In a publish on X on Tuesday, crypto analyst Ali Martinez (@ali_charts) shared a protracted‐time period Dogecoin (DOGE) value chart highlighting a essential assist stage that, if misplaced, may open the door for a steep correction. Martinez pinpointed $0.19 as the road within the sand. Ought to the meme‐impressed token dip beneath this threshold, he argues, “the likelihood of a deeper correction towards $0.06 considerably will increase.”

Dogecoin Crash To $0.06 Incoming?

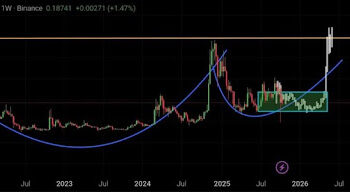

The weekly chart—which spans again to early 2014—depicts Dogecoin buying and selling inside a broad ascending channel. Stable black development traces enclose many of the value motion from DOGE’s earliest sub‐penny valuations to the all‐time excessive of roughly $0.73 in 2021. Dashed traces working parallel to those development traces seem to behave as mid‐channel guides, capturing smaller swings inside Dogecoin’s bigger market cycles.

Notably, DOGE has spent extended durations shifting laterally inside the decrease vary of this channel, solely to interrupt out sharply when it has examined the higher boundaries. When Martinez posted the chart, Dogecoin was seen hovering round $0.225, simply above a key horizontal assist area within the chart.

Associated Studying

Overlaid on the channel are intensive Fibonacci ranges derived from Dogecoin’s lengthy‐time period value historical past. The 0.786 Fib retracement—generally seen as a make‐or‐break assist in deeper corrections—appears to align close to $0.1978, very near the $0.19 stage Martinez highlighted.

Under $0.19, the chart exhibits few quick technical cushions till roughly $0.13, which is aligning with the decrease a part of the multi‐12 months ascending channel. Beneath that, the $0.06 value level emerges as essentially the most distinguished downside target, doubtlessly matching a key historic congestion space and aligning with the decrease a part of the multi‐12 months ascending channel.

Among the many different Fibonacci ranges seen on the chart are the 0.618 Fib close to $0.05, 0.5 Fib close to $0.03, 0.382 Fib close to $0.015 and 0.236 Fib close to $0.0059. Whereas these decrease Fib traces might not all come into play, they assist map out DOGE’s historic assist/resistance zones within the occasion of an prolonged promote‐off.

Associated Studying

The chart additionally exhibits larger Fib extension ranges similar to 1.272 (round $4.10), 1.414 (round $10.04), and 1.618 (round $36.32). Although these might seem far‐fetched given present market circumstances, such extensions on a protracted‐time period chart can function reference factors if Dogecoin had been to regain robust bullish momentum and climb towards new heights in future market cycles.

For now, all eyes are on $0.19 as Dogecoin’s essential inflection level. If DOGE holds above this stage, it could protect its place within the mid‐vary of the ascending channel. Nonetheless, as Ali Martinez warns, a breach of $0.19 may intensify downward stress and doubtlessly set Dogecoin on a path towards $0.06.

At press time, DOGE traded at $0.206.

Featured picture created with DALL.E, chart from TradingView.com