The Stellar (XLM) market has registered a worth increase previously day gaining by 10.77% in line with data from CoinMarketCap. This worth bounce comes after a moderately bearish week marked by significant losses throughout the final crypto market. Apparently, as these digital property present some minor restoration, famend market analyst Ali Martinez has postulated that XLM could also be getting ready for a significant bullish swing.

XLM’s Bullish Flag Might Propel Costs To $1.20 – Analyst

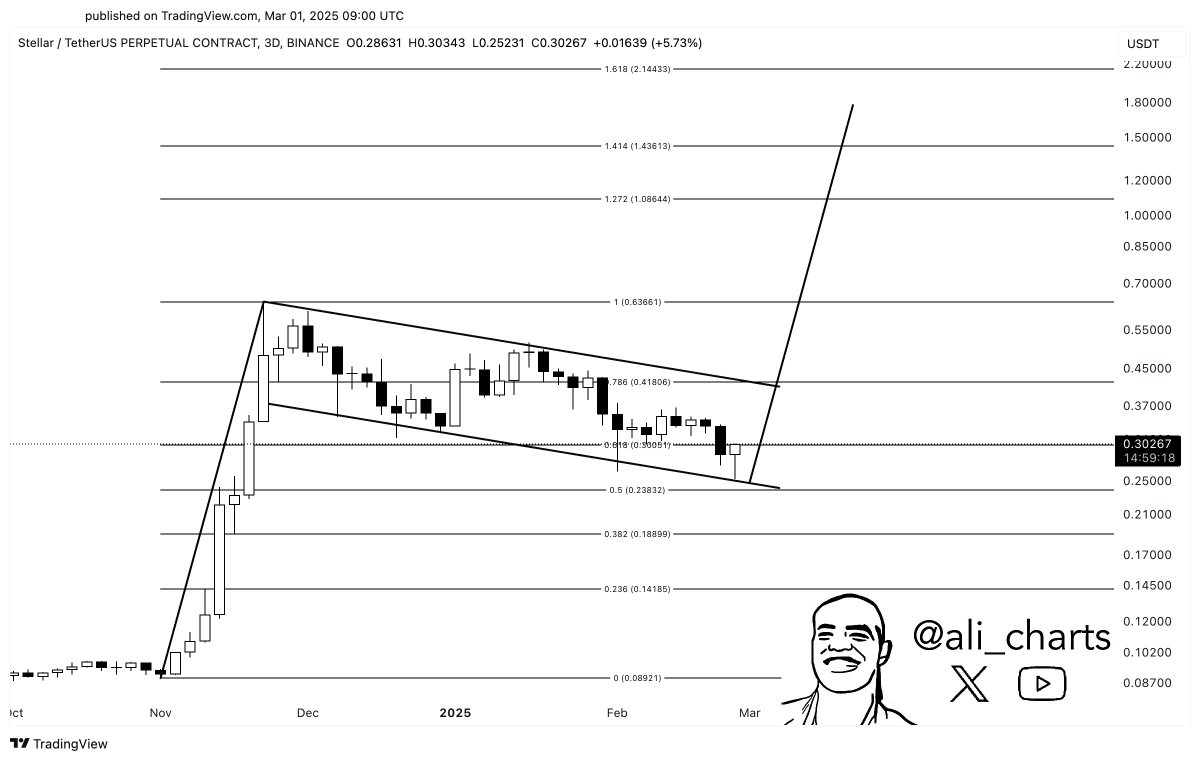

In an X post on March 1, Martinez shared an fascinating technical evaluation of the XLM market. In accordance with the market knowledgeable, there’s a bullish flag formation on the XLM/USDT 3-day buying and selling chart signaling an incoming worth surge.

For context, the bullish flag sample happens when an asset experiences a steep rise in worth representing the flagpole adopted by a consolidation interval with a declining worth motion representing the flag. On the XLM/USDT chart, the bullish flag is fashioned following a worth rally in November 2024 which is trailed by a worth correction section thus far.

Nevertheless, whereas the bullish flag would possibly sign a possible upward momentum able to explode, Stellar should break past the higher boundary of the flag at present at $0.41 to verify any worth surge. Trying past this degree, the altcoin will even face vital resistance to its upward motion at $1.00, $1.21, and $1.41 worth ranges respectively.

Nevertheless, within the presence of ample shopping for strain, XLM may surge by no less than 330% upon affirmation of bullish intent suggesting a minimal worth of round $1.20. This projected rise of Stellar stems from historic knowledge from which a bullish flag is anticipated to provide market positive factors much like the size of its flagpole.

Apparently, the Relative Power Index (RSI) on the XLM/USDT day by day chart additionally helps the bullish potential of the altcoin. In accordance with knowledge from Tradingview, this RSI is at present at 4.59 headed within the upward path, signaling extra room for XLM worth positive factors following its latest restoration.

XLM Value Overview

On the time of writing, XLM trades at $0.3141 after its 10% worth enhance within the final 24 hours as earlier acknowledged. In the meantime, there’s a slight discount in market engagement as indicated by a 1.12% decline in day by day buying and selling quantity.

It’s value noting that XLM nonetheless stays within the pink zone on its weekly and month-to-month timeframes with losses of 5.94% and 27.28%, respectively suggesting bigger bearish market management in latest instances. For a bullish flag breakout to materialize, XLM merchants should enhance the present shopping for strain and induce the next buying and selling quantity.