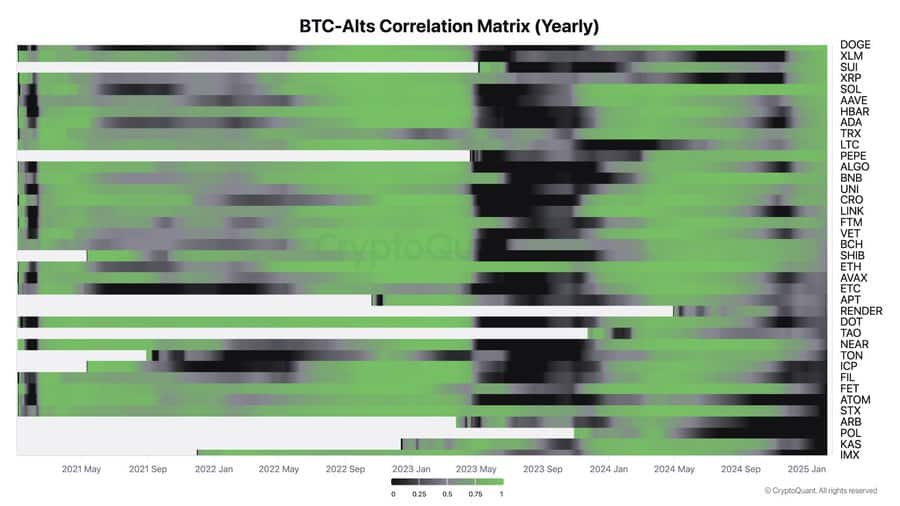

The BTC-Alts Correlation Matrix gives insights into the connection between Bitcoin and numerous altcoins over time.

As could be seen on the chart, sure altcoins like Ethereum, Binance Coin [BNB], and Avalanche [AVAX] have continued to take care of a excessive correlation with Bitcoin, reflecting their tendency to reflect BTC’s value actions.

Nevertheless, a definite development of decoupling has emerged, notably amongst altcoins like Dogecoin [DOGE], Shiba Inu [SHIB], and Pepe [PEPE], in addition to the likes of the Sui Community.

These cash have displayed considerably decrease correlations. Their performances have been pushed by unbiased elements equivalent to distinctive use instances, social sentiment, or ecosystem-specific developments.

Resilient altcoins and memecoin mania

In 2025, altcoins related to institutional adoption demonstrated some notable resilience. Initiatives like XRP decoupled from broader altcoin developments, pushed by rising partnerships with monetary establishments. This institutional backing has bolstered investor confidence, resulting in important beneficial properties on the charts.

Concurrently, the market witnessed a resurgence of memecoins. Regardless of missing inherent utility, these tokens outperformed conventional infrastructure cash, propelled by community-driven enthusiasm and speculative fervor. The launch of President Donald Trump’s memecoin, as an example, spurred the creation of over 700 imitators, highlighting the potent affect of social sentiment on this section.

Psychologically, memecoin investments are sometimes pushed by herd mentality, a typical trait in speculative markets. Traders usually flock to those cash primarily based on prevailing developments quite than elementary evaluation, resulting in speedy value surges.

What does this imply for buyers?

The decoupling from Bitcoin’s correlation implies that buyers have to adapt their methods. With Bitcoin now not dictating altcoin actions, different market drivers have gotten extra necessary. Establishment-backed altcoins tied to finance and enterprise sectors present sturdy potential, providing stability amid market shifts. In the meantime, memecoins thrive on sentiment however stay high-risk, high-reward bets.

With conventional indicators dropping relevance, a focused method is essential. Traders ought to prioritize tasks with real-world use instances and rising adoption. Infrastructure tokens might proceed to lag, making them much less engaging. Diversification and a concentrate on data-driven choices are important because the market evolves, requiring buyers to navigate with precision on this new, decoupled panorama.