A quant has revealed how Ethereum (ETH) noticed a dying cross on this indicator shortly earlier than bearish momentum took the asset in full drive.

Ethereum Fashioned A Dying Cross In Funding Charges Earlier

In a CryptoQuant Quicktake post, an analyst has shared a chart for the Funding Charges of Ethereum. The “Funding Rates” refers to a metric that retains monitor of the quantity of periodic price that merchants on the derivatives market are exchanging between one another proper now.

When the worth of this indicator is optimistic, it means the long contract holders are paying a premium to the short traders to be able to maintain onto their positions. Such a pattern suggests a bullish sentiment is shared by the vast majority of the derivatives merchants.

Alternatively, the metric being beneath the zero mark implies a bearish mentality is dominant within the sector, as brief holders are overwhelming the lengthy ones.

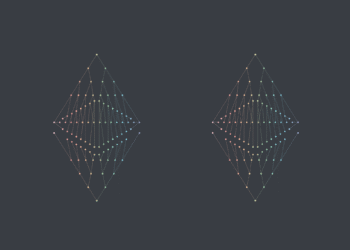

Now, right here is the chart for the Ethereum Funding Charges posted by the quant, which exhibits the pattern within the 50-day and 200-day easy transferring averages (SMAs) of the indicator during the last couple of years:

Appears like these two strains noticed a crossover earlier within the 12 months | Supply: CryptoQuant

As displayed within the above graph, the 50-day SMA of the Ethereum Funding Charges crossed beneath the 200-day SMA in January of this 12 months. This means that the optimism out there witnessed a shift.

From the graph, it’s seen that for the reason that crossover within the two SMAs of the indicator has emerged, the ETH value has been sharply transferring down. The pattern isn’t distinctive to the asset, as the broader cryptocurrency sector has additionally seen the same sample, with traders changing into risk-averse.

Within the first half of final 12 months, the Funding Charges noticed the identical sort of crossover, after which, the Ethereum value adopted up with a interval of bearish motion.

It wasn’t till the reverse crossover occurred, with the 50-day SMA discovering a break above the 200-day SMA, that bullish momentum returned within the cryptocurrency market. The identical sample was additionally seen again in 2023.

It’s attainable that for constructive value motion to return for Ethereum and different property, a bullish crossover within the Funding Charges might as soon as once more should happen. “When the speculators return and begin utilizing their grasping leverage, the crypto bull market will start,” notes the analyst.

When this could occur, nevertheless, is anybody’s guess, because the 50-day and 200-day SMAs of the indicator are at the moment fairly far aside. In 2024, the strains took many months earlier than they crossed again, so it’s attainable that it’ll take a while for the crossover to happen now as nicely.

ETH Worth

Ethereum is transferring to finish the month of March on a purple word as its value has fallen to the $1,800 degree, after seeing a decline of just about 14% prior to now week.

The pattern within the ETH value during the last 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.