Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

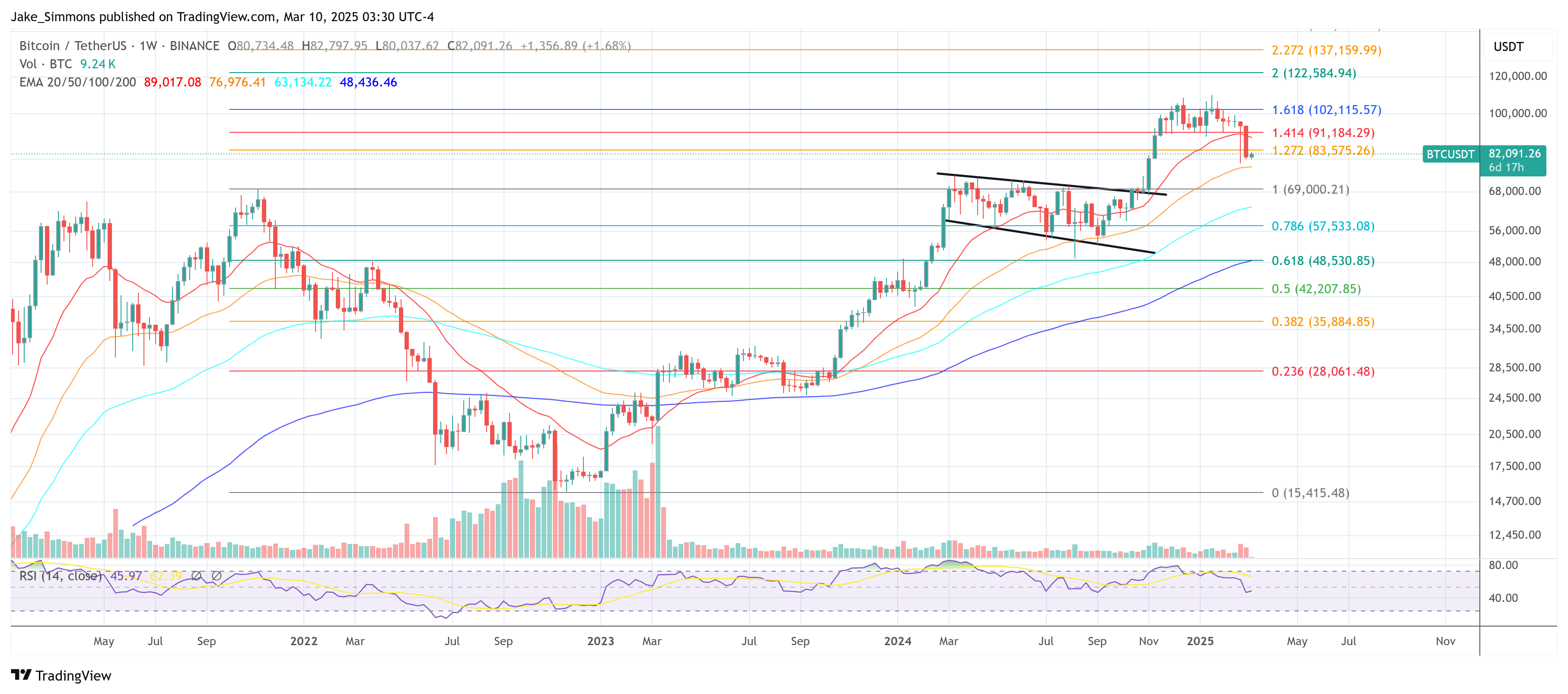

Bitcoin’s worth endured one other bout of volatility over the weekend, shedding 5% on Sunday to dip beneath the $80,000 mark, earlier than settling close to $82,000. This newest decline locations the cryptocurrency roughly 25% beneath its all-time excessive of $109,900. Analysts attribute the downturn to ongoing commerce tensions—linked to President Donald Trump’s newest tariff measures—and the fears of a looming recession.

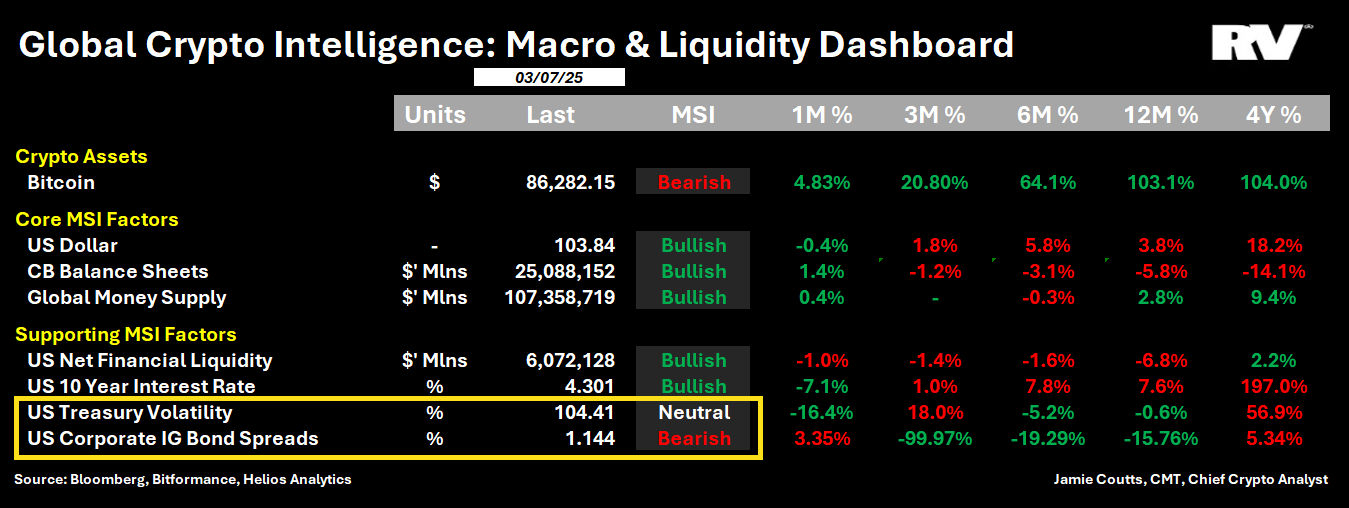

In the meantime, a weakening US Greenback Index (DXY), which has fallen from 110 to 103 since mid-January, coinciding with Trump’s second time period in workplace and may very well be a possible bullish catalyst for the Bitcoin worth. In a sequence of posts on X, Jamie Coutts, Chief Crypto Analyst at Realvision, presents a have a look at the present market atmosphere, highlighting two key metrics that might form central financial institution coverage—and, by extension, Bitcoin’s trajectory. “Bitcoin is like taking part in a sport of Rooster with central banks,” Coutts writes.

Associated Studying

He defined that whereas the greenback’s latest decline helps a bullish framework for Bitcoin, rising Treasury bond volatility (tracked by the MOVE Index) and widening company bond spreads are inflicting concern: Coutts emphasised the function of US Treasuries as the worldwide collateral asset. Any spike of their volatility, he argued, forces lenders to impose bigger haircuts on collateral, tightening liquidity. “Rising volatility forces lenders to use haircuts on collateral, thereby tightening liquidity. […] Above 110 [on the MOVE Index] and I think there will likely be just a few issues on the central planner ranges.”

Over the previous three weeks, US investment-grade company bond spreads have been widening, a shift Coutts views as a sign that danger property—together with Bitcoin—might face stress: “This implies that the demand retaining yields compressed relative to Treasuries is fading—and additional widening may very well be unfavorable for danger property.”

Regardless of these cautionary flags, Coutts stays optimistic about Bitcoin’s medium-term prospects, primarily because of the dollar’s “rapid decline.” He famous that the greenback’s drop in March—one of the vital month-to-month dips in 12 years—traditionally has coincided with bullish inflection factors in Bitcoin’s worth. In keeping with his analysis, “They’ve all occurred at Bitcoin bear market troughs (inflection factors) or mid-cycle bull markets (pattern continuations).”

Associated Studying

Whereas acknowledging the restricted historic dataset for Bitcoin, Coutts additionally cited key catalysts he believes might propel the digital asset greater:

- Nation-State Adoption: “A world nation-state race is underway,” Coutts wrote, describing a state of affairs through which nations both embody Bitcoin of their strategic reserves or ramp up mining efforts.

- Company Accumulation: He factors to the potential of firms—notably Strategy (MSTR)—including 100,000 to 200,000 BTC this yr.

- ETF Positions: Change-traded funds could “double their positions,” additional driving institutional inflows.

- Liquidity Dynamics: In Coutts’s phrases, “The Spice Should Stream.”

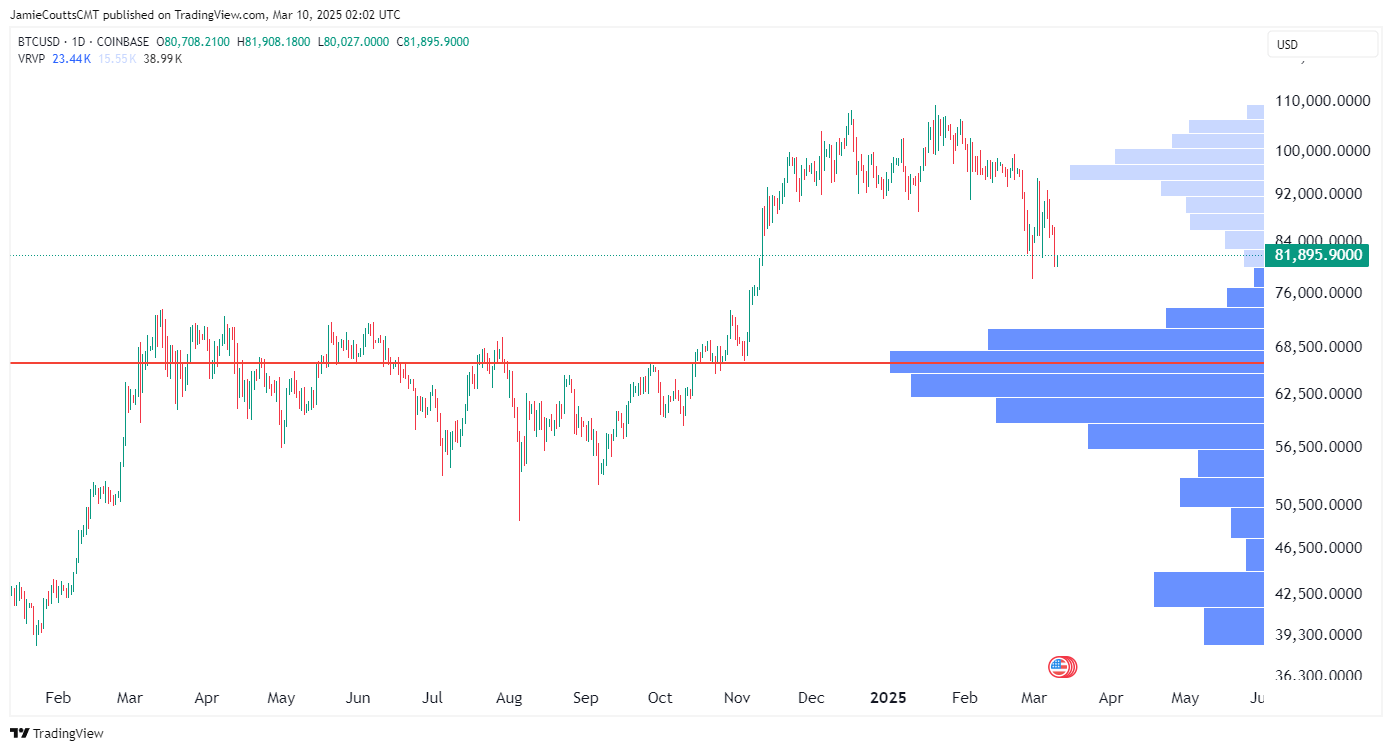

Coutts additionally talked about that Bitcoin seems to be “filling an enormous hole” and reiterated his view {that a} slide beneath the high-$70,000 vary would sign a basic market shift. In the meantime, he sees central bankers edging nearer to doable intervention as Treasury volatility and credit score spreads climb: “If Treasury volatility and bond spreads hold rising, asset costs will proceed their decline. In the meantime, this can possible push the central planners to behave.”

In closing, Coutts provided a concise abstract of why he believes Bitcoin is successfully locked in a showdown with central banks: “Consider Bitcoin as a high-stakes sport of hen with the central planners. With their choices dwindling—and assuming HODLers stay unleveraged—the percentages are more and more within the Bitcoin proprietor’s favor.”

For now, the world’s largest cryptocurrency seems to be treading a line between macroeconomic headwinds—highlighted by a unstable bond market—and the tailwinds of a weakening greenback. Whether or not Bitcoin continues to retreat or resumes its long-term ascent will possible rely upon how world policymakers reply to mounting bond market pressures—and whether or not holders are ready to maintain taking part in “hen” with the central planners.

At press time, BTC traded at $82,091.

Featured picture created with DALL.E, chart from TradingView.com