- Bitcoin’s obvious demand, measured by the 30-day sum of every day block subsidies minus one-year inactive provide modifications, signaled bearish strain

- Holders accelerated promoting, reinforcing bearish market situations

Bitcoin’s [BTC] current value actions mirrored a fancy interaction between demand, leveraged merchants’ sentiment, and key stakeholders’ actions. As BTC dropped from $84,600, merchants miscalculated market route, with many taking lengthy positions on the mistaken time.

On the similar time, giant Bitcoin holders decreased their positions, growing promoting strain throughout the board. Furthermore, demand indicators appeared to level to one of many weakest durations of 2025, with new provide exceeding inactive provide.

Bitcoin’s obvious demand, measured by the 30-day sum of every day block subsidies minus one-year inactive provide modifications, hinted at bearish strain at press time. Between 2 December 2024 and 10 March 2025, demand peaked at 105k BTC on 16 December 2024, with the value at $97.5k.

Nonetheless, by 3 March 2025, demand had plummeted to -100k BTC because the cryptocurrency dropped to $80k on the charts. The 30-day Easy Transferring Common (SMA) of demand additionally declined from 105k BTC to 77.5k BTC, reinforcing this downtrend.

A shift from optimistic demand to adverse demand occurred after mid-January 2025, with sustained adverse demand taking maintain by 17 February 2025. This shift instructed that new provide outpaced the retention of inactive BTC, resulting in downward strain on the value.

If demand stays adverse, Bitcoin may take a look at $75k, doubtlessly declining to $70k. A reversal above 0 would possibly stabilize the crypto at $85k, although sustained shopping for strain could be wanted to substantiate a restoration.

Misalignment with market developments

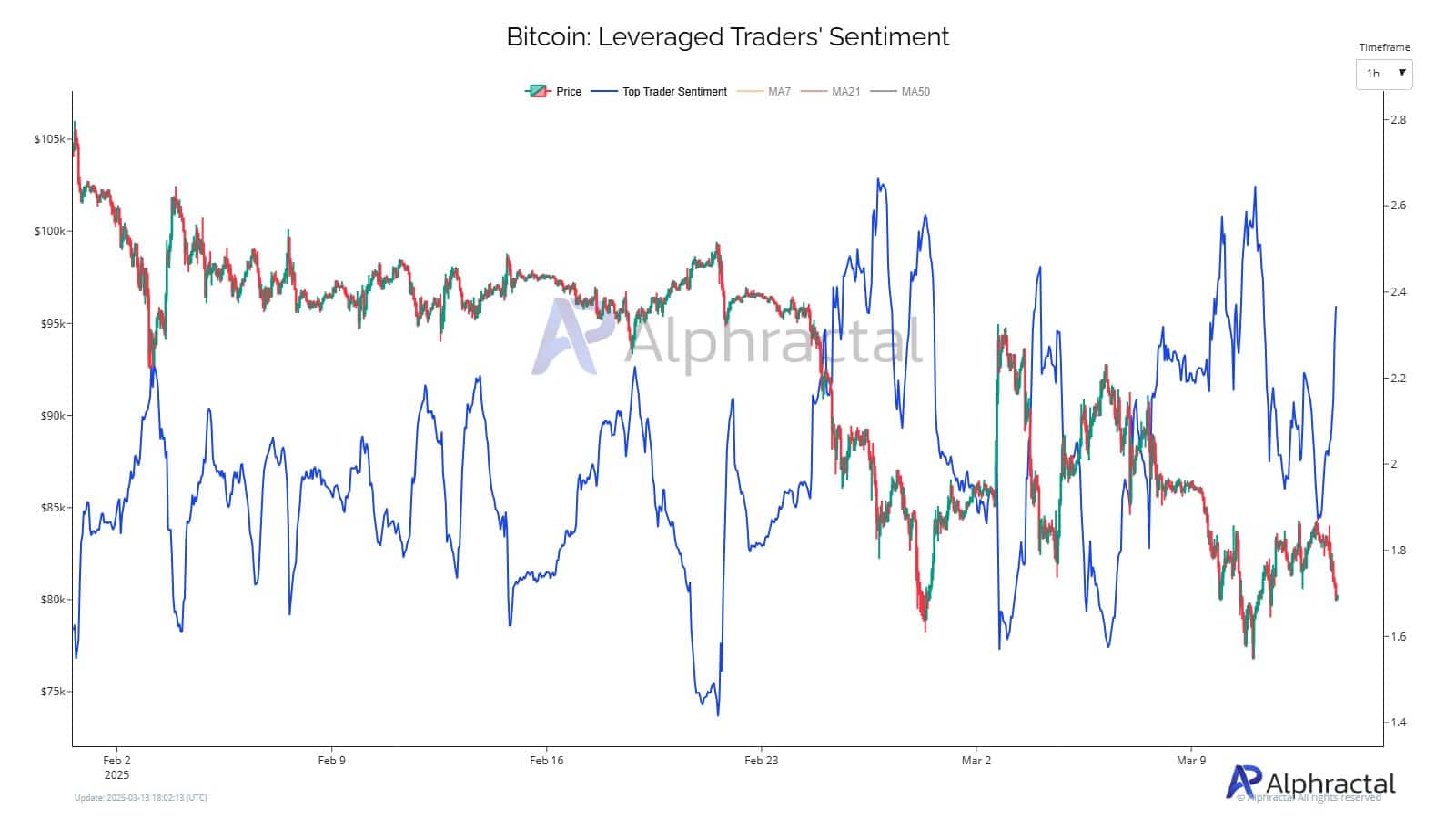

That’s not all although. Leveraged merchants misjudged Bitcoin’s value motion, as sentiment shifts did not align with the value motion. From 2 February to 9 March, Bitcoin traded at $95k whereas prime dealer sentiment registered -2.8 – An indication of maximum bearishness.

By 16 February, sentiment flipped to 2.8 as the value fell to $85k, indicating that merchants had been going lengthy regardless of the downtrend.

The Transferring Averages (MA7, MA21, MA50) of sentiment fluctuated, with the MA50 peaking at 2.2 on 23 February, even because the crypto dropped to $80k. On 9 March, sentiment fell to 1.4 whereas Bitcoin recovered to $84k, once more misaligning with value route.

This persistent misjudgment is an indication of overconfidence in a rally that didn’t materialize. If merchants proceed this sample, additional liquidations may push BTC to $78k. Nonetheless, a realignment of sentiment with value developments may help a restoration, although market conduct stays unpredictable.

Stakeholders’ promoting provides strain

Lastly, Massive Bitcoin holders accelerated promoting, reinforcing bearish market situations. During the last three months, wallets holding 100–1,000 BTC decreased their holdings by 50,625 BTC, lowering their market share from 23.48% to 22.94%.

Equally, wallets with 10–100 BTC shed 7,062 BTC, bringing their share down from 21.84% to 21.71%.

This promoting pattern coincided with Bitcoin’s value decline from $97k to $84k between 21 January and a pair of March. The promoting strain intensified because the crypto neared $80k on 22 February – An indication that main stakeholders lacked confidence within the value sustaining larger ranges.

If this pattern persists, Bitcoin may take a look at $75k. Nonetheless, if giant holders start accumulating once more, BTC would possibly rebound to $88k.

Bitcoin’s street ahead

Bitcoin’s outlook stays unsure, with weak demand, misaligned dealer sentiment, and enormous stakeholder promoting shaping its trajectory. Demand dropped to -100K BTC on 3 March, reflecting market weak point.

Leveraged merchants persistently miscalculated developments, with sentiment shifts failing to align with value actions. In the meantime, stakeholders offloaded 57,687 BTC, growing downward strain.

If these developments persist, Bitcoin could decline additional to $75k. Nonetheless, a shift in demand or bettering dealer sentiment may set off a restoration to $90k.