Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has skilled a much-needed surge above the $2,000 stage, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism out there, however the momentum was short-lived, as ETH rapidly pulled again under the extent and was unable to substantiate a strong maintain. Analysts extensively agree {that a} sturdy and sustained transfer above $2,000 is essential for Ethereum to provoke a broader restoration rally.

Associated Studying

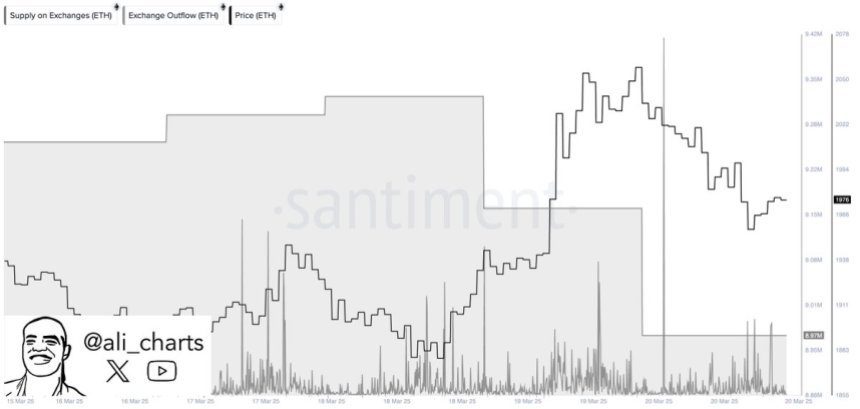

Regardless of the hesitation at resistance, on-chain knowledge exhibits indicators of rising investor confidence. In response to Santiment, buyers have withdrawn over 360,000 ETH from centralized exchanges within the final 48 hours. This shift is usually interpreted as a bullish sign, suggesting that giant holders are transferring their belongings to personal wallets, probably in anticipation of upper costs.

In the meantime, the broader macroeconomic panorama continues to use strain. Commerce battle tensions and unpredictable coverage selections from the U.S. authorities have weighed closely on each crypto and conventional markets, intensifying volatility and investor uncertainty. Nonetheless, Ethereum’s newest alternate outflows trace at a possible development shift — one that would favor accumulation and set the stage for the following main transfer, supplied bulls can reclaim and maintain above the $2K threshold.

Ethereum Faces Crucial Check Amid Alternate Outflows

Ethereum has misplaced over 57% of its worth since mid-December, falling from a excessive of round $4,100 to current lows close to $1,750. This sharp correction has created a difficult atmosphere for bulls, who’ve repeatedly did not reclaim and maintain larger worth ranges.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly set up assist above this stage, it may present the muse for a restoration rally. Nevertheless, a failure to take action would probably end in additional draw back and reinforce the bearish development.

Associated Studying

The present market panorama struggles with uncertainty. On one facet, continued macroeconomic headwinds—rising commerce tensions, inflation issues, and coverage shifts from the U.S. authorities—have weakened investor confidence and pushed volatility throughout threat belongings. However, there are indicators of potential restoration and accumulation.

High crypto analyst Ali Martinez shared data from Santiment, revealing that buyers have withdrawn over 360,000 ETH from centralized exchanges prior to now 48 hours. Traditionally, large-scale withdrawals are thought-about a bullish sign, as they recommend buyers are transferring belongings into chilly storage for long-term holding slightly than getting ready to promote.

This transfer may point out rising confidence amongst massive holders and sign the early phases of a brand new accumulation section—supplied Ethereum can maintain above $2,000.

Worth Holds Regular Under $2,000

Ethereum is presently buying and selling at $1,960 after briefly making an attempt to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 stays an important barrier that bulls should overcome to shift market momentum of their favor. Regardless of a small bounce from current lows, Ethereum has struggled to achieve traction amid persistent market uncertainty.

Bulls must push ETH above $2,000 and reclaim larger ranges similar to $2,150 and $2,300 to substantiate the start of a restoration section. A sustained transfer above these ranges wouldn’t solely sign a possible development reversal however may additionally appeal to sidelined buyers again into the market. Till that occurs, Ethereum stays weak to continued draw back strain.

Associated Studying

If bulls fail to interrupt above the $2,000 resistance within the coming periods, Ethereum may lose assist at present ranges and revisit decrease demand zones round $1,850 and even $1,750. With the broader crypto market nonetheless below the affect of macroeconomic volatility and weak sentiment, the approaching days are prone to be pivotal for ETH’s short-term route. A decisive transfer both above or under this key vary will probably set the tone for the following main worth motion.

Featured picture from Dall-E, chart from TradingView