Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

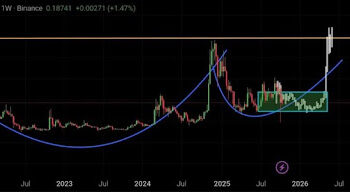

A latest Dogecoin evaluation on TradingView has highlighted a potential situation the place DOGE may dip under the $0.165 mark earlier than rebounding. The analyst, reviewing the 4-hour candlestick chart, pointed to extraordinarily oversold RSI ranges as a foundation for this outlook. Though a bounce seems to be the extra possible final result, there may be nonetheless a 30 to 40% likelihood of a short-term drop into deeper support territory.

Dogecoin RSI Dips Beneath 10 On 4-Hour Chart To Probably Prolong Decline

The Relative Energy Index (RSI) is a technical evaluation indicator used to measure an asset’s momentum. When above 70, the asset is taken into account overbought, that means it is likely to be due for a value correction or pullback. However, readings under 30 are thought of oversold, that means that the asset is likely to be undervalued and could bounce upward soon.

Associated Studying

Within the case of Dogecoin, the meme coin has been beneath intense promoting stress because the starting of March. This promoting stress has seen it lose most of its value positive factors in late 2024 and break under notable help stress. This, in flip, has seen the RSI fall in direction of the oversold ranges throughout a number of timeframes.

In keeping with the technical overview, the Relative Energy Index on the 1-hour timeframe is between 25 and 27, signaling sturdy oversold situations. On the 4-hour chart, the RSI has dropped even decrease, falling beneath 10, which usually signifies an asset is due for a corrective bounce. The each day RSI is at present hovering round 32 to 33, nonetheless above the oversold zone however trending downward. These readings counsel that whereas bearish stress is current, the setup of a bounce from oversold ranges more and more favors a rebound as patrons look to re-enter close to help.

Analyst Sees Bounce Towards $0.172–$0.175 As Extra Possible Final result

In keeping with the analyst, the break of the RSI under the oversold ranges points to a decline towards the $0.1580 and $0.1590 help area. Regardless of the potential of a decline towards the $0.1580 to $0.1590 help area, the analyst famous the next likelihood (round 60 to 70%) of a near-term bounce after hitting this help area, probably focusing on the $0.172 to $0.175 vary.

Associated Studying

The projection hinges on Dogecoin’s attainable response to such a deeply oversold RSI degree. The analyst emphasised that that is an assumption reasonably than monetary recommendation, however the technical context helps the probability of a reduction rally if the help holds.

On the time of writing, Dogecoin is buying and selling at $0.1649, down by 3.6% previously 24 hours. With each draw back and upside scenarios laid out, short-term Dogecoin value motion now is determined by how the market reacts on the present $0.165 degree. A transfer towards $0.172 or increased may unfold rapidly if patrons step in proper now. Nonetheless, if promoting continues, Dogecoin may proceed its decline all through the week earlier than trying a restoration.

Featured picture from Unsplash, chart from Tradingview.com