- Bitcoin merchants de-risk as FOMC uncertainty looms.

- With a 9% January acquire, can Trump’s insurance policies gasoline recent momentum for BTC?

January has traditionally been a sluggish month for Bitcoin [BTC], however 2025 is bucking the pattern with a 9% acquire. But, a report drop in Open Curiosity and damaging CME premiums sign that merchants are slicing their BTC publicity.

With the U.S. financial system as the important thing set off, is that this simply warning—or the start of a bigger shift?

What’s occurring within the U.S.?

U.S. buyers are those to observe proper now. The Coinbase Premium Index (CPI) has been within the red for seven days straight, aligning with BTC’s dip from $104K to $102K.

As de-risking continues, with over $3 billion in Futures positions closed, shopping for stress stays tepid.

With the FOMC assembly looming giant, merchants are stepping again from high-risk leverage trades, maintaining any main surge in open positions off the desk – for now.

Though inflation appears below management and Trump is pushing for decrease oil costs, it’s the execution of those insurance policies that has the market in a holding sample. Till readability comes, merchants are staying on the sidelines.

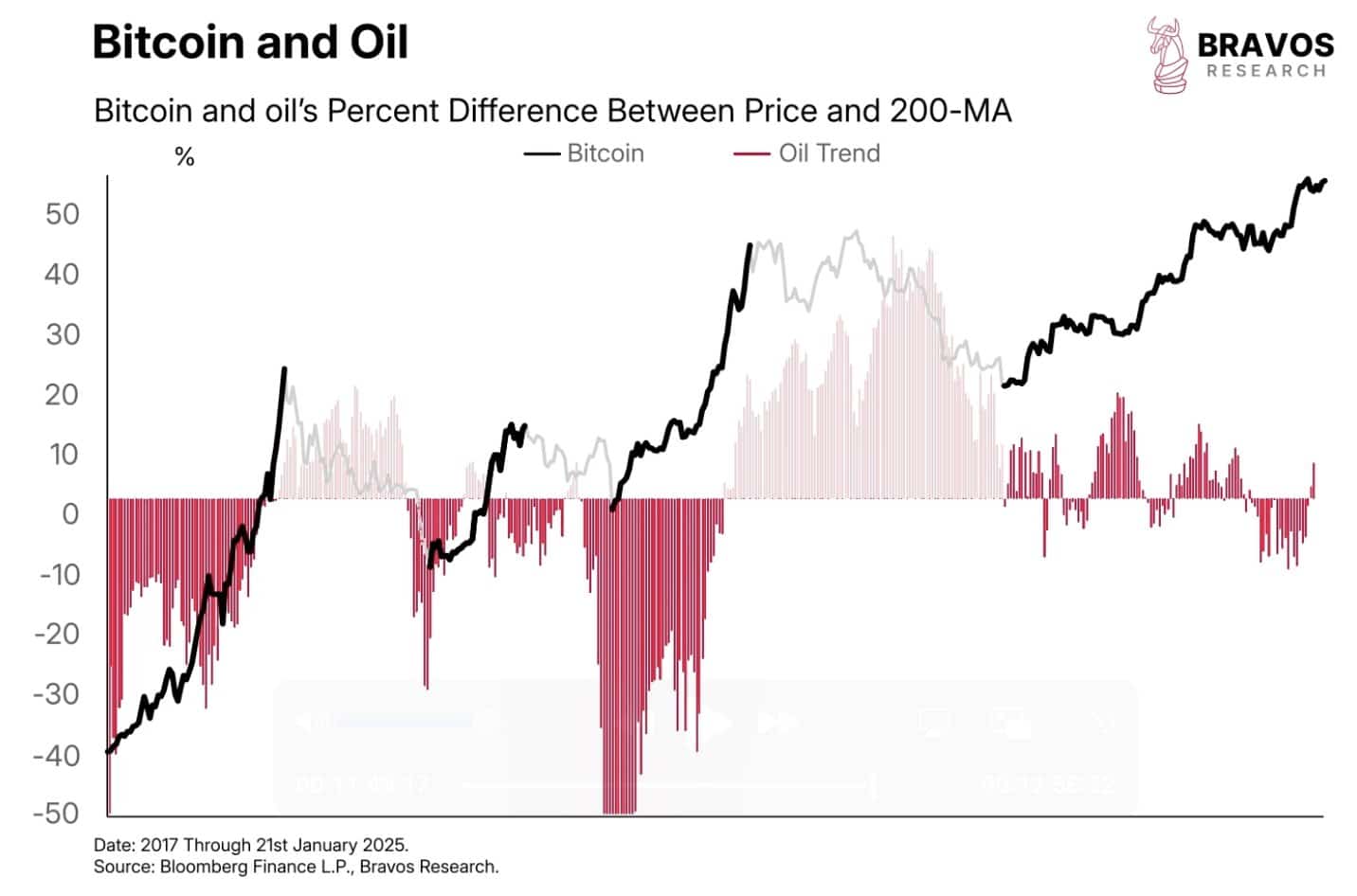

Bitcoin usually performs effectively when oil costs fall. If oil helps cool inflation, the Fed might reduce charges. Watch this intently—it could possibly be a key issue within the coming days.

Bitcoin in January

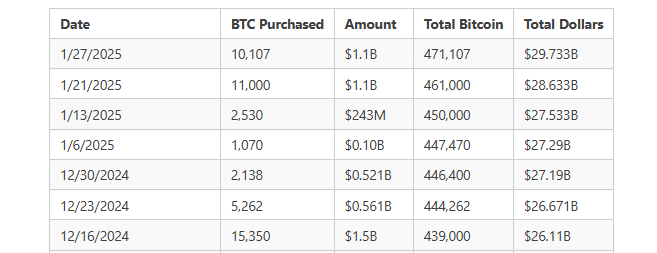

Between Trump’s inauguration, MicroStrategy’s ongoing main Bitcoin accumulation, and a 10-month excessive in ETF quantity, Bitcoin noticed a stable 9% soar in January.

These key drivers are setting the stage for a possible market shift. If bullish expectations falter, the $87K–$90K vary may emerge as a robust help zone, with main gamers probably stepping in to purchase up BTC.

It’s harking back to December’s value drop, when BTC fell from $106K to $89K in simply two weeks after inflation ticked up 0.2%.

Throughout that interval, MicroStrategy made three enormous Bitcoin purchases, every value over a billion {dollars}, doubling down on their Bitcoin wager.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

So, whereas the market is treading cautiously, a Bitcoin ‘crash’ appears unlikely.

If something, a significant shock may come if the Fed defies expectations – however with Trump pushing for decrease charges, the market appears poised to climate any potential storm, bringing much-needed reduction in 2025.