- BTC STHs might have panic-sold in response to the current information in regards to the Bybit hack.

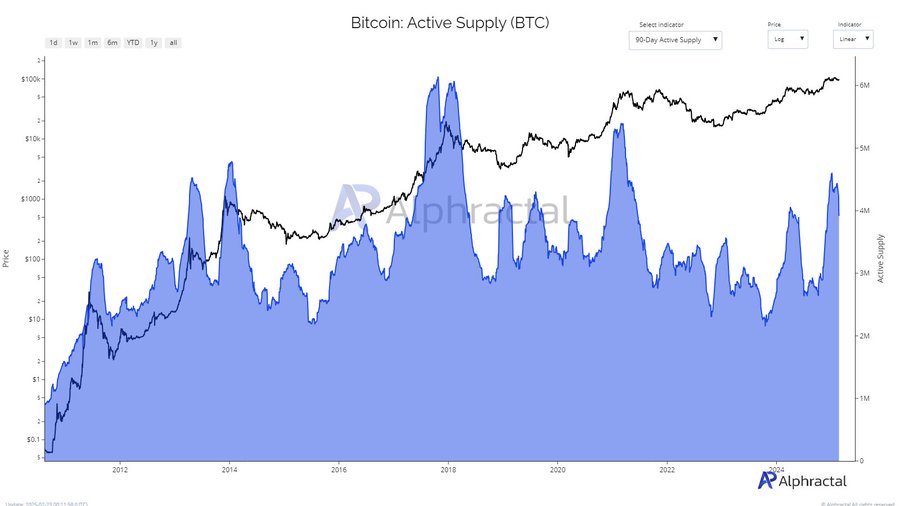

- Evaluation of the 90-Day Lively Provide mirrored a notable decline in current months.

Prior to now 24 hours, Bitcoin [BTC] skilled notable volatility. Quick-Time period Holders (STHs) realized substantial losses, doubtless pushed by panic-selling following the Bybit hack information.

Additionally, over the previous 16 hours, BTC’s 4-hour chart on Binance confirmed important bearish indicators.

The Exponential Shifting Common (EMA) cross displayed a bearish crossover, with the 9-period EMA dropping under the 26-period EMA round hour 14, signaling short-term downward momentum.

This aligned with BTC’s worth decline to $96,259.9, marking a -0.12% drop from the earlier interval.

The Relative Power Index (RSI) stood at 46.05, reflecting a impartial however barely bearish outlook.

This RSI degree steered that BTC remained in a consolidation section, with no clear overbought or oversold situations. If it rebounds above 50, bullish sentiment would possibly return, supporting worth restoration.

Additionally, the Cumulative Quantity Delta (CVD) confirmed a web quantity delta of -94.67K, reflecting sturdy promoting stress within the final 8 hours.

These indicators collectively pointed to capitulation, the place STHs offloaded BTC, doubtlessly forming a short-term native backside as promoting stress diminished.

Panic promoting peaks: What’s the turning level?

The Quick-Time period Holder Revenue & Loss (P&L) to Exchanges Sum chart for the final 24 hours additionally highlighted important losses amongst STHs.

The dominance of pink bars, peaking at -43.9K BTC, indicated heavy panic-selling round $90K to $95K following the Bybit hack information.

The STH revenue line remained minimal, reinforcing the concept few short-term merchants noticed positive factors. Comparable traits occurred in early 2022, the place excessive realized losses preceded short-term worth recoveries.

This knowledge steered a possible native backside, as distressed promoting usually exhausts downward momentum, making a potential shopping for window for merchants.

BTC’s liquidity shift

Evaluation of the 90-Day Lively Provide chart for BTC, protecting 2012 to 2025, mirrored a notable decline in current months. As of early 2025, energetic provide hovered round 4M BTC, down from 6M BTC in late 2024.

This metric, indicated a decline in buying and selling exercise. Usually, rising energetic provide suggests greater demand and bullish sentiment, whereas declines sign distribution and lowered curiosity.

The present pattern implied STHs had largely exited, doubtlessly lowering promoting stress.

This sample mirrored 2018, when declining energetic provide preceded worth stabilization, supporting the capitulation speculation and reinforcing short-term backside formation.

An indication of power or additional decline?

Deep evaluation confirmed that BTC netflow chart for aggregated exchanges during the last three months revealed a pointy web outflow of -546.11 BTC previously 24 hours.

This was a big reversal from the earlier week’s +226.57 BTC common inflows, and the 30-day common of +1.29K BTC inflows.

A sudden unfavourable netflow usually signifies that holders are withdrawing BTC to off-exchange wallets, suggesting lowered promoting stress.

This sample resembled mid-2021, when massive BTC outflows preceded worth rebounds. Moreover, the 24-hour netflow change of +269.71 BTC steered renewed shopping for curiosity.

In conclusion, Capitulation occasions, similar to heavy short-term holder losses and declining trade netflows, traditionally precede short-term recoveries.

Whereas short-term volatility stays, long-term indicators recommend a possible shift towards restoration as promoting stress subsides.