- Bitcoin’s short-term holder provide is rising. Does this sign a possible market shift or continued uncertainty?

- Key resistance close to $87,000 might decide BTC’s subsequent breakout as short-term holders regulate their positions.

Bitcoin’s [BTC] worth motion has triggered notable shifts in market participation, significantly amongst short-term holders [STH].

Latest information reveals that STH provide has elevated considerably over the previous month, reflecting renewed speculative curiosity as BTC makes an attempt to reclaim key resistance ranges.

Does this point out a bullish continuation, or are short-term holders establishing a distribution section?

Brief-term holders’ affect on Bitcoin’s worth pattern

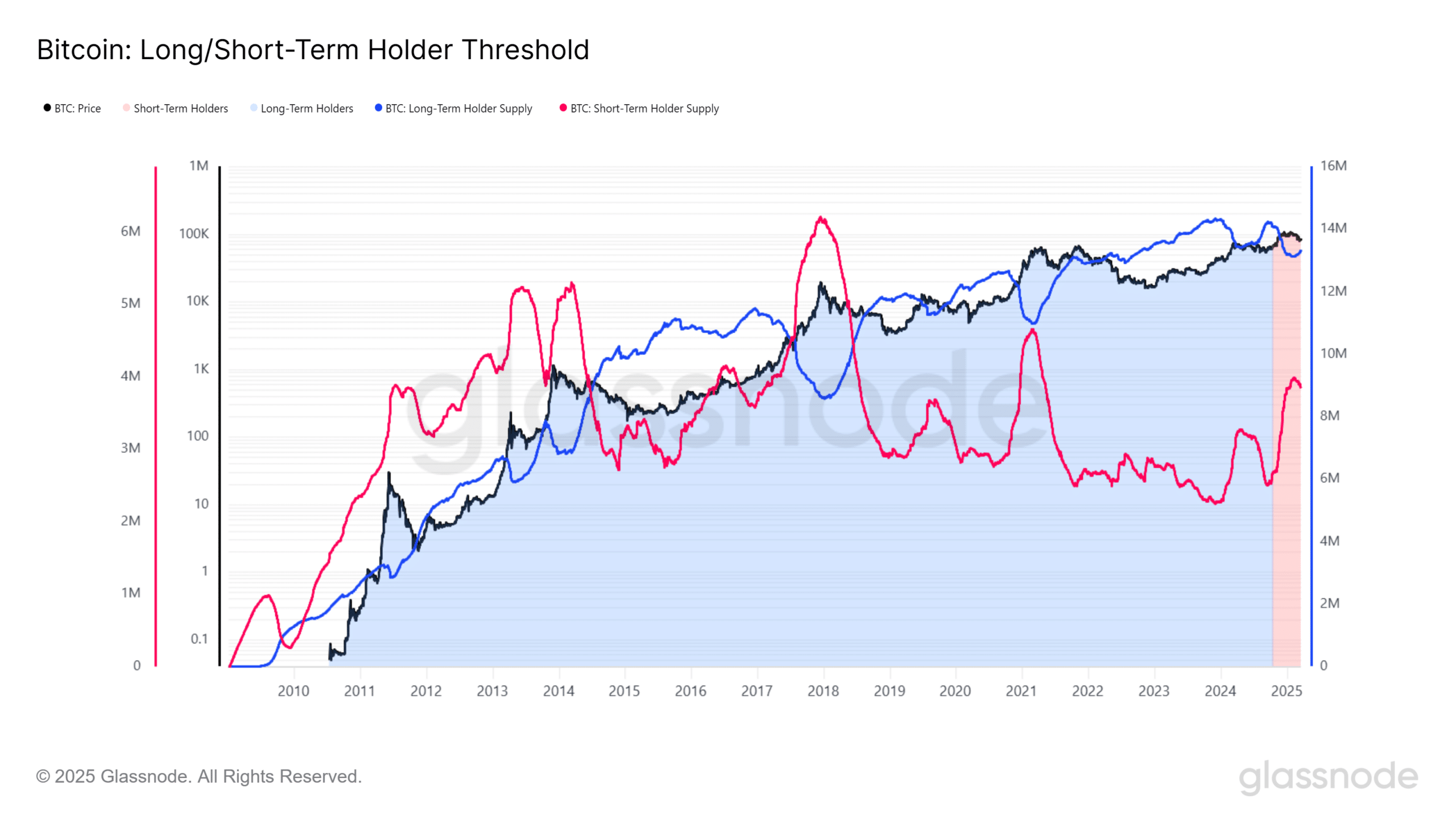

Glassnode’s Lengthy/Brief-Time period Holder [LTH/STH] threshold information means that STH provide has seen a pointy rise in correlation with Bitcoin’s current worth restoration to $85,856.

Traditionally, a rise in STH holdings throughout an uptrend usually indicators heightened buying and selling exercise, resulting in both sustained bullish momentum or profit-taking that stalls worth development.

The newest chart reveals that whereas long-term holders [LTH] preserve a dominant place, the current uptick in STH provide suggests a shift in market sentiment.

STH provide tends to rise when new market members enter throughout a rally, but when profit-taking accelerates, it might add promoting strain that limits BTC’s upside potential.

Key BTC worth ranges and market implications

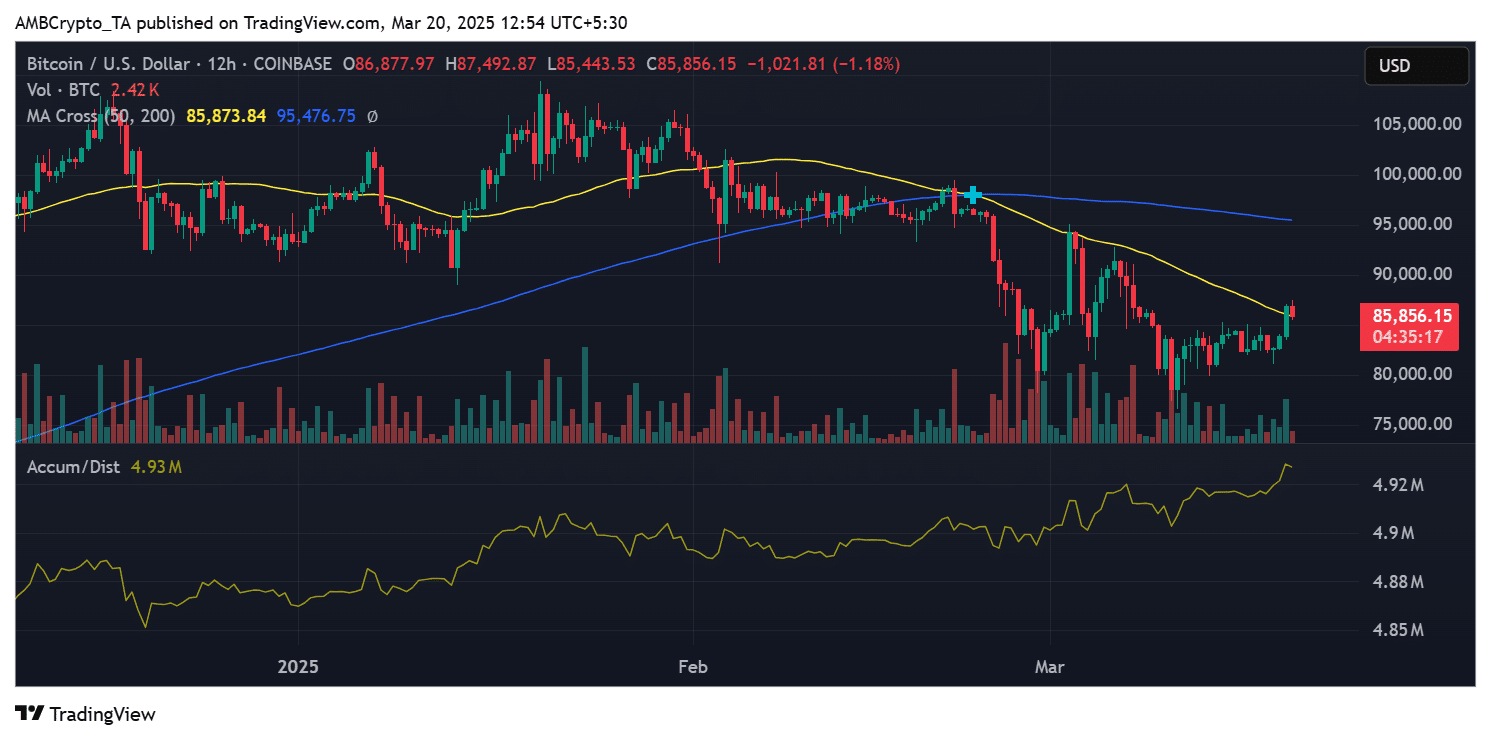

Bitcoin’s worth was $85,856 at press time, testing resistance close to its 50-day transferring common at $85,873.

If short-term holders proceed accumulating and holding onto their positions, BTC might try a breakout towards the 200-day transferring common at $95,476.

Nonetheless, if STHs start offloading their holdings at resistance ranges, BTC might face a correction towards the $82,500-$83,000 help vary.

One other crucial issue is accumulation tendencies. As of this writing, the buildup/distribution indicator confirmed a rising pattern at 4.93 million BTC, indicating ongoing demand.

If this continues, it might present a basis for BTC to stabilize and push increased.

Additional upside or volatility for BTC?

The current improve in STH provide highlights rising dealer exercise, which might both help additional upside or result in near-term volatility.

The market’s response to key resistance ranges will decide BTC’s subsequent main transfer.

If demand stays robust, Bitcoin might regain its bullish momentum, but when promoting strain will increase, a deeper pullback could also be on the horizon.