- Ethereum’s charge drop and rising accumulation could sign the beginning of a market rebound

- Decline in ETH alternate reserves hinted at a possible provide squeeze and upcoming value rally

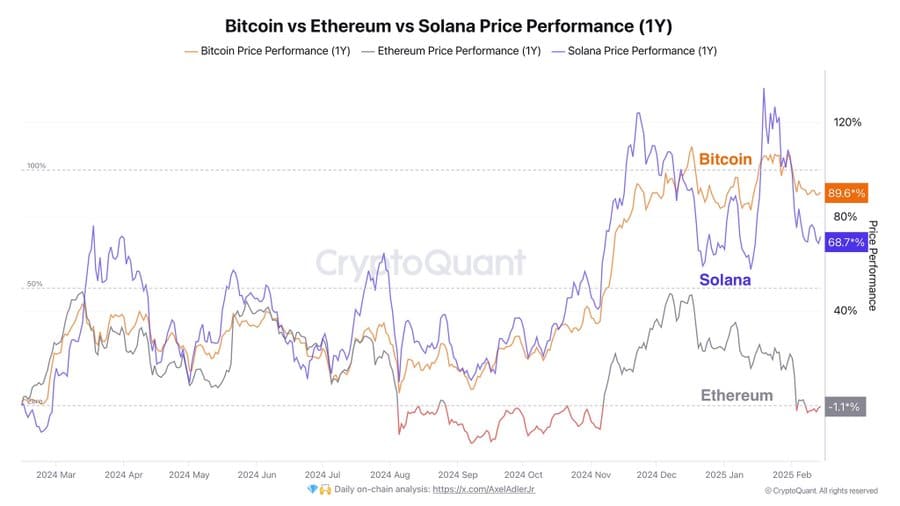

Ethereum [ETH] has underperformed, in comparison with its friends for over a 12 months. Nevertheless, new on-chain information is likely to be pointing in the direction of a possible shift. Whereas ETH is down 1.1% year-over-year, Bitcoin [BTC] and Solana [SOL] have posted large positive factors.

Now, two key developments – plunging transaction charges and accelerating accumulation – could also be indicators of rising investor confidence.

Might this sign the beginning of an Ethereum resurgence?

How decrease charges have an effect on community exercise and adoption

Ethereum’s transaction charges have dropped by over 70% this week, with whole day by day charges now at $7.5 million, down from $23 million simply weeks prior. This decline follows a latest enhance within the fuel restrict, which successfully expands block capability and reduces congestion.

Traditionally, decrease charges have correlated with increased community utilization. Throughout earlier charge declines in 2021 and mid-2023, as an example, day by day lively addresses and transaction counts surged.

If this sample holds, Ethereum may see a renewed uptick in on-chain exercise. Nevertheless, what’s essential is whether or not this uptick in exercise interprets into sustained demand fairly than short-term speculative surges.

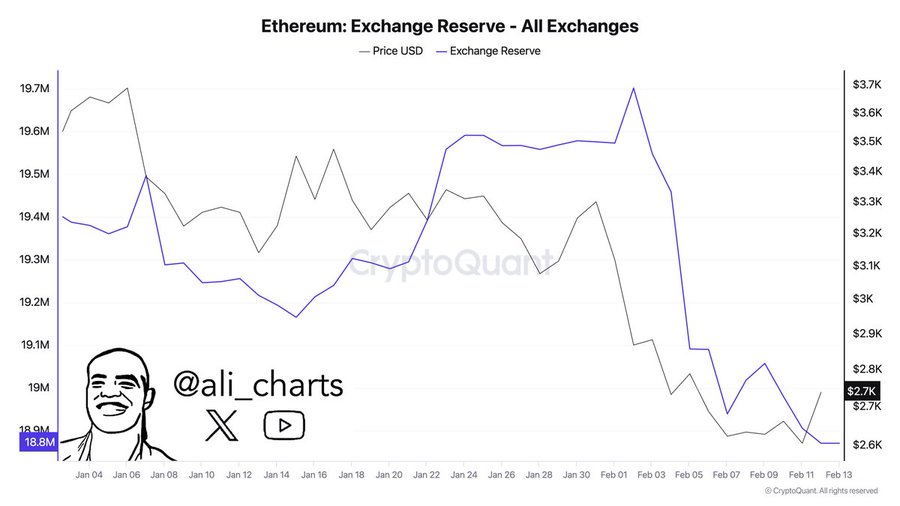

Does the sharp decline in ETH alternate reserves sign a provide squeeze?

Ethereum alternate reserves have fallen sharply, from 19.7 million ETH in early January to 18.8 million ETH in simply 10 days.

Such a pointy decline is an indication that buyers are transferring property to self-custody, decreasing the fast provide out there for promoting.

Traditionally, such sharp drawdowns have usually preceded value rallies. The final comparable alternate reserve decline occurred in This autumn 2023, which was adopted by a 35% value surge over the next two months.

If this value pattern continues, Ethereum may face a provide squeeze. Significantly if demand rebounds alongside decrease charges.

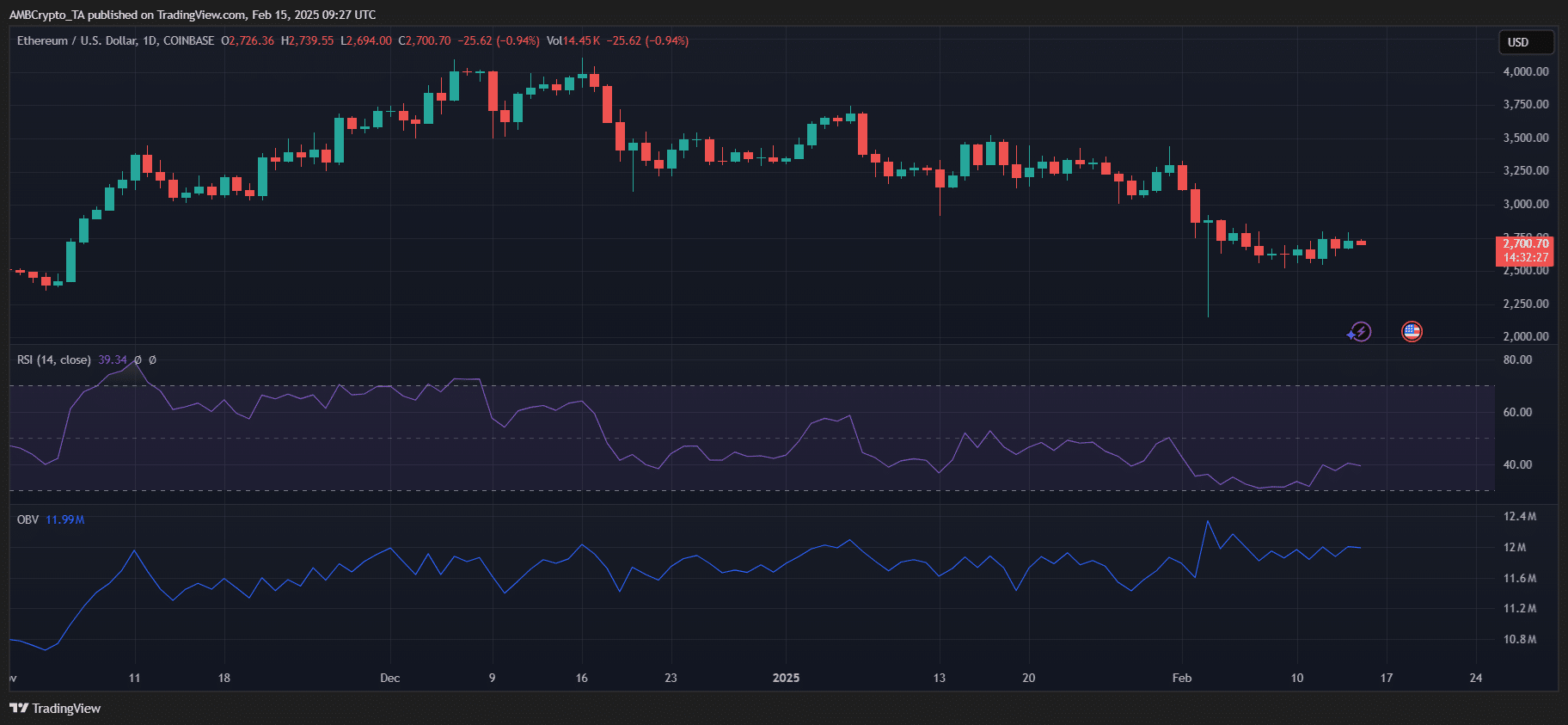

Technical indicators present lack of bullish momentum

Regardless of enhancing on-chain metrics, nonetheless, at press time, Ethereum was still down 1.1% YoY. It was lagging behind Bitcoin (+89.6%) and Solana (+68.7%).

Current information additionally highlighted a powerful resistance round $2,800, with ETH struggling to interrupt above it regardless of rising accumulation. The RSI sat at 39.34, indicating that whereas Ethereum could also be close to oversold situations, it’s but to realize bullish momentum.

Moreover, the OBV confirmed a scarcity of robust shopping for strain – An indication that whereas provide has been tightening, demand is but to surge.

For ETH to interrupt out, it wants a decisive push previous the $2,800-$2,900 vary backed by rising quantity. If this fails, a retest of $2,500 will stay a risk earlier than any sustained upside.