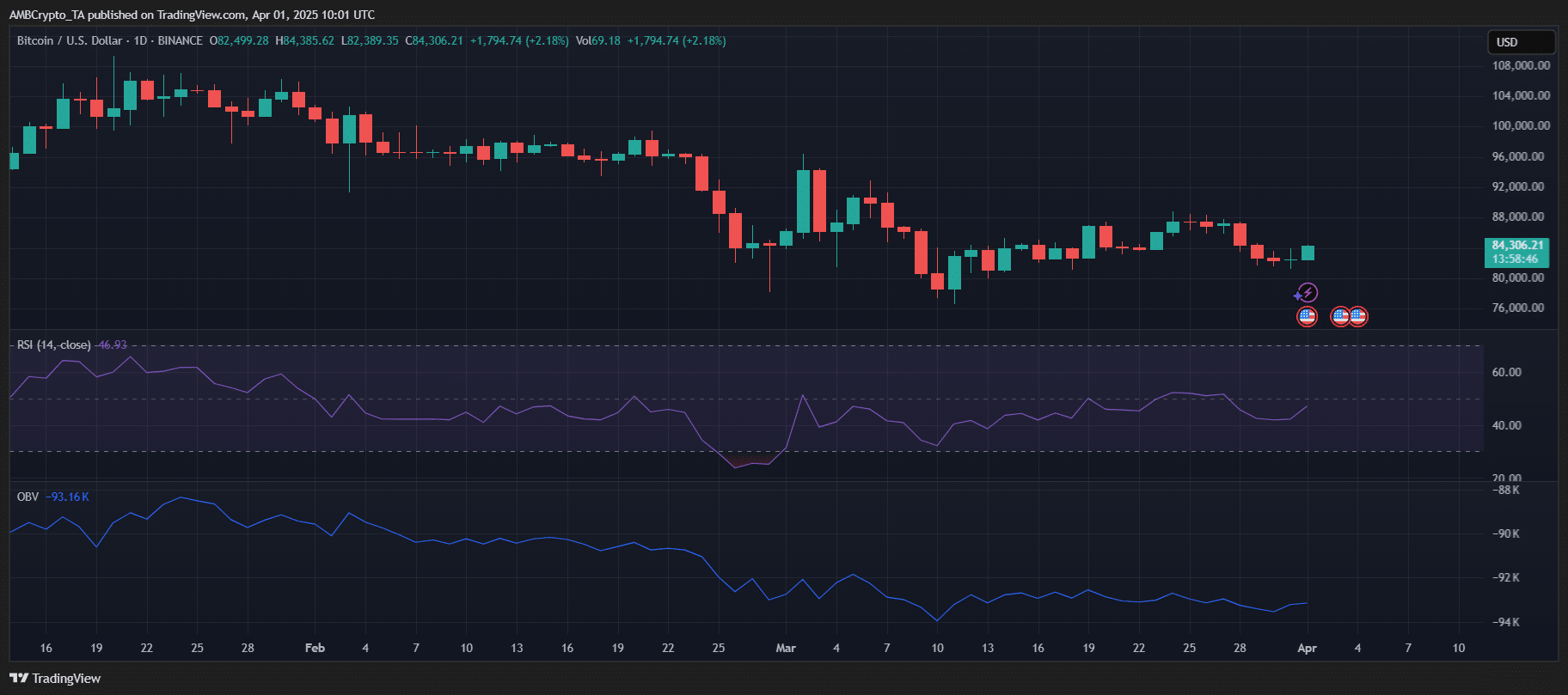

- Bitcoin’s short-term holders present restraint, decreasing promoting stress and signaling potential for secure progress.

- With much less speculative capital, Bitcoin’s market is changing into extra resilient, indicating decreased draw back volatility.

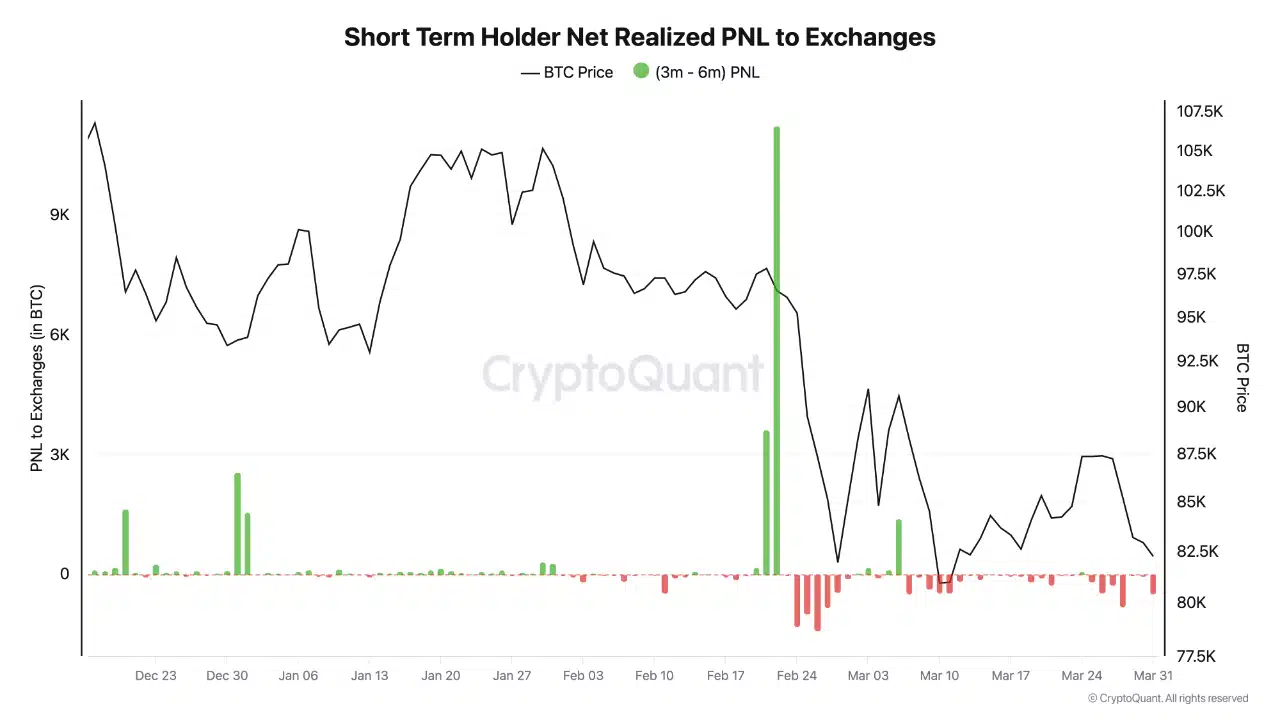

Bitcoin [BTC] is navigating risky situations, with a notable shift amongst short-term holders (STHs), who now management 40% of the community’s wealth.

Regardless of current losses, these sometimes reactive sellers are displaying restraint, decreasing promoting stress.

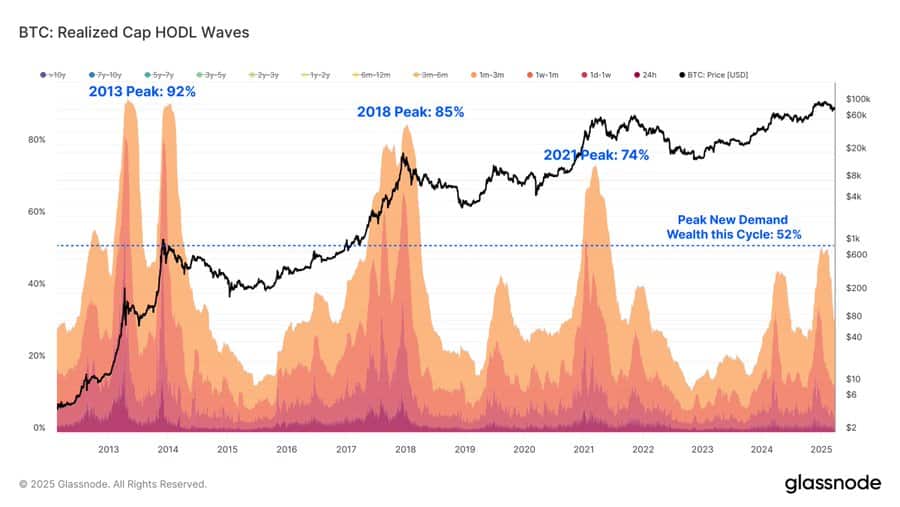

Whereas that is far under previous peaks, the place new investor wealth reached 70-90%, it indicators a extra balanced, tempered bull market.

This shift suggests a possible turning level for Bitcoin, with much less draw back volatility, paving the best way for stability and progress.