Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has prolonged its decline under $90,000 as on-chain knowledge exhibits whales selling off in large quantities. This worth decline comes amidst the otherwise bullish news of Donald Trump signing an government order for a Strategic Bitcoin Reserve (SBR). The dearth of bullish momentum regardless of this has introduced into play the possibility of an prolonged bearish transfer from right here.

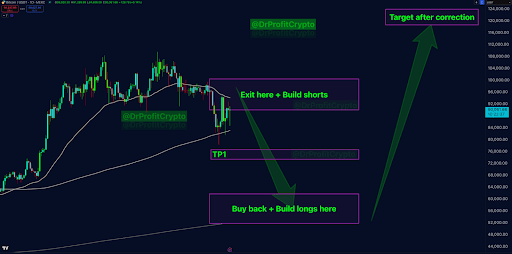

A well known crypto analyst, Physician Revenue, has raised alarms about an impending main correction in Bitcoin’s worth. In an in depth submit on social media platform X, he outlined his causes for this shift, arguing that the present market circumstances sign the beginning of the primary giant Bitcoin correction of this cycle.

Strategic Bitcoin Reserve: A Misinterpreted Narrative?

Widespread crypto analyst Physician Revenue revealed that he’s promoting a good portion of his holdings and coming into quick positions. Notably, the analyst pointed to the latest information surrounding the Strategic Bitcoin Reserve as a key issue that led him to reevaluate his bullish stance. He emphasised that whereas retail buyers see this as a game-changing improvement, giant gamers and whale buyers have already priced within the impression.

Associated Studying

Many crypto buyers anticipated an accumulation of Bitcoin by the US authorities with a view to strengthen the reserve. Nevertheless, as an alternative of the anticipated ensuing shopping for stress on Bitcoin, the manager order centered on Bitcoin confiscated from earlier seizures, which left bullish buyers underwhelmed.

In line with Physician Revenue, the choice to log off on this coverage sooner than anticipated signaled a shift in market dynamics. His expectation was that this transfer would materialize months later, permitting Bitcoin’s worth to maintain upward momentum earlier than the primary vital correction. As a substitute, he now sees this because the primer for a long-term decline.

Is This The Starting Of Bitcoin’s First Massive Correction? Value Ranges To Warch

Physician Revenue firmly believes that Bitcoin has but to expertise a proper correction in this cycle, noting bull market developments the place the asset has seen no less than one 40-50% drop earlier than reaching new all-time highs. He sees the latest developments as the ultimate push earlier than a 40% to 50% decline. As such, the analyst famous that that is the perfect window for distributing promote orders and coming into quick positions.

Associated Studying

His outlook suggests a retracement to as little as $50,000–$60,000 earlier than Bitcoin resumes its long-term bullish trajectory. Breaking down his buying and selling technique, he disclosed that he has already bought 50% of his Bitcoin holdings, which he collected at $16,000. He has positioned quick orders inside the $90,000–$102,000 vary, with goal earnings set at $74,000 for the primary take-profit stage, adopted by a whole exit within the $50,000–$60,000 area and a full buyback to double holdings.

Regardless of his short-term bearish outlook, the analyst maintains that Bitcoin will eventually rally to new highs within the $120,000–$130,000 vary. On the time of writing, Bitcoin is buying and selling at $86,530.

Featured picture from Unsplash, chart from Tradingview.com