- A number of the stolen Bybit funds are traceable, whereas others have vanished into untraceable channels

- Within the meantime, the crypto group stays on excessive alert.

The notorious Bybit hack triggered a serious FUD second throughout the crypto market.

A complete of $1.4 billion (round 500,000 ETH) was compromised, with 77% nonetheless traceable, 20% gone darkish, and three% frozen. Right here’s a breakdown of how the funds have been moved.

A breakdown of the hacked funds

Out of the $1.4 billion stolen within the hack, an intensive evaluation uncovered the next key insights – 77% of the stolen funds stay traceable, offering some hope for restoration.

Nevertheless, 20% of the funds have disappeared from the radar, making them exceedingly tough, if not inconceivable, to trace. On a extra optimistic be aware, 3% of the funds have already been efficiently frozen.

The hacker employed a sequence of subtle methods to maneuver and obscure the stolen belongings. Hackers quickly transformed a considerable 417,348 ETH into Bitcoin throughout 6,954 wallets, averaging 1.71 BTC per pockets.

The sheer quantity of Ethereum [ETH] transformed into Bitcoin is more likely to have a major affect on BTC’s market liquidity. This huge-scale conversion might improve the provision of Bitcoin on exchanges.

With uncertainty surrounding BTC’s subsequent transfer, this inflow of liquidity might intensify market volatility within the coming days.

Potential for ETH/BTC volatility

The Bybit hack has set the stage for a turbulent interval within the crypto market. The motion of $1.4 billion in compromised funds – significantly the large conversion of ETH into Bitcoin – will create a major ripple impact on market liquidity.

For one, with funds distributed throughout 6,954 wallets, transactions might unfold throughout a number of exchanges, rising the complexity of monitoring the funds.

On high of that, there’s rising pressure over the dearth of affirmation of Trump’s pro-ETH/BTC positon. Critics are already speculating that it may very well be a part of a broader market manipulation technique, stirring doubts amongst traders.

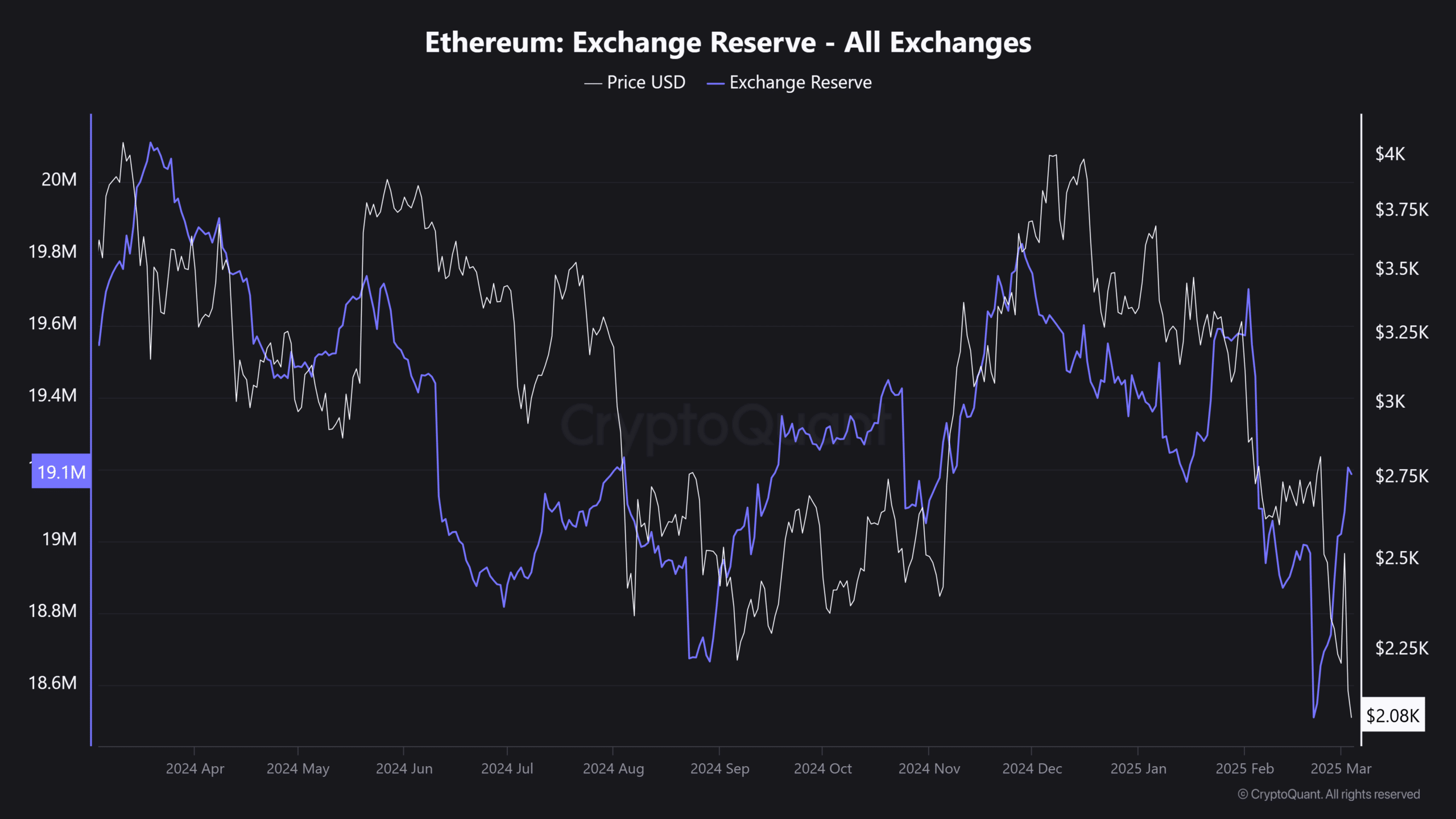

Furthermore, ETH reserves, after hitting a yearly low, at the moment are starting to rise once more, which solely provides gas to the hearth. On this local weather of heightened pressure, absorbing the sell-side liquidity might be something however simple.

Tread rigorously! Merchants and traders might want to navigate a risky panorama, the place sudden strikes can set off sharp market reactions within the coming days.