- United States’ SEC confirmed Bitcoin miners and PoW swimming pools aren’t securities, offering much-needed regulatory readability

- Ethereum’s PoS transition is going through rising criticism proper now

In a welcome flip of regulatory readability, the USA’ SEC has drawn a agency line within the digital sand – Bitcoin miners and proof-of-work (PoW) swimming pools aren’t securities.

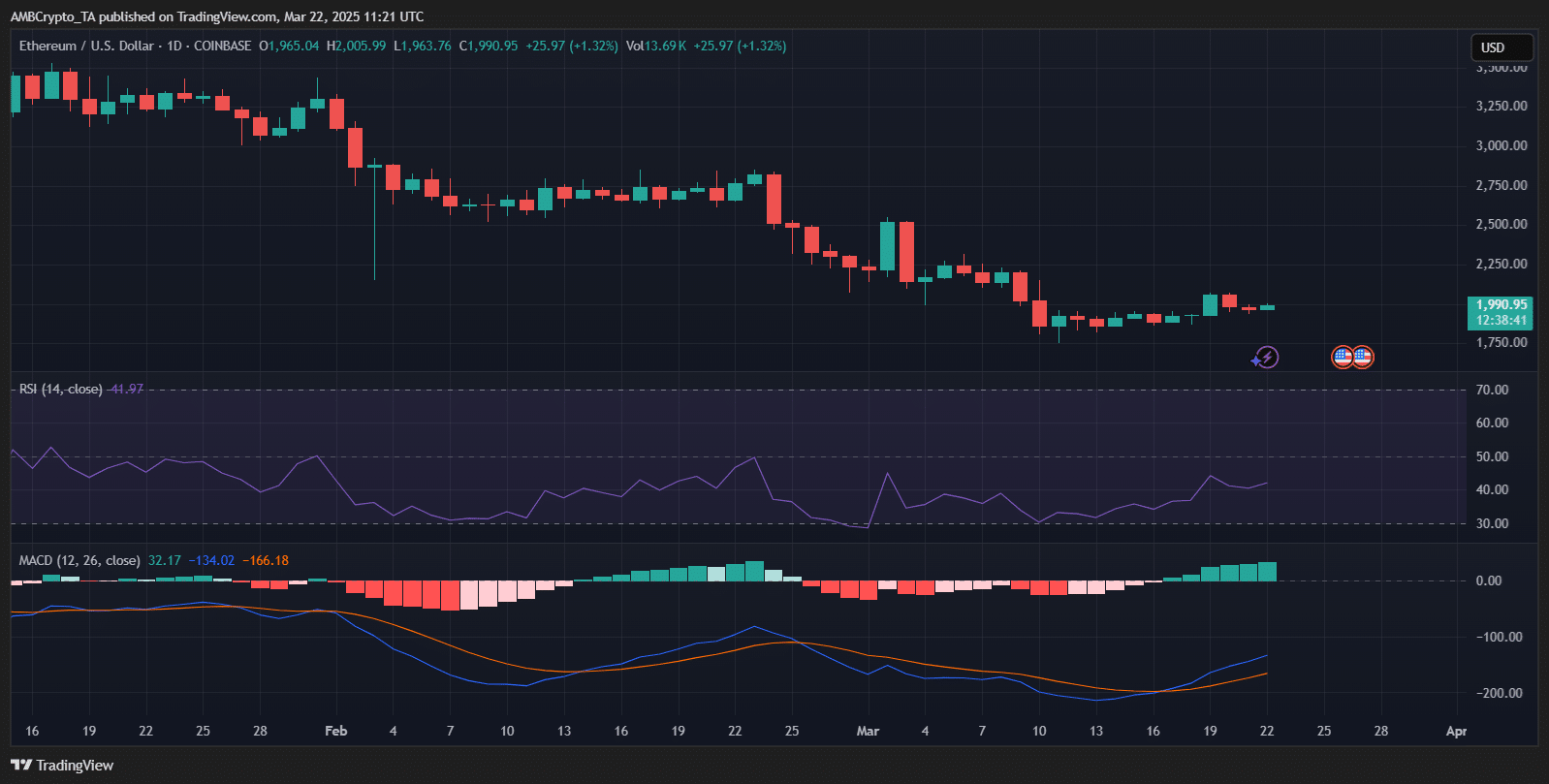

It’s a long-awaited distinction that gives aid to a core a part of the crypto ecosystem, particularly as Ethereum’s [ETH] transition to proof-of-stake (PoS) continues to divide opinion. With one foot in stability and the opposite in experimentation, the trade now finds itself at a regulatory crossroads – however at the least, for PoW, the trail simply bought a little bit clearer.

SEC attracts the road on PoW mining

In a long-awaited clarification, the SEC’s Division of Corporation Finance confirmed that PoW mining – each solo and pooled – doesn’t fall beneath U.S securities regulation. The assertion emphasised that mining exercise on public, permissionless blockchains like Bitcoin is an administrative operate, not an funding contract.

“It’s the Division’s view that “Mining Actions” … don’t contain the supply and sale of securities…”

Since miners depend on computational energy reasonably than a central entity to generate income, the “efforts of others” prong of the Howey check doesn’t apply. The choice affords regulatory aid to PoW miners and indicators a extra clear method beneath the brand new SEC management.

Calls to rethink Ethereum’s PoS mannequin resurface

Following the SEC’s clarification on PoW mining, critics of Ethereum’s PoS transition are as soon as once more amplifying their requires a return to the previous consensus mannequin. For instance – Distinguished trade voice Meltem Demirors believes that Ethereum’s shift to PoS has diluted the community’s core worth by accelerating the rise of Layer-2 (L2) options.

“Proof of Stake was a mistake. Ethereum may have been a trillion-dollar protocol with its personal strong power to compute ecosystem. As an alternative, MEV extracts billions in worth from customers and apps.”

In line with her, PoS fragmented the Ethereum ecosystem and missed a chance to construct a trillion-dollar protocol powered by an energy-to-compute financial system akin to Bitcoin’s. She additional claimed that beneath PoW, Ethereum may have pushed innovation in GPU computing and {hardware} acceleration.

Echoing this sentiment, Red Panda Mining shared a reasonably blunt assertion on X.

With PoW now having fun with regulatory readability, the controversy round Ethereum’s architectural path is heating up as soon as once more.