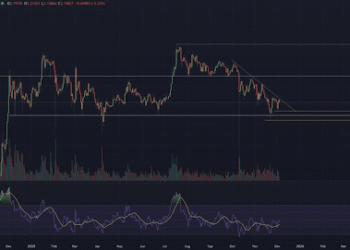

Chainlink (LINK) is flashing bearish alerts because it types a pennant sample, hinting at a possible continuation of its downward trajectory. After struggling to realize bullish momentum, the worth stays in consolidation, with sellers protecting a decent grip in the marketplace. If this sample performs out, LINK may very well be liable to a steep drop, with key help ranges dealing with elevated stress.

Market sentiment seems cautious, as bulls try to carry the road in opposition to rising bearish momentum. A breakdown from this construction would possibly speed up losses, pushing LINK towards cheaper price zones. Nonetheless, if patrons handle to invalidate the sample, a aid rally could also be in play.

Analyzing Value Motion: Bearish Pennant Alerts Breakdown

At present, Chainlink continues to commerce throughout the confines of the bearish pennant pattern, indicating a state of indecision available in the market. Neither the bulls nor the bears have established agency management, as the worth stays constrained inside converging trendlines.

Usually, this consolidation section means that market contributors are in a wait-and-see mode, anticipating a technical or basic catalyst for a decisive breakout in both route.

Whereas the structure of a bearish pennant sometimes alerts a continuation of the earlier downtrend, LINK’s hesitation signifies that bulls are nonetheless trying to defend key help ranges. Nonetheless, and not using a robust surge in shopping for stress, the chance of a breakdown stays excessive.

If LINK breaches the decrease boundary of the pennant with robust quantity, an accelerated decline is probably going, reinforcing the bearish outlook and rising promoting stress. This breakdown might appeal to bearish momentum, pushing the worth towards key help ranges.

Moreover, the asset is at present trading beneath the 100-day Easy Transferring Common (SMA), additional strengthening the damaging development available in the market. This positioning means that LINK’s ongoing makes an attempt to regain upward momentum might face vital resistance.

Potential Breakdown Targets: How Low Can LINK Go?

The formation of a bearish pennant in Chainlink’s value motion raises the potential for additional draw back, with the measured transfer goal and key help ranges offering a roadmap for potential value motion.

Ought to the bears seize management and a breakdown happen beneath the decrease trendline, LINK’s downward development might speed up, pushing the worth beneath the essential $17.96 help stage. This drop eyes a deeper decline towards the $15 mark, the place patrons might try to regain momentum and forestall extra losses.

Nonetheless, if bulls handle to defend these key ranges and provoke a robust rebound, LINK would possibly invalidate the bearish setup and shift towards a recovery, probably focusing on the $19.87 resistance stage. A decisive transfer above this threshold would reaffirm bullish momentum and pave the way in which for extra positive aspects.