Dogecoin (DOGE) has been in a short-term downtrend for the previous two weeks, shedding over 29% of its worth since hitting an area excessive on January 18. The meme coin has confronted constant promoting stress, mirroring broader market uncertainty. Nevertheless, this downtrend could also be nearing its finish as DOGE approaches key demand ranges which have traditionally supported value recoveries.

Associated Studying

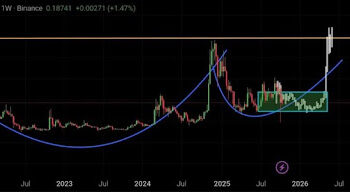

Prime analyst Scient shared a technical evaluation on X, highlighting that Dogecoin is organising for a large leg greater. In response to Scient, DOGE is presently consolidating above the 1-day assist stage whereas additionally discovering robust assist on the 1-day 100 EMA. This indicators a possible reversal as shopping for stress begins to construct at these essential ranges.

If Dogecoin manages to hold this support and push greater, it may sign the beginning of a recent rally, with merchants eyeing the subsequent key resistance ranges. A confirmed breakout from this consolidation part would seemingly drive renewed bullish momentum and appeal to extra buyers again into the market.

Dogecoin Holds Above Key Demand

Dogecoin is buying and selling at a key demand stage round $0.32, and the subsequent few days will likely be essential in figuring out its short-term route. Market sentiment stays unstable, with many analysts calling for an extra decline as uncertainty grips the broader crypto market. The downtrend that began on January 18 has put stress on DOGE, and merchants are watching intently to see whether or not it could maintain its present ranges or break decrease.

Regardless of the bearish sentiment, high analyst Scient shared a technical analysis on X suggesting that Dogecoin could also be gearing up for a large rally. In response to Scient, DOGE is presently consolidating above the 1-day assist whereas additionally discovering robust assist on the 1-day 100 EMA. These ranges have traditionally been key turning factors for Dogecoin, and their capacity to carry may point out that patrons are stepping again in.

Scient additionally identified that decrease assist ranges exist, with robust lows at $0.262 coinciding with the 1-day 200 EMA. These zones, in keeping with Scient, current good alternatives for spot accumulation. He stays bullish so long as DOGE holds above these ranges, cautioning {that a} shut beneath the 1-day 200 EMA could be the one actually bearish sign.

Associated Studying

For now, Dogecoin stays at a pivotal level. If it maintains assist and breaks greater, a robust rally may comply with. Nevertheless, if the worth fails to carry key ranges, additional draw back may very well be on the horizon. Traders and merchants are intently monitoring whether or not this consolidation part will flip into the subsequent main uptrend for DOGE.

Value Motion Particulars: Crucial Ranges

Dogecoin is presently buying and selling at $0.32 after experiencing days of promoting stress and adverse market sentiment. The meme coin has struggled to regain bullish momentum since its sharp decline from the January 18 excessive of $0.43. Now, DOGE is at a vital stage, and bulls should step in to forestall additional draw back.

For DOGE to remain in a robust place, the worth should maintain above the $0.30 mark. This psychological stage has acted as a key demand zone up to now, and shedding it may result in a sharper correction. If bulls handle to take care of assist at this stage, the subsequent main problem will likely be reclaiming $0.35. A breakout above this resistance may reignite bullish momentum and set the stage for a robust restoration.

Associated Studying

Nevertheless, failure to defend the $0.30 stage may expose Dogecoin to additional declines. On this case, the subsequent main demand zone sits round $0.25, representing a 20% drop from present ranges. This stage additionally coincides with the 1-day 200 EMA, which has traditionally acted as robust assist. If DOGE drops that low, it’s going to seemingly set off elevated accumulation, however for now, all eyes stay on its capacity to carry above $0.30.

Featured picture from Dall-E, chart from TradingView