The constant retail demand for Bitcoin on the $100,000 mark, which signifies excessive investor confidence, has just lately drawn discover. Nonetheless, as a result of short-term holders are driving the current accumulating development, market watchers are warning of a attainable fall to $95,000.

Associated Studying

Retail Buyers Accumulate At File Tempo

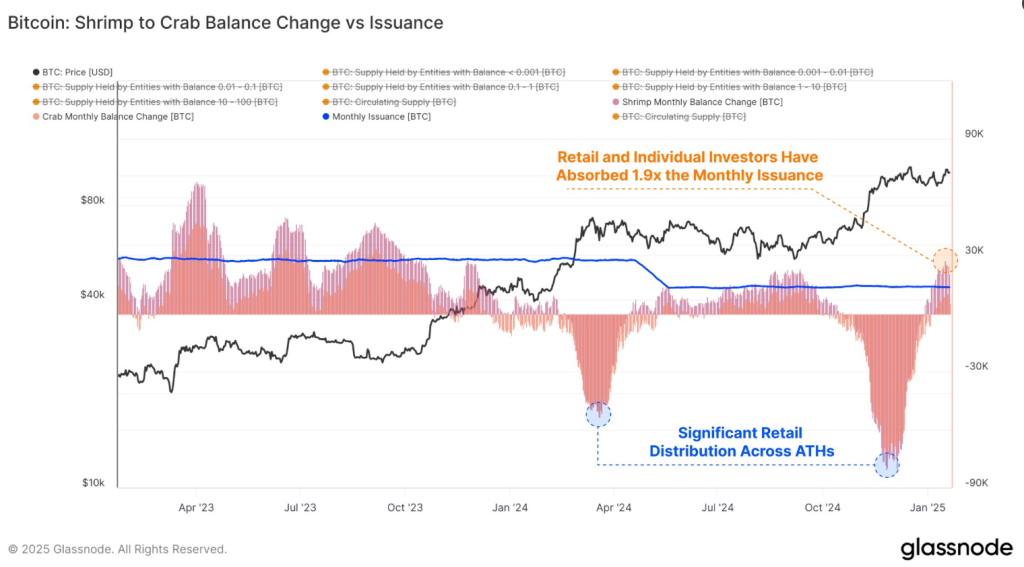

Retail buyers, which embrace smaller holders termed as “Shrimps” and “Crabs,” have been enthusiastically accumulating Bitcoin. Within the final month, Glassnode stories that these teams collectively added 25,600 BTC to their portfolios. That’s practically twice the quantity of newly mined Bitcoin over the identical interval, an indication of great demand for the “digital gold” at its value peaks.

Demand from retail buyers for #Bitcoin at costs round $100K stays robust – The Shrimp-Crab cohort (as much as 1 and 10 #BTC, respectively) absorbed 1.9x the newly mined Bitcoin provide final month, a complete of +25.6k $BTC: https://t.co/l0sjVN2Toi pic.twitter.com/UdzcCWXAGo

— glassnode (@glassnode) January 23, 2025

The buying exercise of those smaller buyers highlights an much more basic retail enthusiasm development. Nonetheless, consultants should nonetheless train warning. Though this diploma of accumulation is outstanding, the dominance of short-term holders (STHs) on this surge introduces a component of danger for market stability.

Brief-Time period Holders Pose A Danger

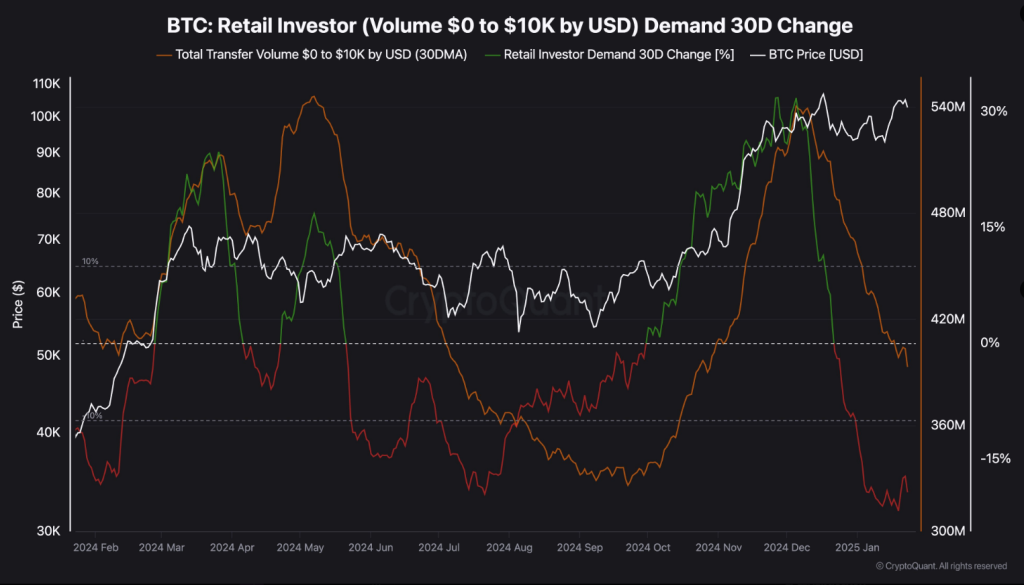

Typically promoting off throughout slight declines to ensure good points, STHs are famend for his or her quick responses to market modifications. Significantly in circumstances of sudden volatility for Bitcoin, this reflexive conduct may set off larger promoting strain. Teddy, a market analyst, underlined that the existence of STHs might need a significant affect on momentary value swings.

Whereas STHs (Brief-Time period Holders) have certainly absorbed a good portion of the newly mined Bitcoin provide, it’s essential to think about the behavioral tendencies of this group. STHs are traditionally extra vulnerable to panic throughout minor market fluctuations, usually leading to… pic.twitter.com/dasfRgjOFR

— Teddy (@TeddyVision) January 23, 2025

Traditionally, the markets are additionally extra delicate to the downtrends with STH. Analysts really feel that together with this prevailing development, at such ranges, warning for buyers could be prudent.

Glassnode: Slim Bitcoin Vary

One other anomaly which Glassnode picked out within the value motion of Bitcoin is an unusually tight vary over the previous 60 days. Such occasions have been precedents for unstable instances forward.

This coincides with historic traits, which counsel that the market will expertise both a breakout or a breakdown quickly. Whereas the sustained $100,000 value stage displays optimism, the market’s slim vary provides an air of unpredictability.

Associated Studying

A Doable Pullback Quickly?

Given all of those elements, some consultants consider Bitcoin could also be due for a slight value adjustment within the close to future. Some consultants, like market veteran Michaël van de Poppe, predict a retreat to $95,000, primarily because of STHs promoting within the face of market uncertainty.

In the interim, retail demand stays a strong supply of assist at $100,000. Buyers ought to, nevertheless, brace themselves for volatility and hold an eye fixed out for market indicators. As Bitcoin trades close to its peak, the interplay of retail euphoria and market dangers will decide its subsequent strikes.

On the time of writing, Bitcoin was trading at $105,141, up 3.2% and three.2% within the day by day and weekly timeframes.

Featured picture from Vecteezy, chart from TradingView