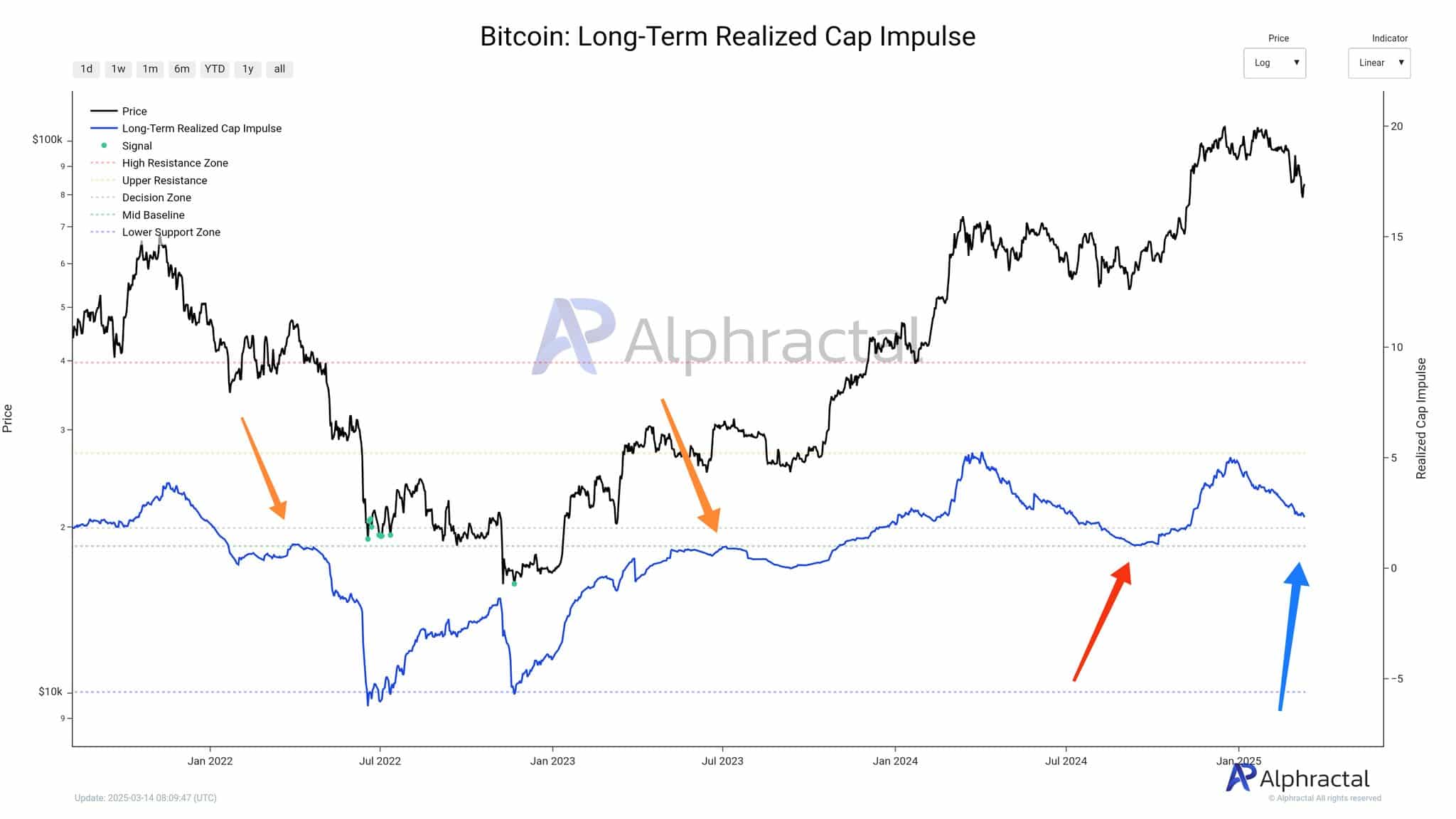

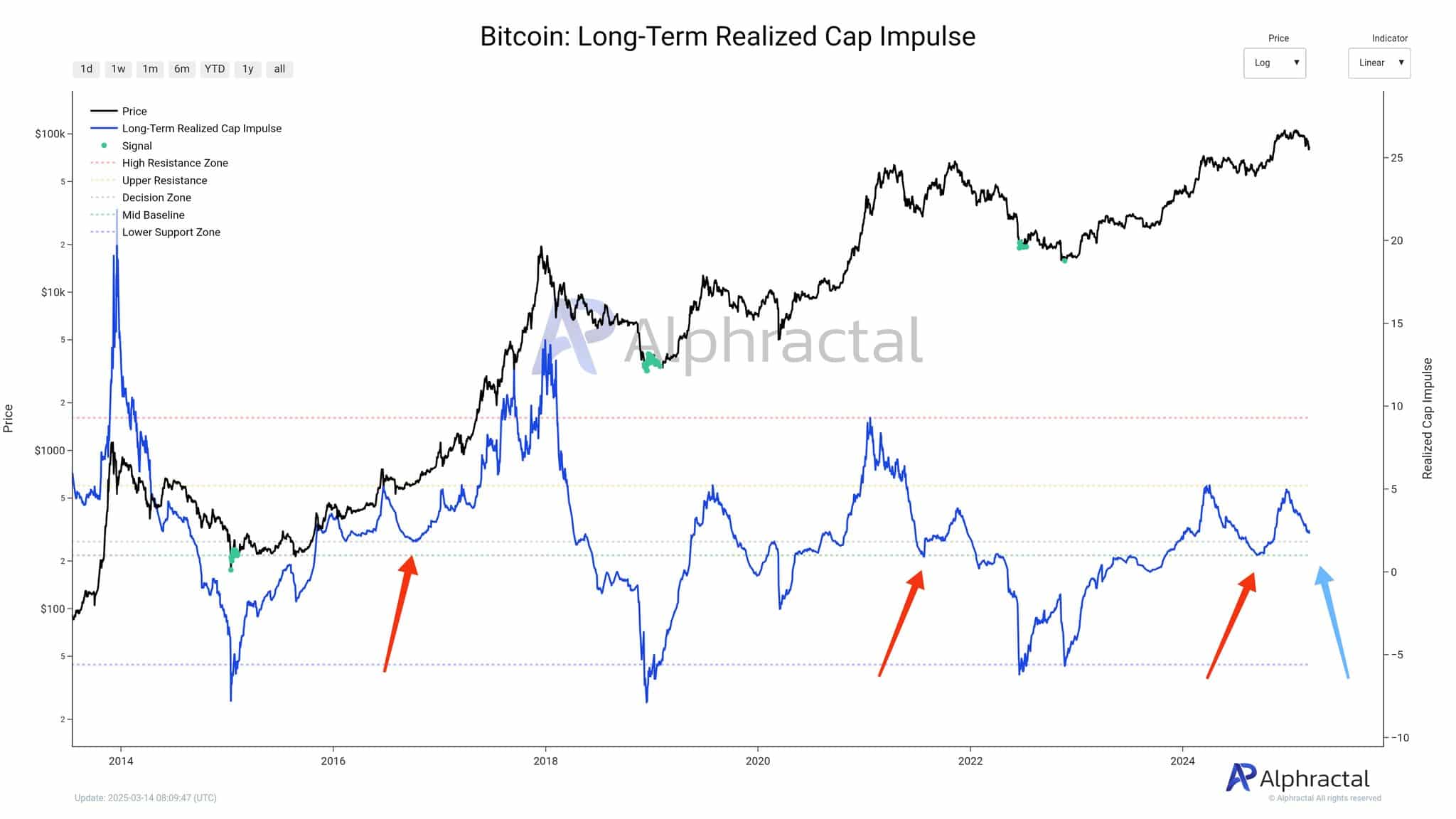

This metric isolates the fee foundation of older UTXOs (unspent transaction outputs), providing insights into the habits of long-term holders. These buyers sometimes accumulate throughout bear markets and distribute in bull phases.

A rising long-term realized cap suggests sustains capital inflows and rising conviction, whereas a decline could level to profit-taking or weakening market sentiment.

Traditionally, Bitcoin has reacted sharply every time this metric has approached key ranges – Both launching new rallies or falling into consolidation.

What does the info say?

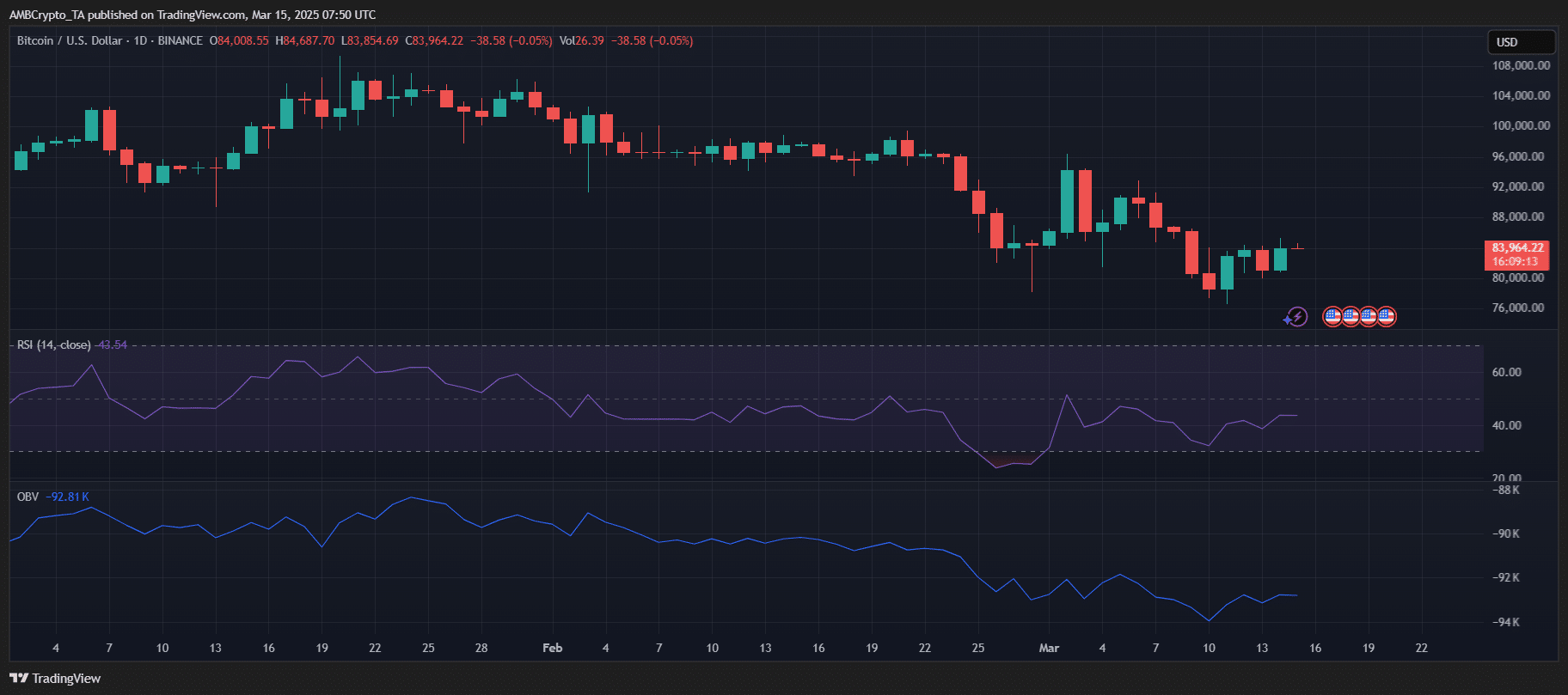

Newest information revealed a decline from native highs, with the metric drifting in the direction of the mid-baseline. This cooling development may point out that the market could also be getting into a pause after months of bullish momentum.

Traditionally, a impartial or adverse realized cap impulse has preceded consolidation phases – or, in some circumstances, market corrections. Within the connected chart, the newest purple arrow pointed to this threat, although a blue arrow hinted on the potential for a restoration.

Notably, in each 2016 and 2020, dips on this metric had been adopted by renewed bullish momentum and eventual all-time highs. If this sample holds, Bitcoin may quickly shift into an accumulation section forward of one other breakout.

Nonetheless, whereas on-chain indicators stay cautiously optimistic, macro and market-specific components will closely affect the street forward.