Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

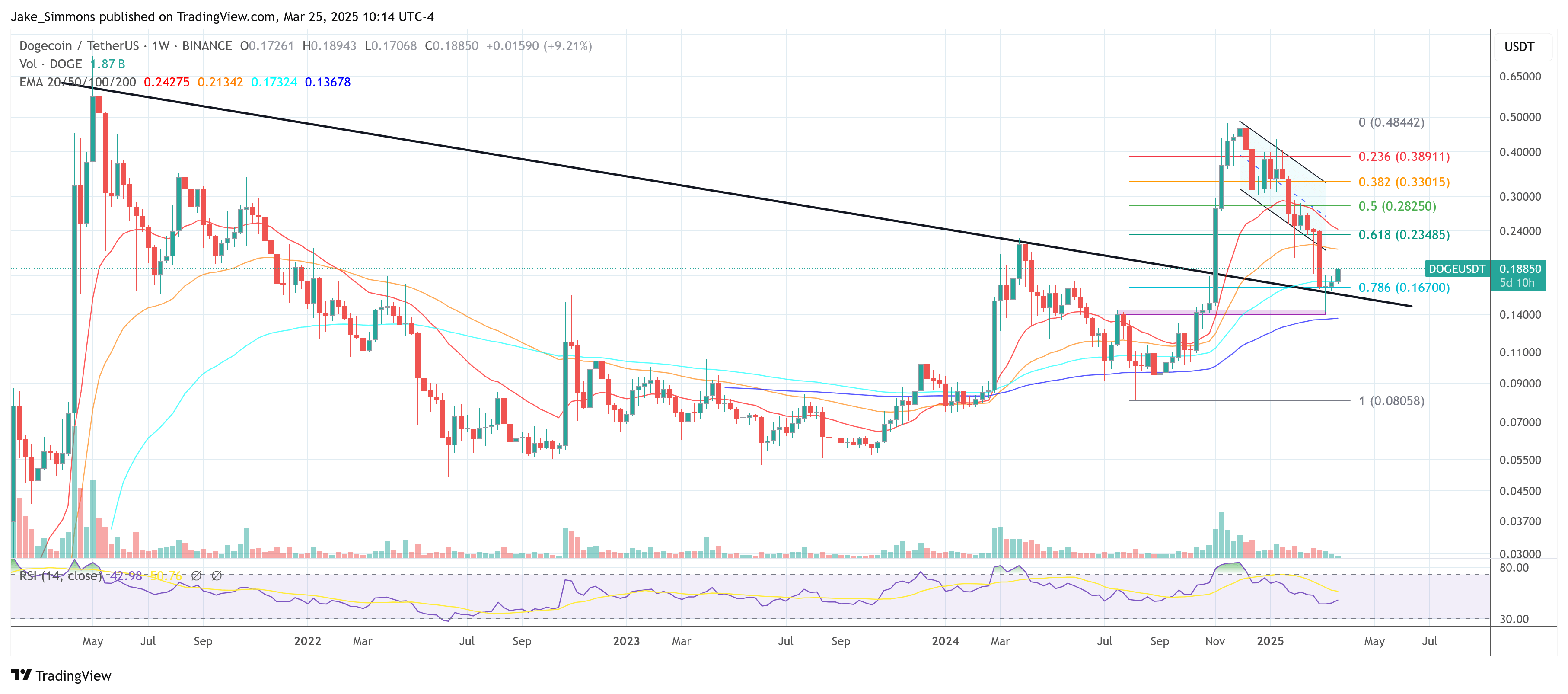

Crypto analyst Kevin has offered an replace on Dogecoin’s value construction, highlighting how a number of technical parts have converged to help his thesis that the meme coin stays on observe regardless of latest volatility. The chart, which he first shared two weeks in the past, reveals a confluence of Fibonacci retracement ranges, descending yellow macro development traces, and the positioning of the 200-week SMA (Easy Shifting Common) and EMA (Exponential Shifting Common).

Dogecoin Follows ‘The Plan’

In accordance with Kevin, these converging alerts have collectively allowed Dogecoin to carry out a critical macro back test, a course of that—if profitable—can typically transition a market from a corrective section into a brand new, extra bullish section. “We nonetheless bought work to do of us however to date it’s all going to plan for Dogecoin,” Kevin wrote at present through X.

Associated Studying

Central to his view is the 0.5 Fibonacci retracement degree round $0.15382, which Dogecoin is presently hovering close to. Derived from the coin’s bigger swing excessive, the 0.5 retracement usually denotes some extent of equilibrium in a much bigger market transfer.

This degree additionally intersects with the yellow downward-sloping development traces which have outlined the macro resistance for Dogecoin since its earlier bull market peaks. The synergy between this retracement degree and the development line retest is a key cause Kevin believes the pullback stays orderly and “all going to plan.” Farther above, Dogecoin’s subsequent Fibonacci milestone is the 0.236 degree close to $0.28013 (crimson horizontal band) that might possible should be overcome for a extra definitive uptrend to develop.

Beneath present buying and selling ranges, the chart highlights a cluster of potential help ranges, together with the 0.618 Fibonacci marker round $0.11767 and the 0.65 retracement close to $0.10924. Though there isn’t a assure Dogecoin’s price will drop to those thresholds, Kevin notes that if additional consolidation have been to happen, the coin would possibly discover stability in that zone.

Associated Studying

Further deeper retracement factors embrace the 0.786 degree round $0.08035 and the 1.0 extension down close to $0.04942—areas that, in earlier cycles, offered significant bounces for tokens experiencing extended corrections.

In the meantime, the weekly shifting averages in blue on the chart, particularly the 200-week SMA and EMA, supply additional context for longer-term sentiment. They’re presently working just under Dogecoin’s spot value, forming one other layer of help.

Kevin’s evaluation additionally cites momentum knowledge from the three Day RSI (Relative Energy Index), indicating that RSI readings have been close to traditionally low ranges for Dogecoin. Low RSI readings can generally recommend a market is oversold, which in flip raises the prospect of a aid rally or broader turnaround if different bullish catalysts emerge.

He referenced 4 focal factors he first recognized in a publish two weeks prior: the retest of the macro 0.5 Fibonacci zone, the descending development line confluence, the again check of the 200-week SMA and EMA, and the notably low RSI values. He additional emphasised that Bitcoin’s total resilience, together with the evolution of macroeconomic knowledge and central financial institution financial coverage, may form whether or not Dogecoin’s value can capitalize on these technical alerts.

“If BTC holds up and Macro Financial Knowledge and Financial coverage alter then you definitely simply bought your final alternative to purchase Dogecoin comparatively low cost. Quite a lot of components at play and plenty of work to do However the danger reward at this degree is excellent given the circumstances,” Kevin concluded twi weeks in the past.

At press time, DOGE traded at $0.1885.

Featured picture created with DALL.E, chart from TradingView.com