Main fluctuations within the Ethereum (ETH) market yesterday triggered a wave of reactions throughout social media, with one Ethereum co-founder claiming that sure giant holders—or “whales”—have been intentionally pushing the asset’s worth downward.

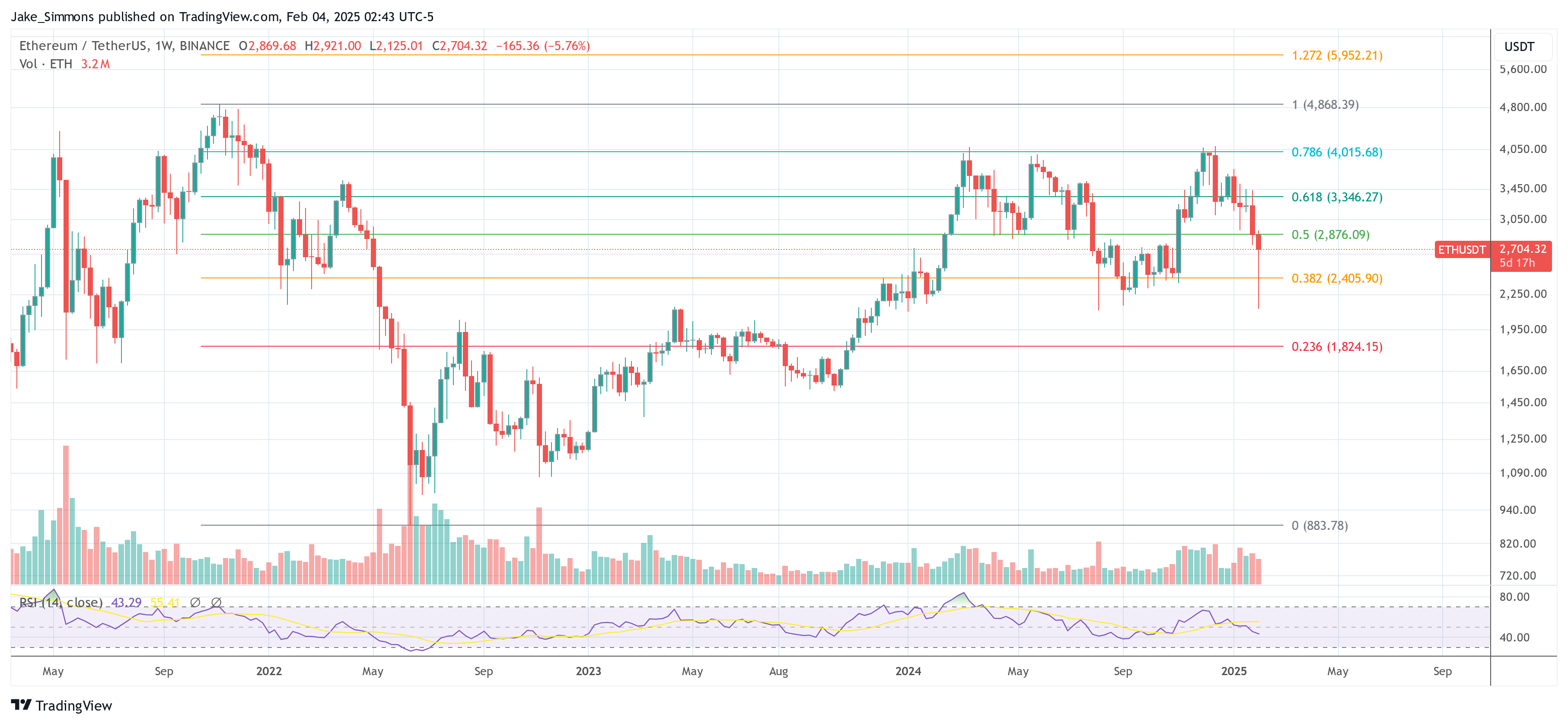

The exercise reached a fever pitch on Monday, February 4, when the ETH worth swung from round $2,900 to as little as $2,120 earlier than bouncing again sharply. Regardless of the intraday plunge, Ether in the end closed the day sporting a 26% inexperienced wick—an unusual worth rebound in such a brief window.

Ethereum Worth Manipulated By Whales?

Analysts attributed the dramatic motion to exterior macroeconomic forces, most notably the US commerce struggle beneath President Donald Trump. After imposing tariffs on Mexico and Canada early within the day, the president later struck an association that spurred a speedy restoration throughout world markets, together with cryptocurrency.

Associated Studying

The turbulence led one observer, recognized merely as “intern” (@intern), the director of development at Monad, to publish a stark sentiment on X: “ETH is dying proper in entrance of us. truthfully by no means thought this is able to occur.”

In response, Ethereum co-founder and ConsenSys CEO Joseph Lubin provided a composed outlook, underscoring that these kinds of worth swings usually are not uncommon for the digital asset: “It occurs frequently. Then it surges. What we’re seeing is whales benefiting from financial turmoil and detrimental sentiment to shake out weak arms, run stops, after which purchase again once they can run that very same playbook in reverse.”

Lubin’s assertion presents a cyclical understanding of crypto volatility, implying that bigger gamers capitalize on market anxiousness—typically exacerbated by macro developments—to strain much less resilient traders into promoting.

A number of distinguished crypto merchants additionally commented on the occasions, particularly on accusations of whale-led manipulation.

One well-known determine, Hsaka (@HsakaTrades), suggested newcomers to not assume ETH’s decline was pushed purely by natural market sentiment: “Expensive noobs, Ethereum is NOT naturally taking place. It’s being pushed down by way of whales putting spoofy promote orders on exchanges to make noobs and threat managers promote to ‘purchase again decrease’. They’re stealing your luggage and can make you purchase again at the next worth.”

Associated Studying

The notion of a concerted “spoofing” technique—the place giant promote orders are positioned after which canceled or solely partially crammed—has lengthy circulated inside crypto communities. The tactic reportedly goals to set off panic sells, thereby letting so-called whales accumulate positions at extra favorable worth ranges.

Distinguished dealer Pentoshi (@Pentosh1) provided a quick however pointed response, highlighting how ETH has underperformed relative to Bitcoin (BTC) over the previous three years: “3 yr shake out up to now. Hope you’re proper.”

The query of why whales would single out Ether particularly was raised by group member EVMaverick392.eth (@EVMaverick392): “Possibly I’ll sound naive, however why do whales carry out this maneuver solely on ether?”

Lubin responded by drawing a parallel to standard financial institution robberies and suggesting that the latest wave of unease surrounding the Ethereum ecosystem has made the asset a main goal: “Why do financial institution robbers rob banks— or used to? The (unjustified) FUD towards the Ethereum ecosystem is at present most pronounced.”

At press time, ETH traded at $2,704.

Featured picture created with DALL.E, chart from TradingView.com