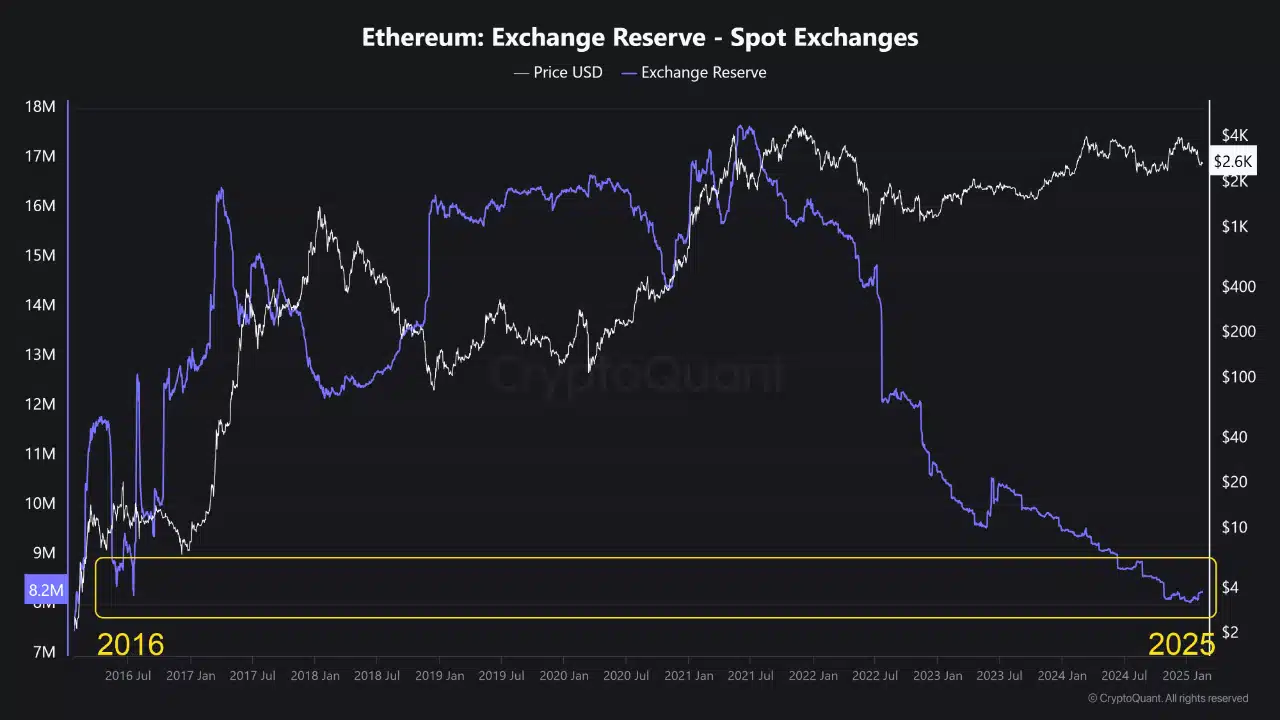

- Ethereum’s provide on centralized exchanges has dropped to its lowest ranges since 2016.

- On-chain knowledge and derivatives traits point out robust accumulation, however value consolidation continues.

Ethereum’s [ETH] provide on centralized exchanges has plummeted to ranges not seen since 2016, sparking intense hypothesis inside the neighborhood.

Traditionally, such provide crunches have paved the best way for important value rallies, as lowered liquidity typically curtails promoting strain.

As Ethereum’s staking ecosystem expands and anticipation round potential spot ETFs features momentum, traders are curious.

Is ETH gearing up for one more explosive breakout, or are market contributors misinterpreting alerts on this advanced panorama?

Historic context

Ethereum’s value surges typically coincide with durations of low alternate provide. Throughout the 2016–2017 bull cycle, ETH’s provide on centralized exchanges dwindled as early adopters accrued the asset. This propelled its value from beneath $10 to over $1,400 by early 2018.

An identical development emerged throughout the 2020–2021 DeFi growth when traders migrated ETH to decentralized finance platforms. This drove its value to an all-time excessive of $4,800.

Extra not too long ago, Ethereum’s post-Merge transition (2022–2023) launched a deflationary mechanism. Staking locked up important quantities of ETH in validator nodes, additional decreasing liquid provide.

Whereas historic patterns present that low alternate provide can sign robust value rallies, macroeconomic circumstances and investor sentiment stay crucial elements in figuring out the subsequent breakout.

Spot and derivatives knowledge supporting ETH’s momentum

Ethereum’s spot market displays a big outflow from centralized exchanges, reaching ranges not seen since 2016, as proven in CryptoQuant data.

This development highlights rising investor desire for self-custody and staking, suggesting long-term confidence in ETH’s worth proposition.

Concurrently, derivatives knowledge from Coinglass reveals rising open curiosity in ETH futures, indicating heightened market participation.

This surge might replicate bullish sentiment, with merchants positioning for an upward transfer, or a cautious hedging technique amid market uncertainty.

Funding Charges and perpetual swaps additional sign market expectations of value appreciation. Collectively, these spot and derivatives traits create a compelling case for Ethereum’s potential breakout.

Ethereum: Indicators of accumulation?

Ethereum’s Internet Trade Outflows have remained excessive over the previous three months, signaling robust accumulation as traders go for self-custody and staking over short-term buying and selling.

Traditionally, such traits have preceded main value surges by decreasing accessible provide.

On-chain knowledge additional helps this shift, with day by day transactions persistently exceeding a million, indicating regular community utilization.

Nonetheless, fluctuations in energetic addresses recommend that whereas current customers stay engaged, new consumer adoption isn’t accelerating on the identical tempo. This might imply that institutional accumulation, quite than broad retail demand, is driving Ethereum’s value motion.

Ethereum at a crossroads: Breakout or extended consolidation?

Ethereum’s current value motion suggests a section of consolidation following its earlier decline. The day by day chart reveals that ETH is at the moment buying and selling beneath each the 50-day and 200-day SMAs, indicating that the broader development stays cautious.

Nonetheless, the RSI hovers round 41.49, signaling that ETH is neither overbought nor oversold, which might level to an accumulation section.

Moreover, OBV stays regular, hinting that quantity inflows haven’t considerably weakened regardless of current value fluctuations.

If shopping for momentum strengthens, Ethereum might reclaim key resistance ranges, doubtlessly confirming a breakout state of affairs.

Conversely, failure to interrupt above the 50-day SMA might result in extended sideways motion or perhaps a retest of decrease help ranges.