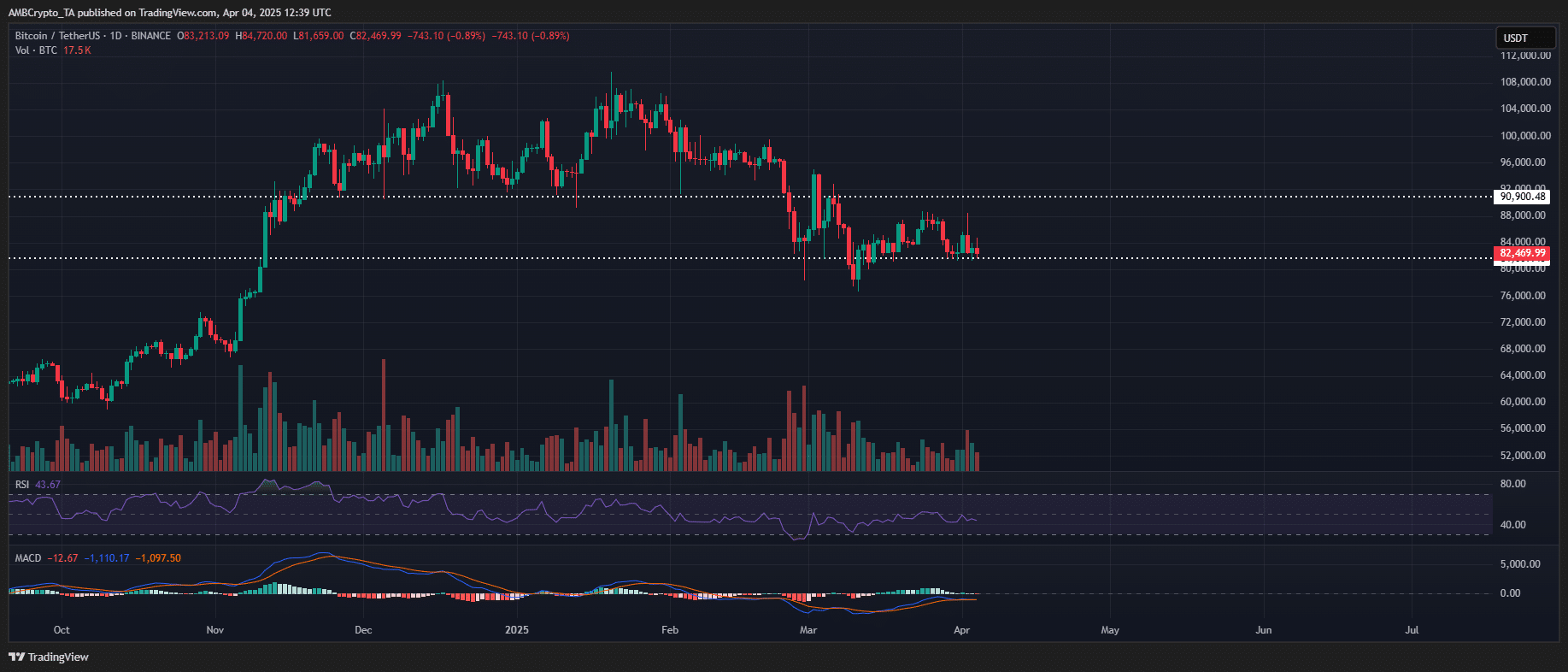

Regardless of Bitcoin sustaining help above the $80k degree amid macroeconomic headwinds, a definitive shift right into a full-blown bull market has but to materialize.

Lengthy-term holders (LTHs) liquidated 1,058 BTC at a mean of $82k as tariff information hit the market, resulting in a retracement again to $81k.

As Q2 unfolds, the lingering results of Trump’s insurance policies on retail sentiment will probably proceed to dampen bullish momentum.

Whereas undervaluation indicators might immediate institutional accumulation, coupled with HODLing habits that maintains help above $80k, retail inflows stay tepid.

This lack of retail participation is a key issue that inhibits important worth motion towards $90k within the quick time period.

With no notable shift in market construction or sentiment from retail buyers, the chance of a breakout this quarter seems muted.