The most important cryptocurrency on this planet, Bitcoin has plunged a dramatic 11% from its all-time excessive. Though some buyers would possibly discover this worth devaluation alarming, historic knowledge signifies that it’s actually small in respect to the opposite market cycles of the cryptocurrencies.

The previous worth traits of Bitcoin present a number of abrupt declines and rises; volatility is all the time current. One has to think about the context of this most up-to-date decline so as to consider its future course.

Associated Studying

Historic Context Of Bitcoin Corrections

Bitcoin has seen many corrections since its inception. As an illustration, Between January 2012 and December 2017, the worth of the alpha coin dropped greater than 10% on no less than 13 events. Some corrections have brought on market worth losses of billions of {dollars} earlier than making first rate rebounds; some have even reached 20% or extra.

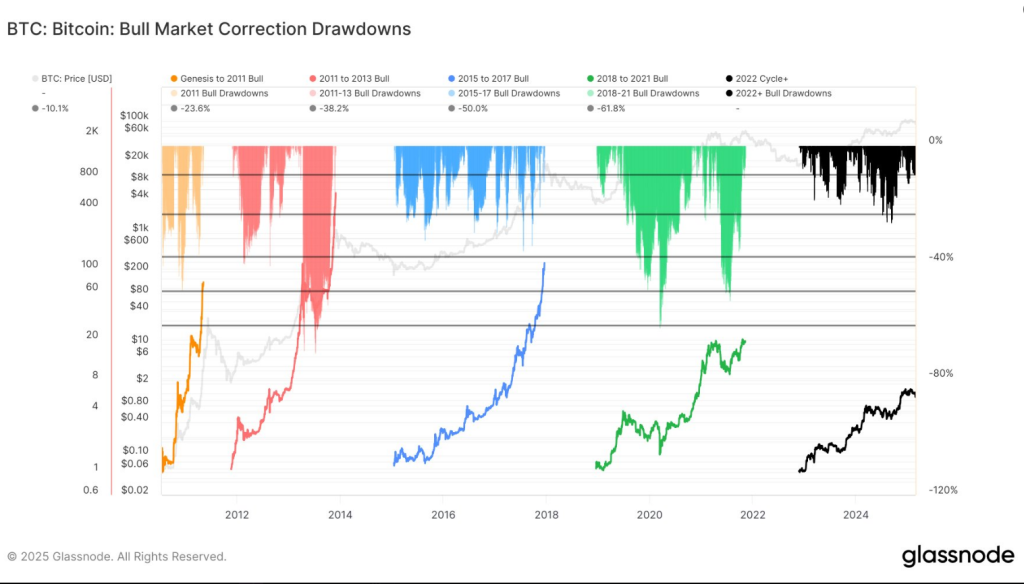

The truth that the present Bitcoin market cycle is much less risky than earlier bull runs is amongst its most noteworthy options. The next patterns of drawdown are seen in historic knowledge from prior cycles:

This cycle continues to be the least risky of all:

🔹2011-2013: Avg. -19.19%, Max. -49.45%

🔹2015-2017: Avg. -11.49%, Max. -36.01%

🔹2018-2021: Avg. -20.41%, Max. -62.62%https://t.co/isZhpa3caS pic.twitter.com/JfhMa5J3kv— glassnode (@glassnode) February 26, 2025

Over time, Bitcoin has proven its capacity to recuperate and set new report highs; these swings are inevitable within the nature of its market motion. Even in bull markets, Bitcoin recurrently undergoes temporary declines that assist to shake off weak palms earlier than it picks again up its growing trajectory.

Current Market Situations

On February 27, 2025, Bitcoin was buying and selling at $85,800, representing a 4% lower from the day past’s shut. The intraday excessive was $89,230 and the intraday low was $82,460. The latest 15% decline within the weekly body surpasses the cycle’s common drawdown of 8.50% however is considerably lower than the 26% decline in earlier cycles.

In comparison with different corrections, which have usually lasted for months, this one may be very modest. Many analysts argue that it isn’t an indication of deeper market concern, however quite a pure a part of Bitcoin’s cycle.

In the meantime, in keeping with on-chain evaluation, except Bitcoin swiftly bounces again over the $92,000 stage, there’s a likelihood that decrease lows will persist within the close to future.

This barrier is essential, because it represents the juncture at which the vast majority of short-term merchants obtain profitability. Alternatively, as they mitigate their losses, Bitcoin could retrace to $70,000, or $71k.

Elements Influencing The Current Decline

The value of Bitcoin has gone down for numerous causes. As all the time, sentiment is an enormous issue within the bitcoin market, and even small adjustments in investor belief could cause large worth swings.

There has additionally been panic promoting due to worries about safety, particularly after the Bybit hack, which value the crypto trade $1.5 billion in losses.

Inflation fears, central financial institution insurance policies, and international financial uncertainty have additionally brought on buyers to be extra cautious with threat belongings. These exterior pressures usually drive Bitcoin’s volatility, making its worth extremely reactive to altering monetary circumstances.

Associated Studying

Based mostly on the way it has behaved prior to now, Bitcoin’s development cycle appears to incorporate dips, despite the fact that it’s at the moment happening. It slowly received higher after years of losses and reached its highest level after consolidations.

Featured picture from Reuters, chart from TradingView