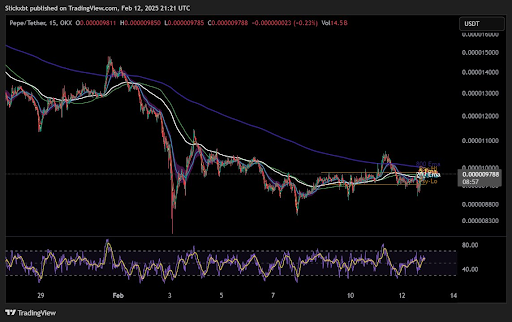

Meme coin PEPE is displaying indicators of bullishness in a market currently filled with uncertainty. This bullish signal is mirrored via PEPE’s projected breakout of the 800 EMA, which is an indication of bullish reversal.

This bullish case for PEPE was first noted by a crypto analyst recognized pseudonymously as Slick on social media platform X. The 800 EMA, which has served as a significant resistance level for PEPE worth uptrends, is now being examined once more after a protracted interval under it.

PEPE Eyes 800 EMA Breakout After Weeks Of Rejection

PEPE is displaying indicators of a possible bullish reversal, with the worth shifting towards a important technical stage that might redefine its short-term trajectory. This important technical stage is highlighted via technical evaluation of the 800 EMA indicator.

Associated Studying

Since January 19, PEPE has constantly traded under the 800 EMA, a pattern that has stored the worth subdued regardless of a number of makes an attempt to interrupt greater. Nevertheless, latest worth motion means that this extended bearish construction could also be coming to an finish.

The shifting averages are converging greater than the earlier makes an attempt. The present setup exhibits a stronger alignment between the brief and long-term EMAs, which signifies weakening resistance and will increase the likelihood of an upward breakout. Nevertheless, this try to interrupt above the 800 EMA is most convincing on the 15-minute candlestick timeframe and is but to be evident on bigger timeframes.

Will This Snowball Into A Bigger Timeframe Reversal?

The query is whether or not PEPE’s breakout try above the 800 EMA on the 15-minute chart will spark a broader shift in momentum throughout greater timeframes. Quick-term breakouts like this function the primer for bigger pattern reversals, significantly when aligned with technical indicators such because the Exponential Shifting Averages (EMAs).

Associated Studying

A successful breakout here might deliver greater timeframe ranges into play, which might imply a longer-term bullish momentum. Nevertheless, there’s nonetheless a danger of a PEPE worth rejection on the 800 EMA, even on the 15-minute candlestick timeframe. As proven within the worth chart above, this rejection has already happened twice this month, as soon as in the beginning of January and once more on January 11.

Nevertheless, the present check is extra peculiar as a result of different EMAs, together with the 200 EMA, have now converged extra intently than throughout the earlier failed breakouts. This alignment means that resistance could also be weakening and will increase the chance of a decisive transfer greater.

On the time of writing, PEPE is buying and selling at $0.000009829, up by 3.13% up to now 24 hours. The rise up to now 24 hours is a constructive sign for PEPE’s breakout from the 15-minute 800 EMA to bigger timeframes.

Nevertheless, there may be nonetheless work to do, as PEPE is presently down by 3.85% in a seven-day timeframe. There’s also a notable resistance at $0.00001019 that might delay any additional uptrend transfer.

Featured picture from iStock, chart from Tradingview.com