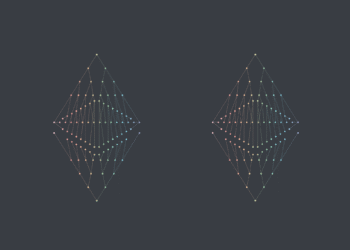

The Ethereum value is drawing consideration to its potential future outlook, as a crypto pundit factors to a putting resemblance between the altcoin’s value motion and Bitcoin’s throughout the 2015-2017 bull cycle. The analyst’s technical chart evaluation suggests that ETH is destined for a breakout to $10,000 this cycle, marking new all-time highs.

Ethereum Worth Chart Mirror’s Bitcoin Historic Breakout

In keeping with Ted Pillows, a crypto pundit on X (previously Twitter), a comparative evaluation of Etheruem’s current price movement and that of Bitcoin throughout a earlier bull cycle highlights a well-known bullish sample. Based mostly on this previous pattern, the analyst confidently predicts that Ethereum will hit $10,000 this cycle.

Between the bull market in 2015 and 2017, the Bitcoin value hit a bear market backside between $201 and $205. After experiencing a little bit of consolidation and volatility, the cryptocurrency ultimately skyrocketed to a historic rally in the direction of $685 and $785, marking new ATHs on the time. This large surge occurred after Bitcoin broke out of resistance ranges across the $465 threshold.

Based mostly on the Pillows’ speculation, Ethereum seems to be following an analogous trajectory, having accomplished its accumulation phase and just lately breaking via main resistance ranges. The primary altcoin has additionally skilled vital volatility just lately, struggling to get better from earlier bearish tendencies and market sell offs that pushed its worth under the $3,000 value excessive.

Whereas nonetheless in consolidation, as no sturdy surge has been recorded within the Ethereum price just lately, Pillows highlights components that would reinforce the altcoin’s bullish outlook. The analyst talked about Ethereum’s Whole Worth Locked (TVL) and Stablecoin liquidity dominance. At present, ETH leads in DeFi, securing the highest TVL throughout all platforms within the house.

Pillows additionally highlighted the affect of institutional demand and accumulation. As these components improve, Ethereum may acquire extra publicity, probably boosting its long-term worth. Lastly, the analyst talked about that Ethereum at present has a decrease inflation rate than Bitcoin and 99% of the altcoins out there.

Based mostly on these seemingly bullish components, Pillows urges buyers and merchants to set their sights increased, dismissing a $5,000 goal as too conservative and advocating for a extra bold $10,000 projection.

ETH Whales Get Again In Motion

Whereas analysts share their optimistic projections about Ethereum’s future outlook, whales are getting in on the bottom flooring and buying ETH tokens in droves. Whereas the latest decline within the value of ETH might have triggered panic promoting for some, deep-pocketed buyers have taken the market crash as a chance to build up.

In keeping with TradeerPA, a crypto analyst on X, new experiences present that ETH has been getting quickly amassed by Ethereum whales. Resulting from this accumulation trend, the analyst advocates for a value rally to new ATHs, pushed by a optimistic shift in market sentiment and elevated demand.

Featured picture from Adobe Inventory, chart from Tradingview.com