- ETH community charges have dropped to a five-year low, pointing to lowered community exercise.

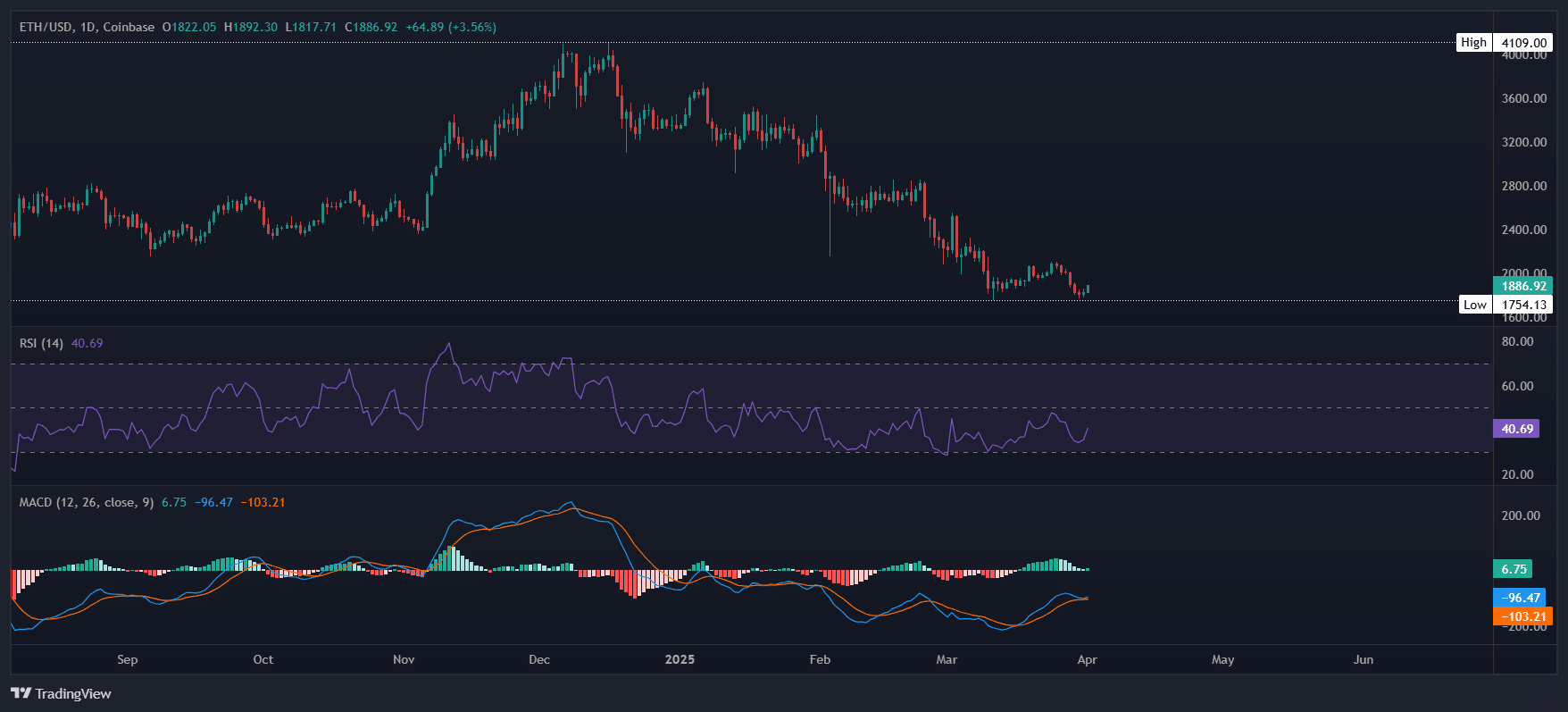

- The RSI reveals indicators of reversal – can ETH break key resistance and set off a full bull run?

Ethereum’s [ETH] community charges have dropped to a five-year low, pointing to lowered community exercise, which may influence its worth. Whereas not a direct bearish sign, the charge decline suggests weaker on-chain fundamentals.

Nevertheless, the Relative Power Index (RSI) reveals indicators of bullish reversal. Can ETH break key resistance and spark a full bull run below these circumstances?

Key resistance amid weak fundamentals

Ethereum is buying and selling at $1,886, up 6% from its lowest level in two days, a degree not seen in over 4 months. With a 23.52% surge in quantity to $15.64 billion, this might sign a basic ‘dip-buying’ alternative.

Technical indicators are turning bullish: the MACD has flipped constructive, the RSI is transferring upwards, ETH/BTC is within the inexperienced, and buy orders dominate perpetual contracts.

These elements recommend $1,750 could possibly be an area backside for ETH, with sturdy rebound potential.

Nevertheless, a bull run continues to be untimely. For FOMO to kick in, ETH wants to carry this sample within the coming days. With high-risk sentiment, dropping assist stays an actual chance.

Ethereum’s community charges have dropped to a five-year low of $608K, down from $18M through the November 2024 rally—signaling weak demand. This aligns with ETH’s 53% worth drop in the identical interval.

With multiple bearish signals and sharp pullbacks, ETH wants stronger fundamentals and a key resistance breakout. With out them, holding its present worth could also be a problem.

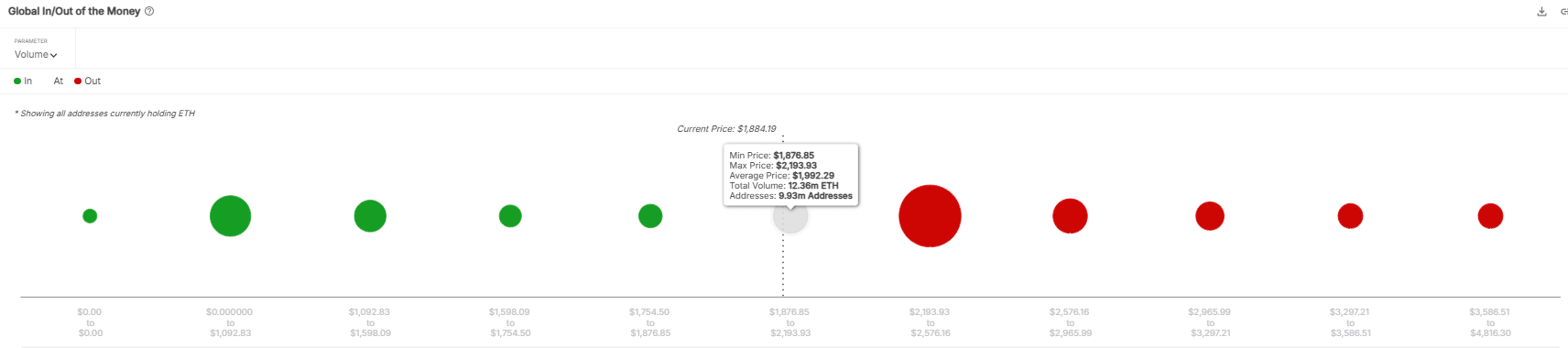

Breaking THIS degree: The safety sign for ETH

Analysts highlight $2,100 as a essential resistance Ethereum should reclaim to maintain a bullish breakout. Failure to carry above this degree may set off a deeper correction.

AMBCrypto’s evaluation reveals that breaching this barrier would push 12.36 million ETH into revenue, placing $26 billion in danger.

Regardless of bullish technicals, weak demand and the absence of a provide shock make reclaiming this degree unsure. Actually, the important thing take a look at isn’t simply breaking $2,100 – however holding above it.