Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

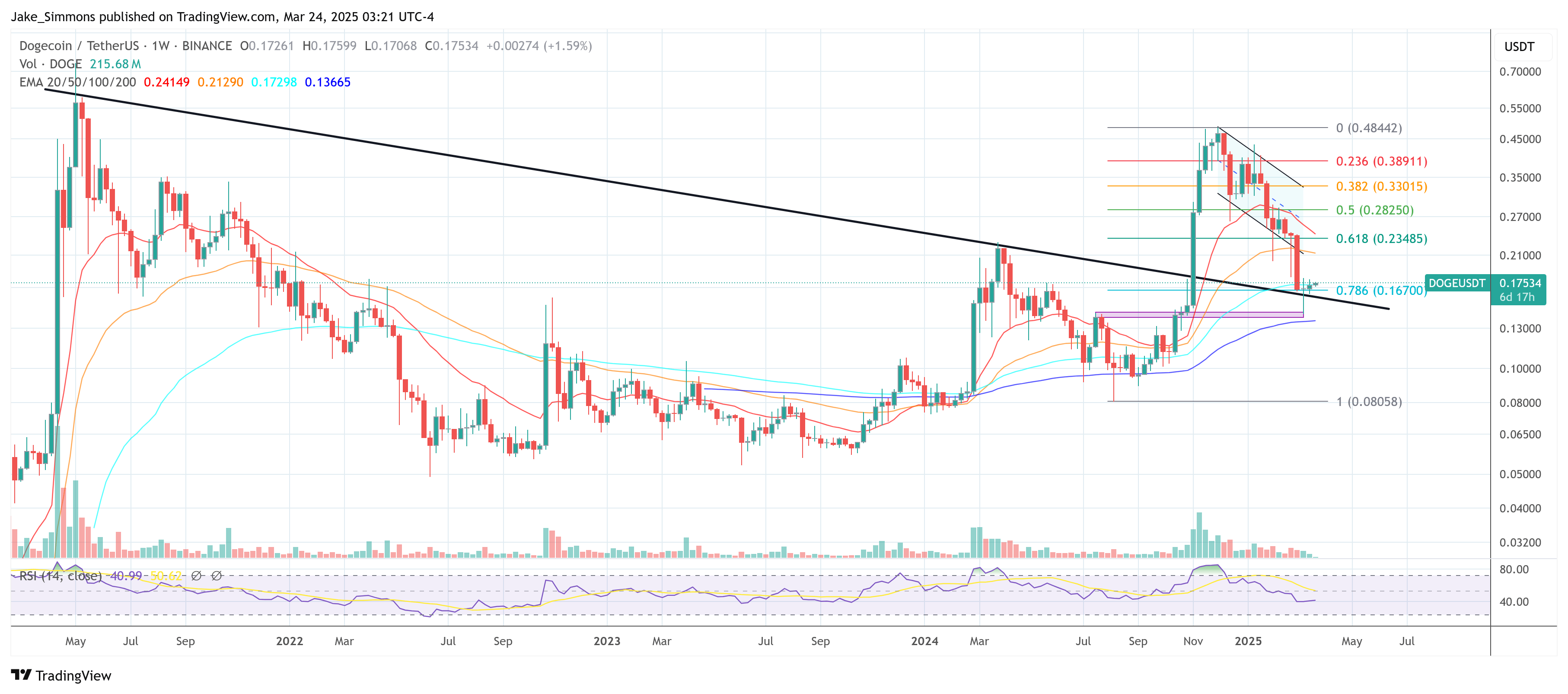

In a contemporary market replace shared on X, crypto analyst Kevin (@Kev_Capital_TA) offered a weekly DOGE/USD chart suggesting that Dogecoin may very well be nearing what he describes as a pivotal inflection level. He said, “My Dogecoin Neighborhood it’s about that point the place I have to present you the Alpha you all need. If we check out DOGE on the weekly timeframe we are able to see that we acquired a weekly demand candle final week on the ‘Final line of bull market assist’ that I identified a few weeks in the past.”

Analyst Sees Large Transfer Coming For Dogecoin

He emphasized the importance of $0.139, calling it important that Dogecoin keep this stage and explaining that, in his opinion, this zone represents a uncommon alternative with “phenomenal” risk-reward potential. He famous, “It would proceed to be completely important that Dogecoin maintain this stage whereas it resets larger timeframe indicators like the three Day MACD, Weekly Stoch RSI and 2W Stoch RSI all of that are getting very near being totally reset.” By referencing these oscillators, Kevin underscored that Dogecoin’s momentum profile appears to be approaching a state wherein downward strain might dissipate and bullish forces might resurface.

He defined that the Weekly Stoch RSI, for instance, is already totally reset, and that the 3-Day MACD is “getting nearer to totally resetting,” whereas the Two-Week (2W) Stoch RSI should still want round one other month earlier than it’s aligned with the decrease, reset area. This mixture of technical situations typically attracts merchants who regard such convergences as indicators {that a} market could also be primed for a marked value transfer.

Associated Studying

Kevin framed his outlook by saying, “For my part this continues to be a spot the place the danger reward ratio on Doge is totally phenomenal provided that if we lose $0.139 sturdy on weekly closes you may lower your trades/losses however your upside potential outweighs your draw back danger by miles.” In essence, he’s inserting the onus on Dogecoin’s capacity to stay above $0.139 on a weekly closing foundation, as a result of within the occasion of a sustained break beneath that line, the bullish thesis may very well be nullified and merchants would seemingly cut back or exit lengthy positions.

Kevin additionally tied the coin’s destiny to the broader crypto panorama, making it clear {that a} resilient Bitcoin value could be vital if Dogecoin is to take care of its footing close to $0.139. He said, “So long as BTC holds these ranges and doesn’t lose 70K then I completely love this spot on DOGE,” which reveals his assumption {that a} weakening Bitcoin would threaten bullish altcoin setups.

Associated Studying

Even so, he stated, “If I have been ever trying to correctly allocate into Doge then I’d positively reap the benefits of this spot from a commerce perspective,” reflecting his perception within the coin’s potential to stay steady on this vary and probably rally as soon as these larger timeframe indicators totally reset. This doesn’t assure an imminent Dogecoin rally, however it underscores why Kevin believes the present market construction might permit for better upside than draw back, and why many merchants and on-chain lovers are intently monitoring these particular situations.

In summarizing his view of what might come subsequent, Kevin defined, “From a holders perspective it’s fairly easy. You need to maintain $0.139 whereas these larger timeframe indicators reset and prepare for the subsequent large transfer.” This sentiment hinges on the notion that when these key momentum and trend-following indicators swing from reset ranges again towards an upswing, a rally might unfold if exterior elements (significantly Bitcoin’s efficiency) stay supportive.

He has thus labeled the $0.139 zone as a make-or-break support level—one which, if breached on the weekly chart, might invalidate his bullish stance. If it holds, nevertheless, Kevin believes Dogecoin is “prepared for the subsequent large transfer.”

At press time, DOGE traded at $0.17534.

Featured picture created with DALL.E, chart from TradingView.com