- ETH has made average restoration, rising by 2.8% over the previous day.

- Ethereum’s outflow hit a 23-month excessive, signaling rising confidence.

Ethereum [ETH] has continued to commerce sideways for the reason that market restoration, and appeared caught inside a consolidation vary.

With ETH struggling to reclaim a better resistance degree, traders have taken this chance to build up.

Ethereum outflow hits 23-month excessive

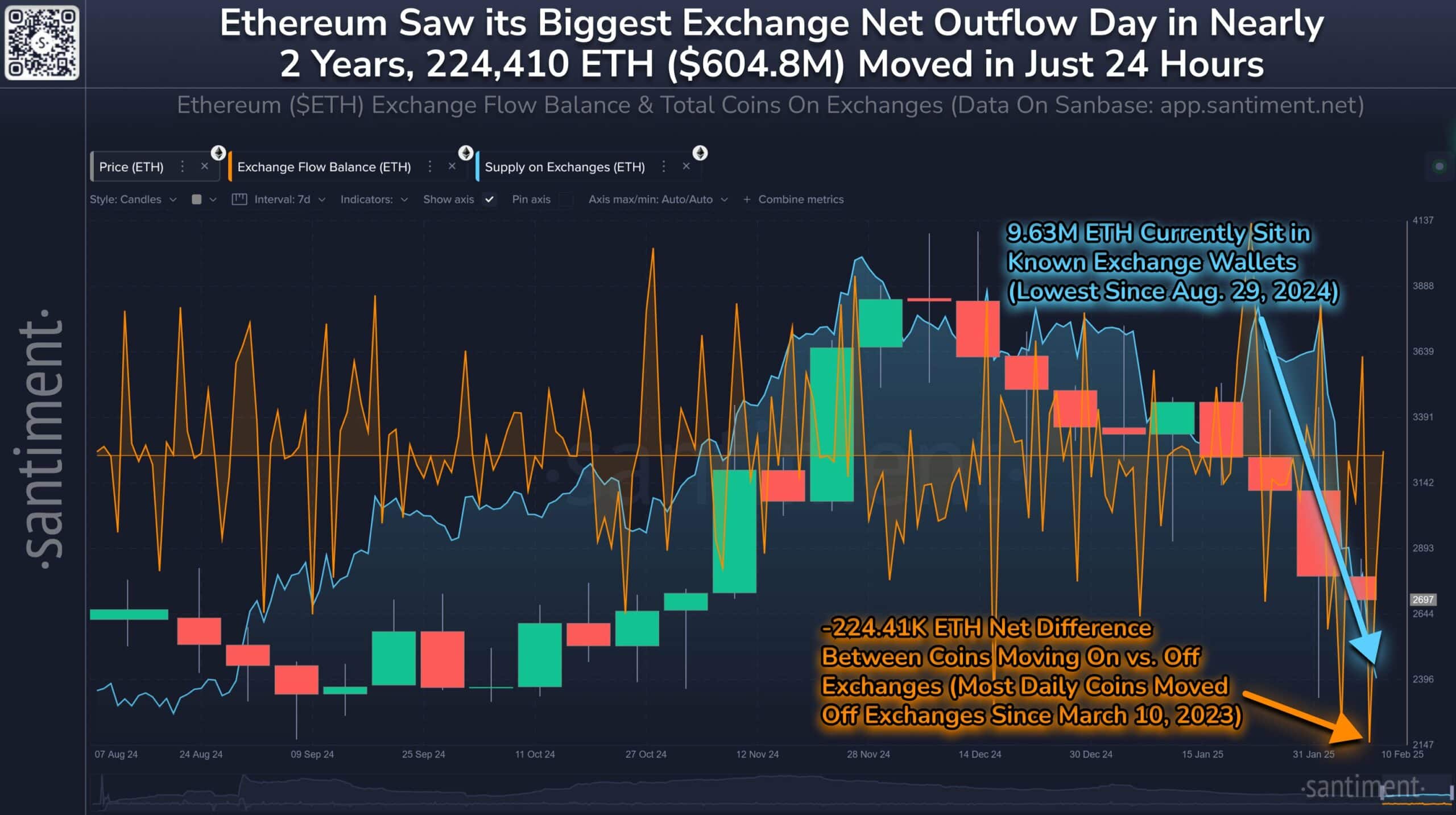

In keeping with Santiment, Ethereum has skilled historic withdrawals from exchanges. As such, Ethereum noticed 224,410 ETH tokens transfer off exchanges within the 24 hours between the eighth and ninth of February.

This pattern prolonged on the tenth of February, with 768.5k in trade outflows. This outflow was the biggest quantity of web cash withdrawn from exchanges in a single day over the previous 23 months.

When trade outflow surges, it implies that traders are actively shopping for the asset and anticipate costs to recuperate and make one other excessive.

Though this can be a long-term notion, it alerts rising market confidence regardless of the worth struggles.

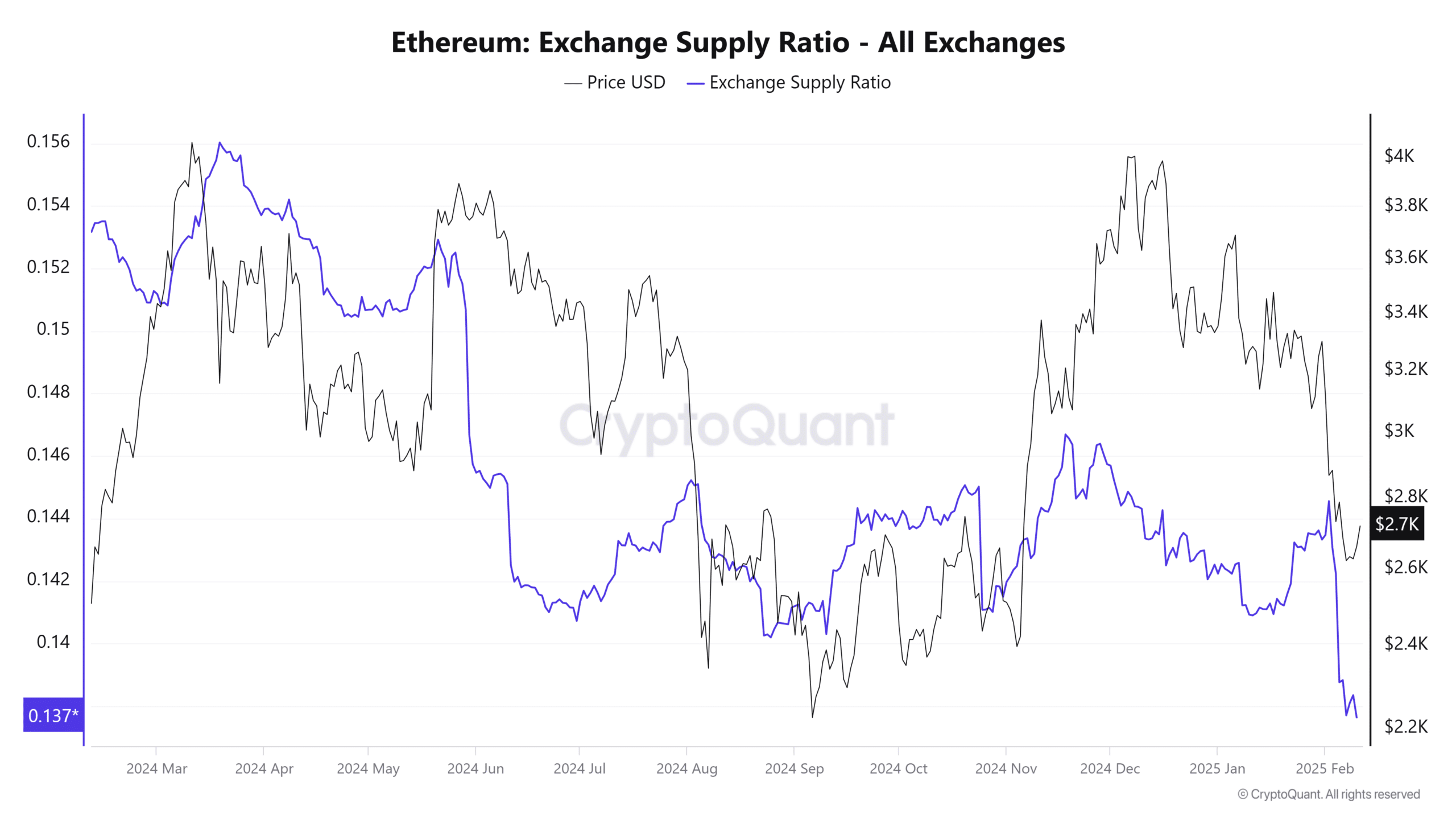

This bullishness was additional confirmed by the trade provide ratio, which declined to hit a yearly low.

Subsequently, ETH traders are at present content material with holding for the long run and would anticipate costs to rise. The shrinking degree of accessible cash to be publicly offered off additionally means much less chance of future main selloffs.

Any affect on ETH?

The rising outflow has positively affected ETH costs. In actual fact, as of this writing, Ethereum was buying and selling at $2716. This marked a 2.84% rise on each day charts, extending this bullish outlook by 0.84% on weekly charts.

Subsequently, with Ethereum experiencing large outflow, it suggests that the majority contributors are at present bullish.

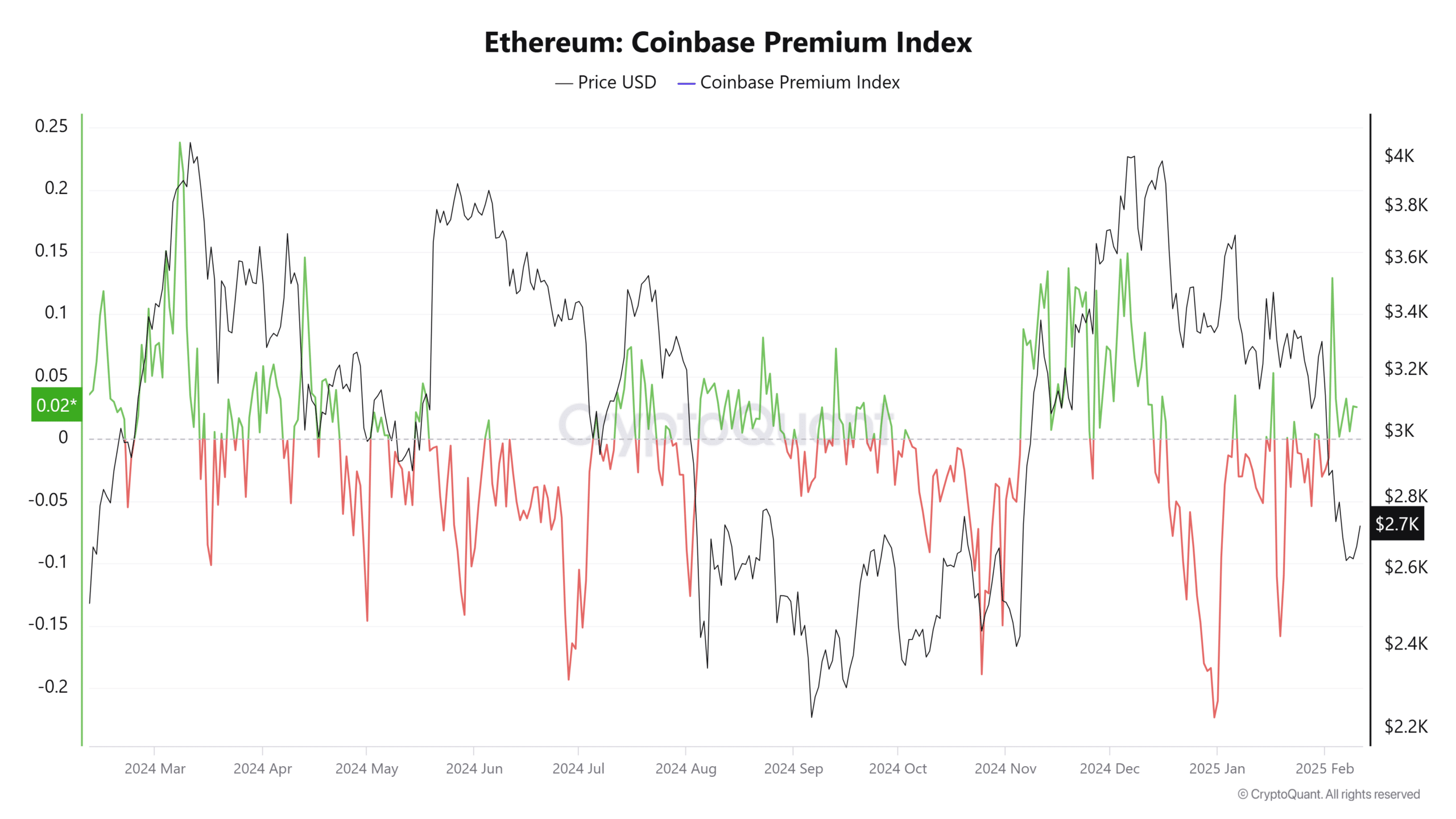

This bullishness is much more prevalent amongst institutional traders. That is evidenced by the truth that the Coinbase premium index has remained constructive all through the week.

Thus, establishments are actively accumulating as ETH is at present within the accumulation section, and the demand from the U.S. market and establishments may place it for additional features.

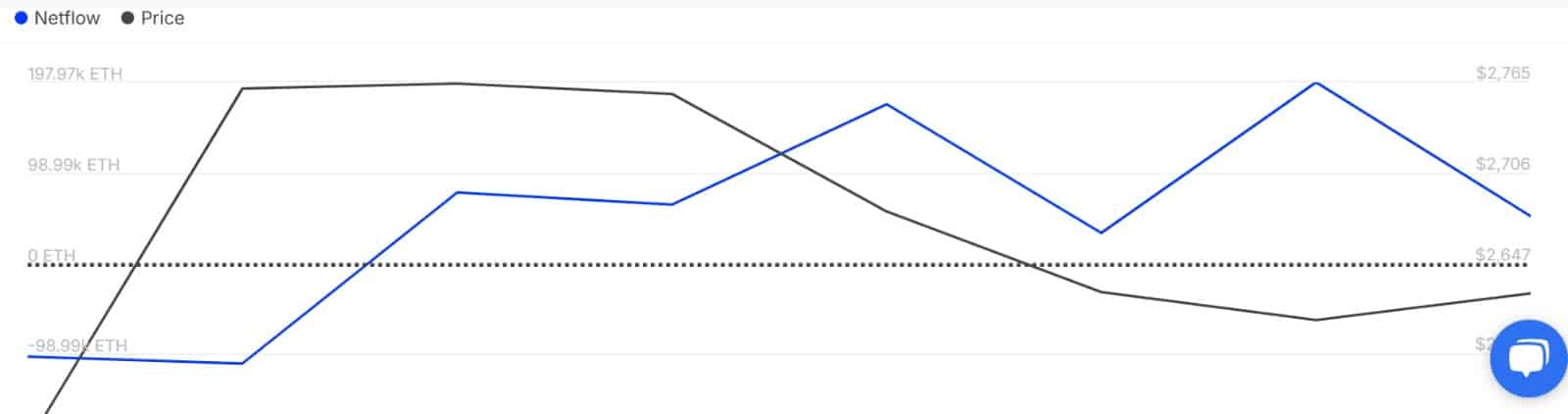

This institutional demand was additional affirmed by massive holders’ netflow, which spiked.

ETH’s massive holders have made extra capital influx than outflow from the fifth of February, experiencing six days of constructive capital influx.

This surge means that whales have been shopping for extra ETH tokens than they have been promoting, reflecting rising market confidence.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

Merely put, ETH is experiencing sturdy bullish sentiments as traders proceed to build up the altcoin.

If this pattern continues, Ethereum may recuperate and reclaim $3000, the place it has confronted a number of rejections. Nevertheless, if patrons fail to carry and sellers enter the market, ETH may drop to $2591.