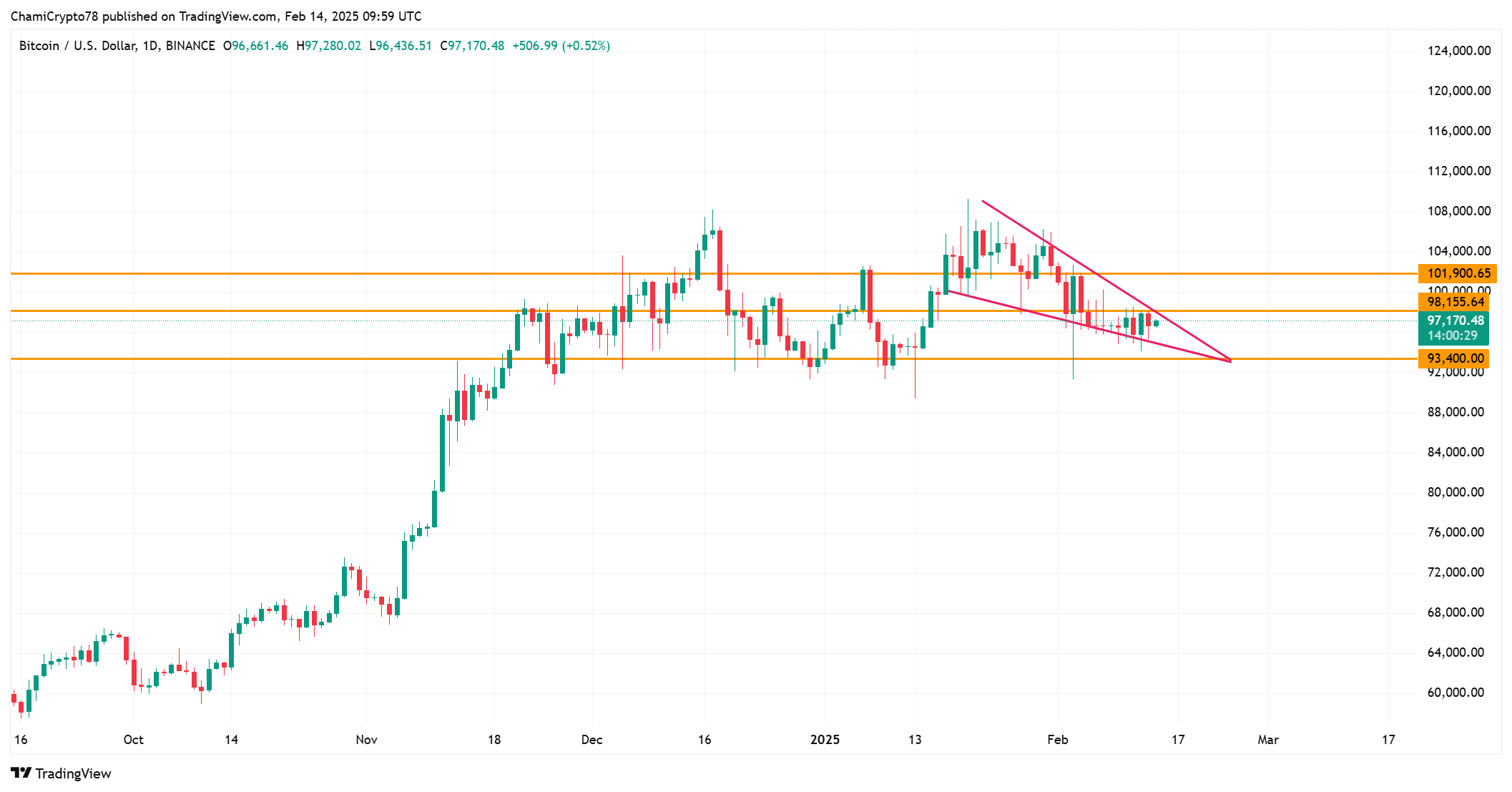

- Bitcoin appeared to be consolidating beneath $101,900, forming a symmetrical triangle for potential breakout or reversal

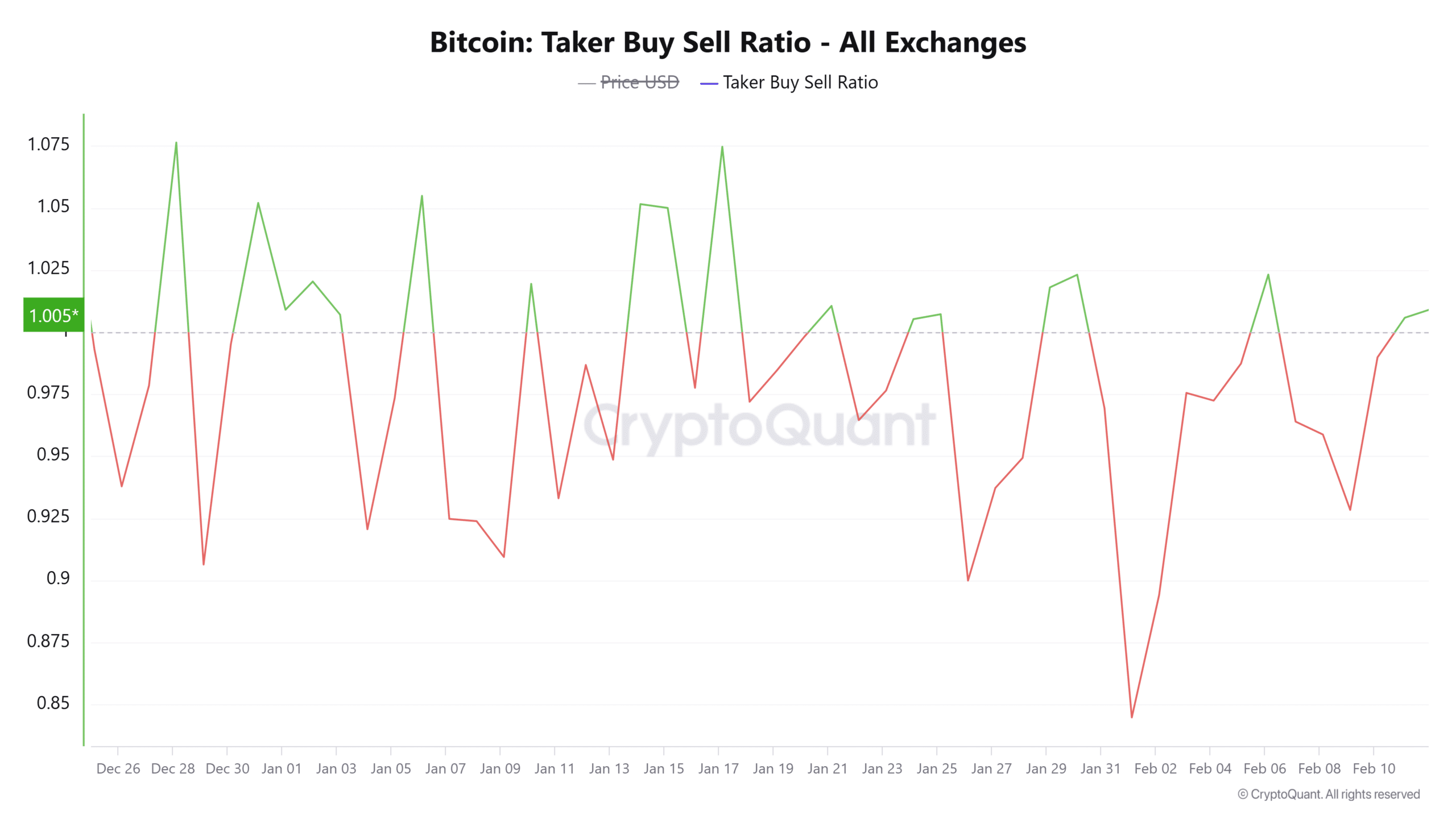

- NVT Golden Cross and Taker Purchase/Promote Ratio hinted at overbought circumstances and average shopping for stress

Bitcoin [BTC], on the time of writing, appeared to be testing essential assist ranges, with merchants now carefully waiting for indicators of a possible breakout or pullback. Valued at $97,183, the world’s largest cryptocurrency hiked by slightly below 1% within the final 24 hours.

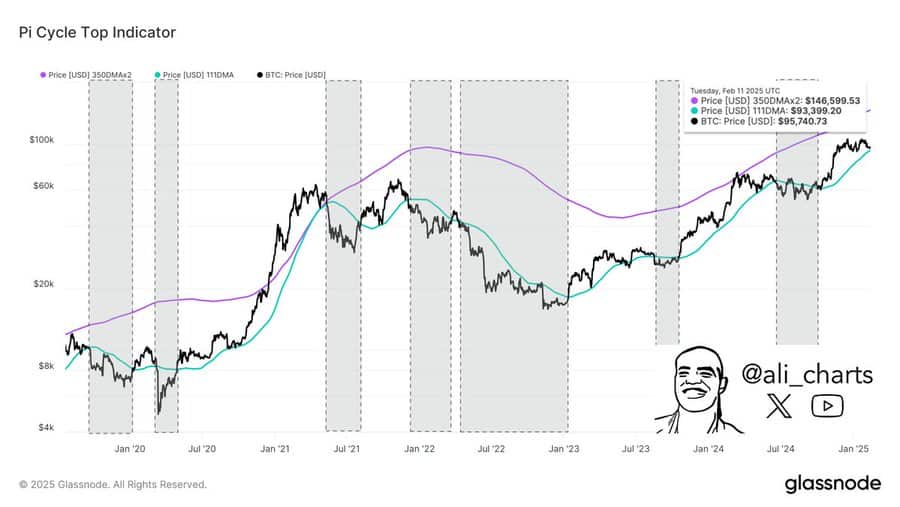

On the charts, the $93,400-level has been marked by the 111-day transferring common. This stage has traditionally served as a key assist, and its conduct might decide Bitcoin’s subsequent transfer. Will Bitcoin maintain regular at this threshold, or is it poised for an additional surge?

Supply: X

What’s subsequent for Bitcoin’s worth?

Proper now, Bitcoin is consolidating beneath the $101,900 resistance zone. Regardless of a number of makes an attempt to interrupt this stage, Bitcoin has been unable to maintain a worth above it in current weeks. Consequently, Bitcoin has been forming a symmetrical triangle – A sample that usually alludes to important worth motion.

Ought to Bitcoin break above $101,900, it might rapidly surge in direction of larger resistance ranges, probably beginning one other rally.

Nevertheless, failure to interrupt this resistance might result in a worth pullback, testing the $93,400 and $97,170 assist zones. Subsequently, merchants might want to monitor these ranges carefully for any indication of a breakout or a reversal.

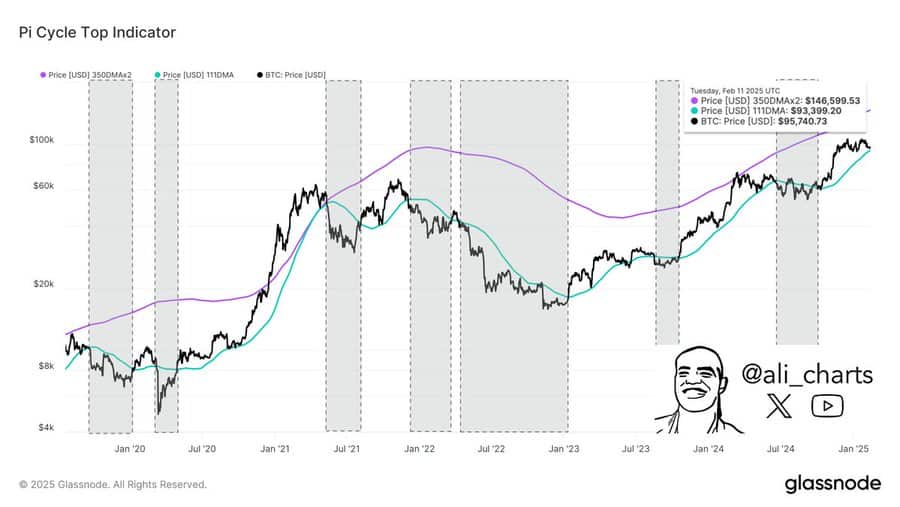

NVT Golden Cross – Ought to merchants be cautious?

Bitcoin’s NVT Golden Cross indicator climbed by 28.21% during the last 24 hours, as per CryptoQuant analytics. Such a change signifies that Bitcoin could also be getting into overbought territory. Particularly because the NVT’s values had exceeded 2.2 too.

Traditionally, such ranges have typically signaled native tops, which may very well be adopted by worth corrections.

Nonetheless, Bitcoin might proceed its bullish momentum if demand stays sturdy. So, this indicator alone will not be sufficient to foretell a direct reversal. Subsequently, whereas warning is critical, Bitcoin might additionally proceed its hike, relying on the power of the market.

Taker purchase/promote ratio – Is shopping for stress constructing?

The Taker Purchase/Promote Ratio rose by 0.95% within the final 24 hours too, hinting at a slight uptick in shopping for stress. Though the ratio was beneath 1, it instructed that there’s extra shopping for than promoting exercise.

If this development continues, Bitcoin might even see upward momentum on the charts. Nevertheless, if the promote stress intensifies, Bitcoin might face a reversal, testing its key assist zones as soon as once more. Subsequently, market sentiment will play a vital function in figuring out Bitcoin’s subsequent transfer.

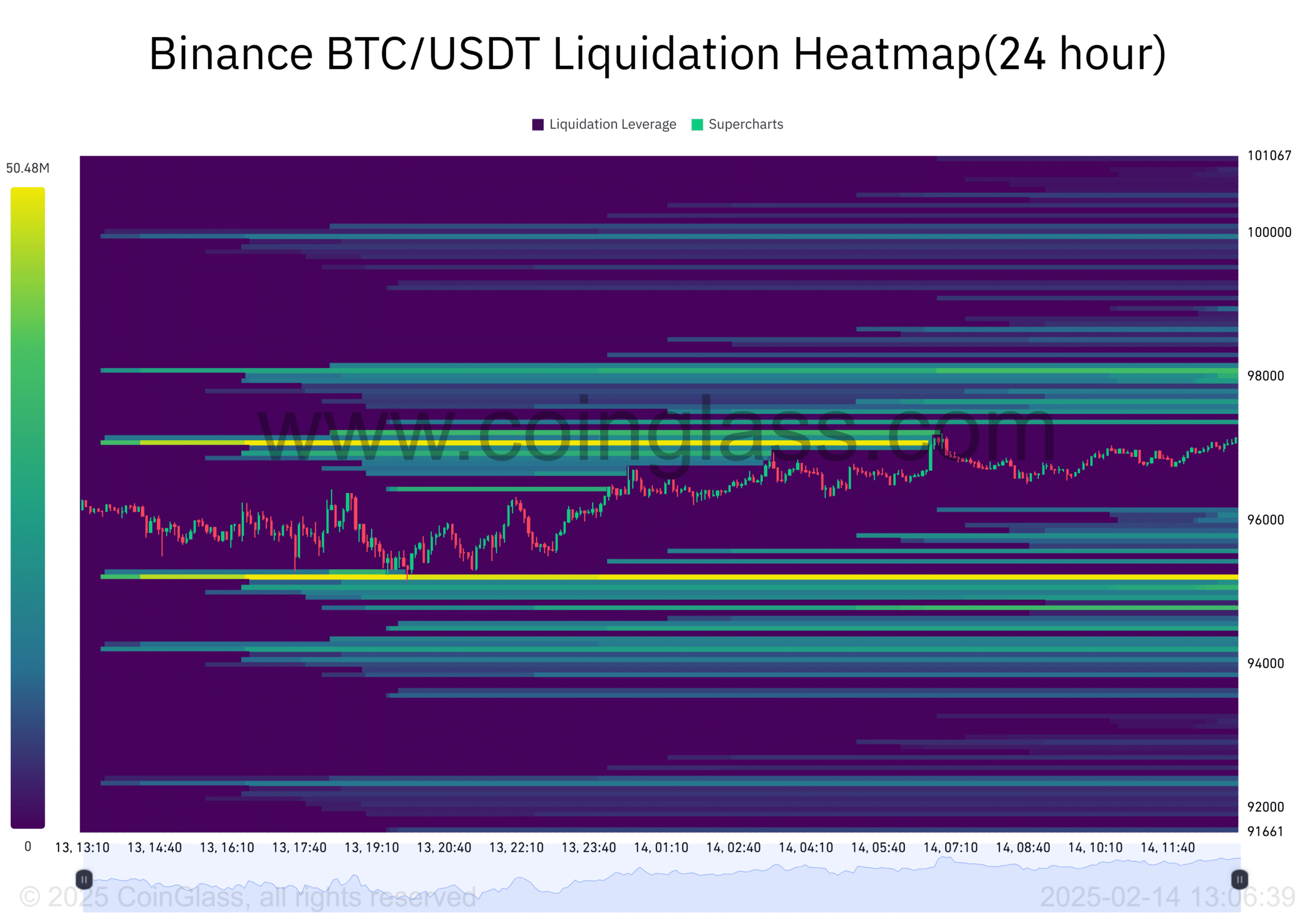

What do liquidations reveal?

Bitcoin’s liquidation heatmap revealed important focus of liquidations across the $93,400 assist stage and the $97,170 resistance. If Bitcoin falls additional, liquidations might speed up, sparking a possible rebound.

Alternatively, a push above the $97,170 resistance could set off lengthy liquidations, rising upward worth stress.

At press time, Bitcoin remained near the essential stage close to $97,170, with a number of indicators hinting at doable volatility. The NVT Golden Cross appeared to warn of overbought circumstances too, with the Taker Purchase/Promote Ratio underlining average shopping for stress.

Given the liquidation heatmap and present market circumstances, Bitcoin is extra more likely to check its assist, earlier than transferring decisively. Subsequently, Bitcoin’s subsequent transfer will probably be a check of its key assist ranges, with potential for a rebound or a breakout quickly after.