- Bitcoin’s 1-year proportion change is nearing the unfavourable zone

- Earlier dips have led to downturns, however 2020’s instance suggests there could be hope for restoration

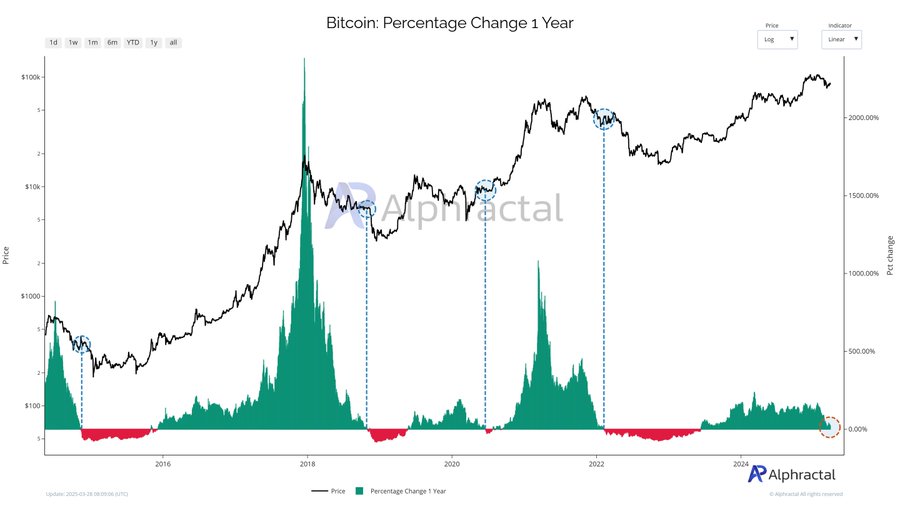

Bitcoin’s [BTC] 1-year proportion change is approaching the unfavourable zone – A sign that has traditionally been related to bearish market tendencies. Whereas three out of the final 4 cases of such a dip led to declines, there’s an opportunity that this time may mirror 2020’s market habits. Again then, the unfavourable shift was a part of a broader consolidation section.

If this downward development continues, it might sign the potential for brand new lows within the close to future.

1-Yr proportion change – Significance of the unfavourable zone

The 1-year proportion change of Bitcoin tracks its worth distinction over a rolling 12-month interval, serving as a key indicator of market sentiment. When this metric enters the unfavourable zone, it reveals that Bitcoin’s worth is decrease than it was a 12 months in the past.

Traditionally, this has been linked to bearish momentum, signaling waning shopping for curiosity or a hike in promoting strain. The truth is, out of the final 4 cases, three led to sustained downturns, whereas one had minimal affect.

Now, whereas the unfavourable zone hinted at decreased volatility and decrease threat, it doesn’t all the time assure additional losses. Exterior elements additionally play a job.

What does the information say?

Alphractal’s chart revealed that Bitcoin’s 1-year percentage change, alongside worth actions, marked 4 key intervals when the metric dipped under zero.

The primary occasion in 2015 was a short dip throughout restoration from 2014’s bear market. The longest unfavourable section occurred between 2018 and 2019 after Bitcoin fell from $20,000 to round $3,200. A brief unfavourable interval in 2020 was linked to COVID-19 market disruptions, whereas the newest episode in 2022 adopted the drop from $69,000 to under $20,000.

Supply: Alphractal

It’s March 2025 now and Bitcoin’s 1-year proportion change is nearing zero – An indication og potential motion into the unfavourable zone. Analysts are divided on whether or not this means a consolidation section or the chance of a brand new bearish cycle.

The case for consolidation

Dangers of sustained unfavourable motion

Bitcoin’s 1-year proportion change shifting into the unfavourable zone might sign an additional decline on the charts. Earlier cases present sustained unfavourable motion typically correlates with bearish tendencies, indicating misplaced momentum.

If the metric drops under zero, it might counsel the rally has stalled, prompting a risk-off strategy.

Exterior elements might deepen this downturn. Extended negativity might strain Bitcoin to retest help ranges, triggering panic promoting and a deeper bear cycle.

Source link