- ETH/BTC ratio’s recent lows have fueled a brand new debate about investing in ETH

- Speculators are nonetheless anticipating ETH to hit $4k in 2025

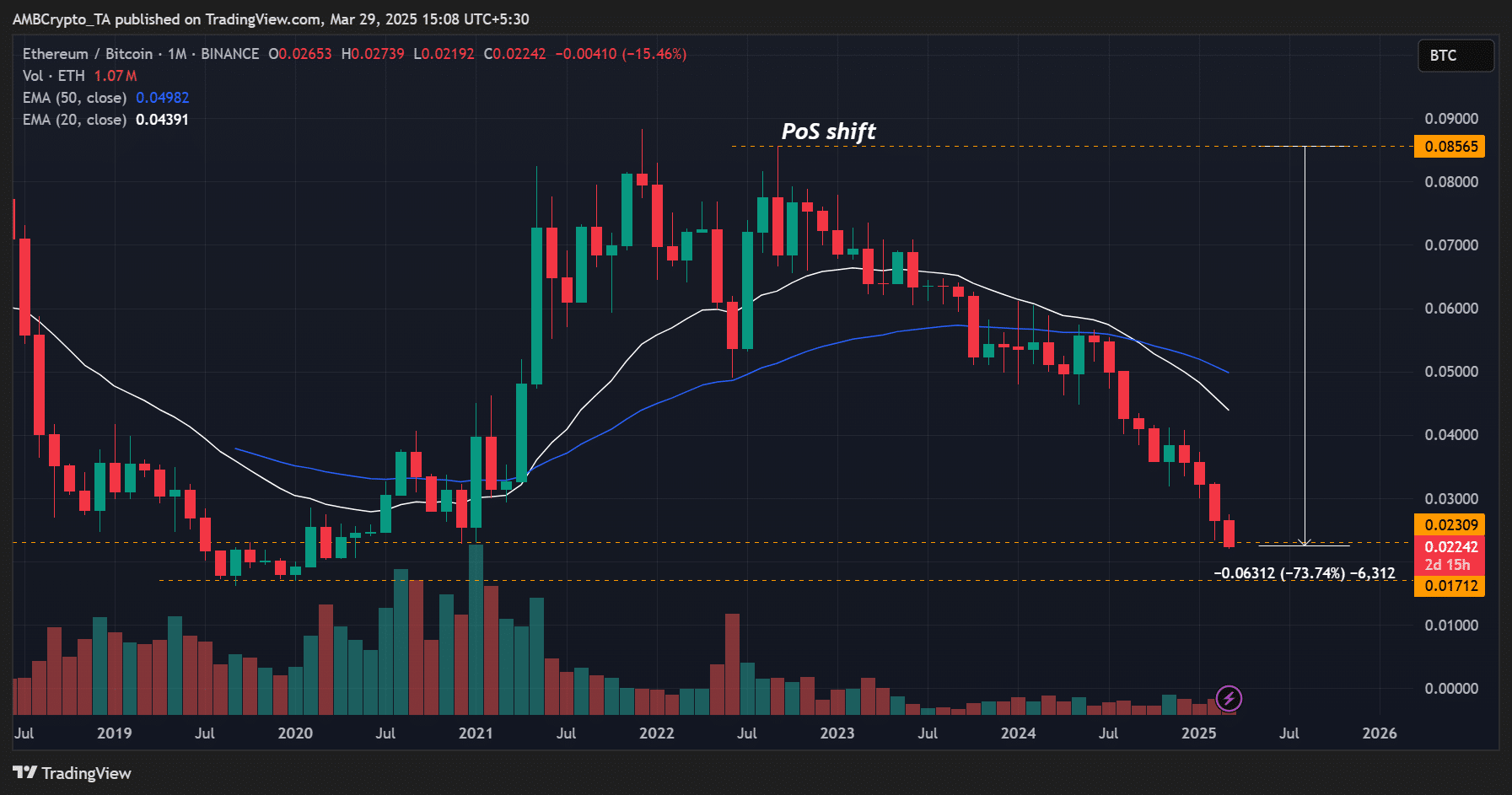

Ethereum [ETH] has weakened in opposition to Bitcoin for over three years. This may be finest evidenced by the ETH/BTC ratio, a metric which tracks ETH’s relative worth efficiency in opposition to BTC. It marked a brand new low of 0.022 lately.

Commenting on the prolonged decline, Alex Thorn, Galaxy Digital’s Head of Analysis, stated,

“Ether is down 74% in opposition to Bitcoin since switching from proof of labor to proof of stake.”

In reality, some neighborhood members have even called for the community to return to PoW (proof-of-work), like BTC, assuming that the altcoin’s worth may very well be propped up once more.

Is ETH well worth the guess?

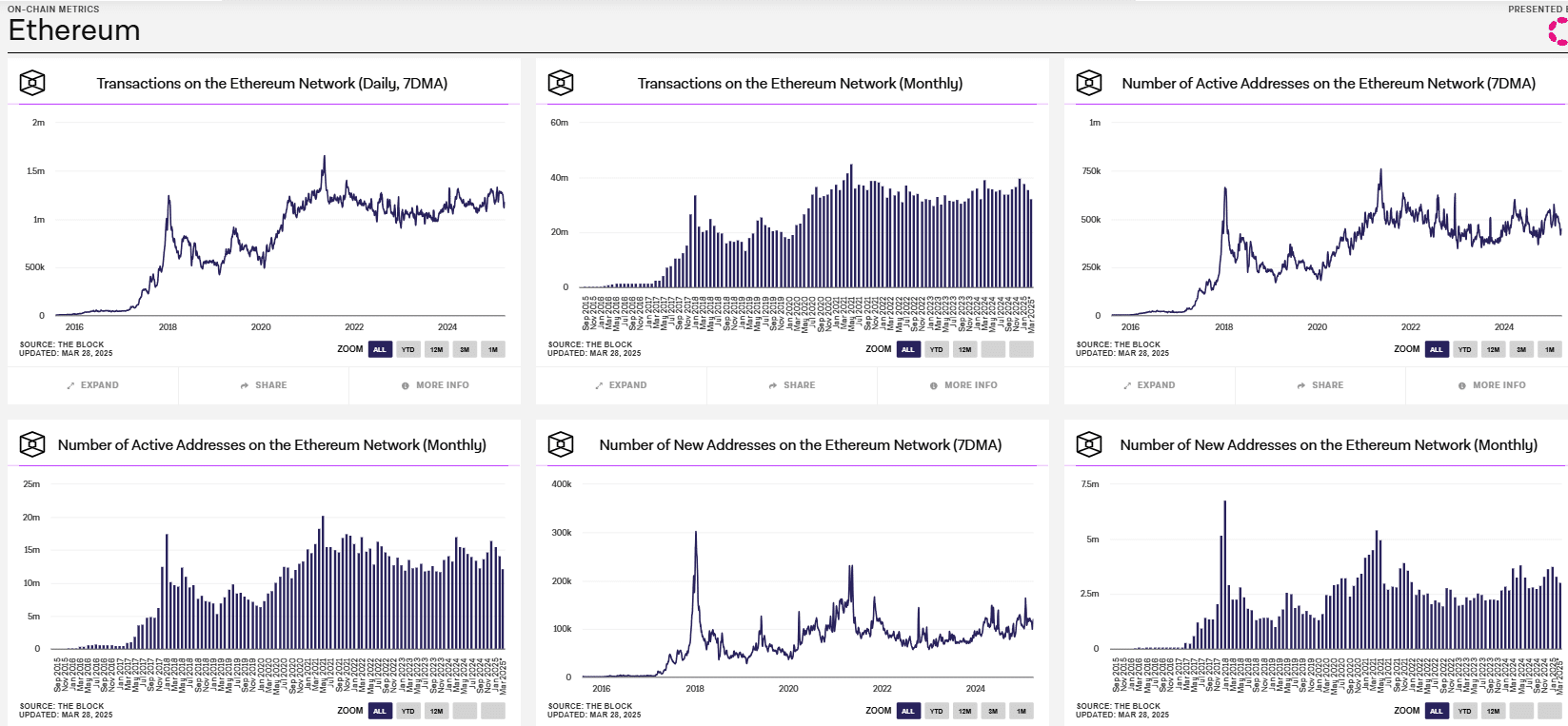

For his half, Quinn Thompson, founding father of macro-focused hedge fund VC Lekker Fund, believes that ETH is “not well worth the funding.” He cited declining community exercise, amongst different causes.

“Make no mistake, $ETH as an funding is totally lifeless. A $225 billion market cap community that’s seeing declines in transaction exercise, consumer progress and costs/revenues. There isn’t a funding case right here.”

He added that the community has its perks as a utility, however not an funding. Nic Carter, accomplice at Fort Island Ventures and co-founder of information aggregator Coinmetrics, echoed this sentiment.

In reality, Carter blamed L2s for killing ETH’s worth and stated,

“The #1 explanation for that is grasping ETH L2s siphoning worth from the L1 and the social consensus that extra token creation was A-OK. ETH was buried in an avalanche of its personal tokens. Died by its personal hand.”

In keeping with Thompson, the ETH/BTC ratio declined by double digits throughout the 2023-2024 bull cycle and it may very well be worse off throughout a bear cycle.

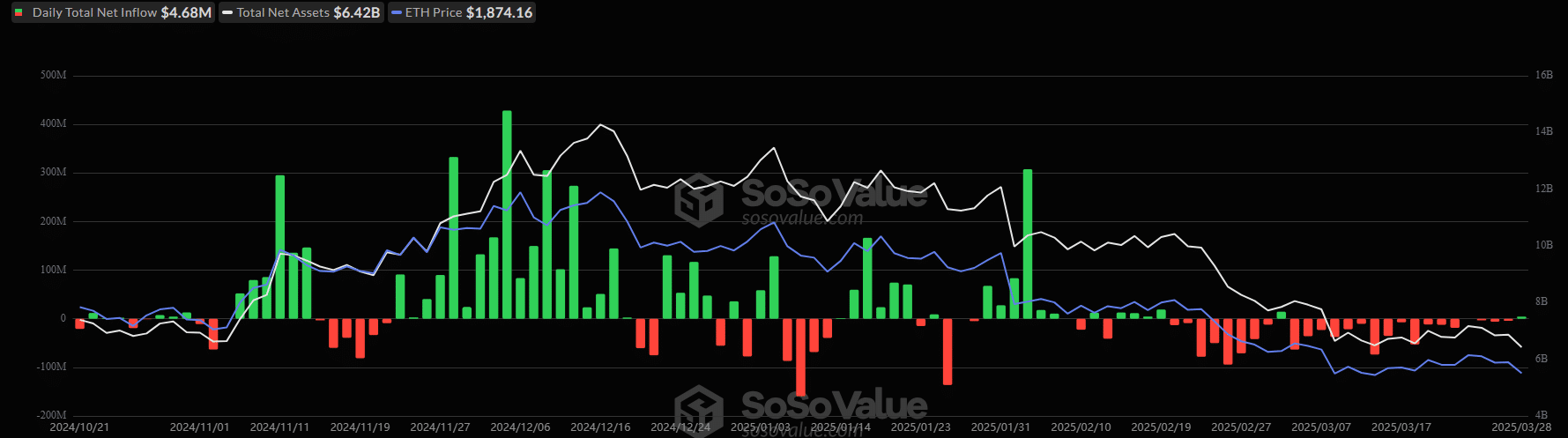

The latest ETF flows additionally exhibited dislocation between the 2 high crypto property. For U.S spot BTC ETFs, the merchandise logged over $1 billion in inflows for 10 consecutive days (Other than final Friday, which noticed $93M outflows).

U.S spot ETH ETFs, alternatively, have recorded constant outflows since 20 February, other than solely two days of inflows. In March, they noticed over $400M in outflows.

Merely put, the damaging sentiment on social media seems to reflect weak institutional traders’ urge for food for the altcoin.

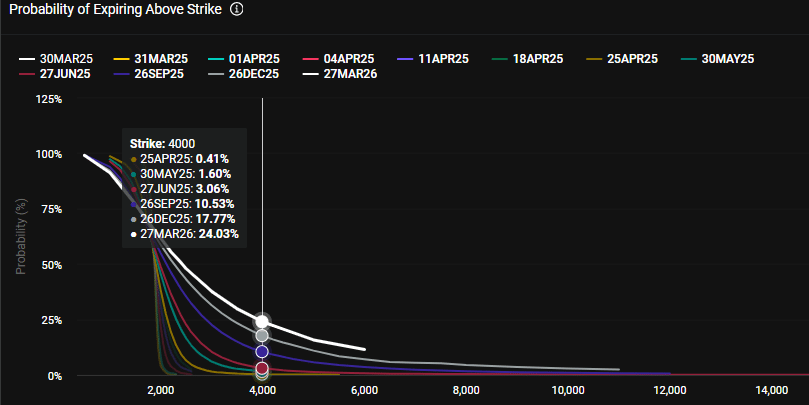

That being stated, the weak flows couldn’t derail ETH’s restoration odds. On the prediction site Polymarket, bettors’ ETH worth goal for 2025 is $4k (With the best quantity of $710k). The second-highest quantity is for $5k.

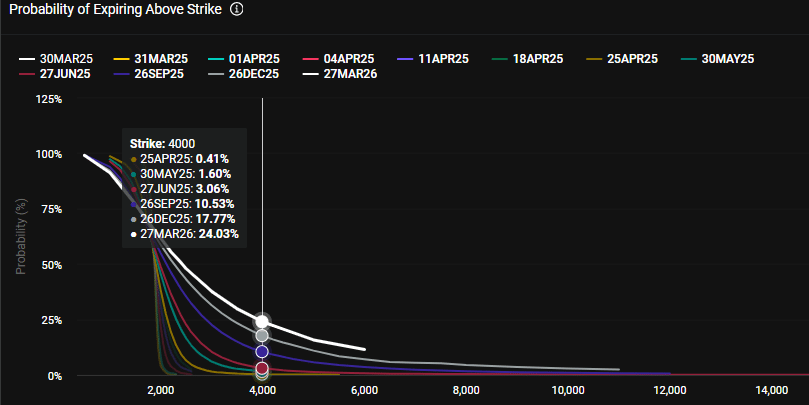

For Choice merchants on Deribit, the $4k goal isn’t anticipated till September (10% probability). On the time of writing, ETH was valued at $1.87k, down 54% from its December highs of $4k.

Supply: Deribit