- ETH gave the impression to be forming an inverse head-and-shoulders sample, which regularly precedes a big upward transfer.

- Promoting strain was steadily rising, doubtlessly delaying any worth restoration.

Over the previous month, Ethereum [ETH] has struggled, shedding 12.08% of its worth. Whereas it briefly rebounded with a 2.69% achieve final week, this momentum appears to be fading.

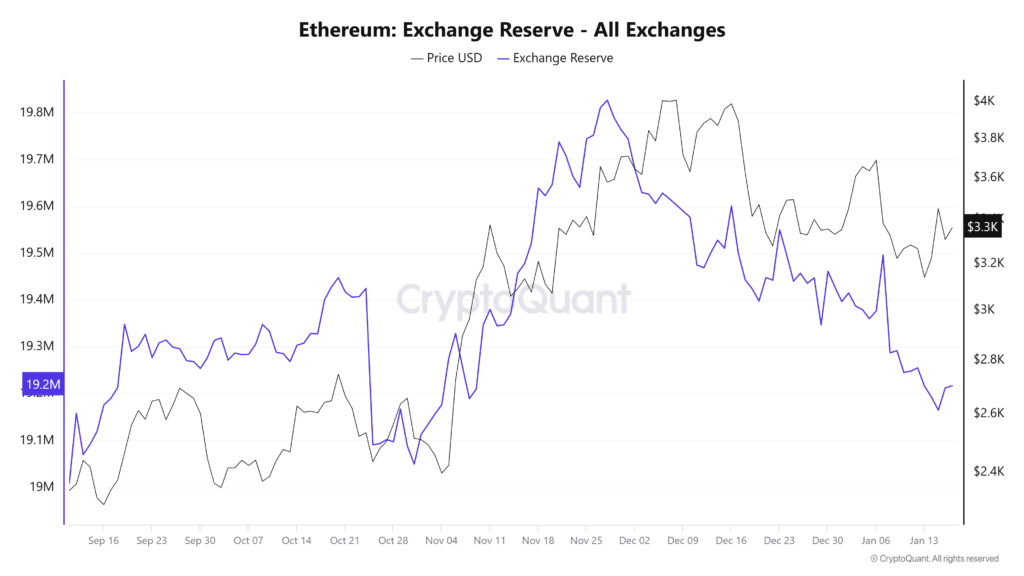

The mixture of chart patterns and present market sentiment—highlighted by a spike in ETH inflows to exchanges—means that its latest 0.35% decline previously 24 hours may lengthen additional.

A bullish sample is rising, however…

In response to analyst Ali Charts, Ethereum is forming an inverse head-and-shoulders sample on the day by day chart. This sample consists of a left shoulder, a head, and a proper shoulder.

The inverse head-and-shoulders is a traditional bullish sample. It sometimes indicators a protracted interval of worth consolidation earlier than a big upward transfer.

ETH is at present growing the fitting shoulder of the sample. This mirrors the left shoulder, with the value trending decrease alongside a descending line. If this trajectory continues, ETH may drop additional to the $2,800 area.

At this stage, it might consolidate for as much as 37 days, just like the left shoulder, earlier than breaking by means of the descending resistance line.

A profitable completion of this sample may lead ETH to its first main resistance zone between $3,850 and $4,100. Past this, ETH may purpose for a brand new all-time excessive, doubtlessly exceeding the $6,750 mark, as indicated on the chart.

AMBCrypto additionally famous that the present market sentiment suggests ETH’s near-term draw back danger stays excessive.

Rising trade provide may set off ETH’s decline

The provision of ETH on cryptocurrency exchanges has been steadily rising, elevating considerations about potential worth strain.

On the fifteenth of January, the quantity of ETH held on exchanges grew considerably, rising from roughly 19,164,848 to 19,214,253 ETH, at press time—a rise of 49,405 ETH.

Such a surge in exchange-held belongings sometimes implies rising promoting strain. Merchants could also be getting ready to dump their holdings.

Trade netflow information, which tracks the steadiness of inflows and outflows on exchanges, helps this outlook.

Over the previous 24 hours, ETH recorded a constructive netflow of round 47,761 ETH. This development signifies a probable enhance in market sell-offs, doubtlessly driving ETH’s worth downward.

If promoting strain persists, ETH may decline towards the $2,800 area, as prompt by latest chart patterns.

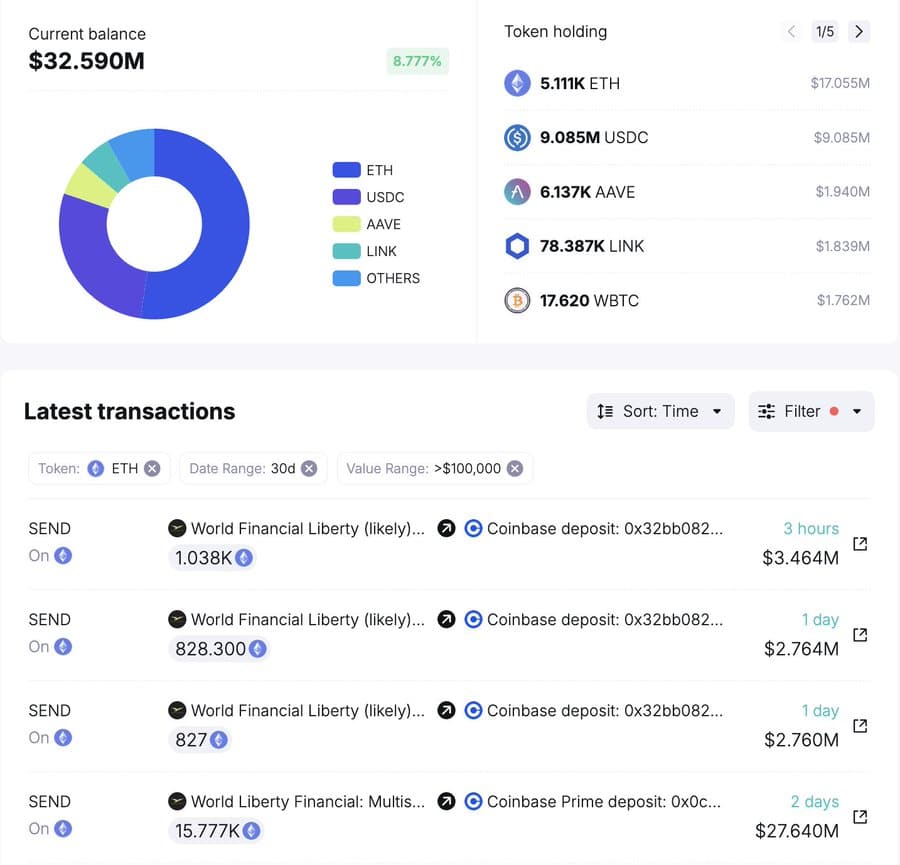

Institutional promoting provides strain

Institutional traders have contributed to the rising promoting strain on ETH, with World Liberty Finance main the cost by transferring a big quantity of Ethereum to exchanges.

In its newest exercise, World Liberty Finance moved 1,038 ETH—valued at $3.44 million—into Coinbase, decreasing its complete ETH holdings to five,111 ETH, value roughly $17.21 million.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

This follows a bigger transaction over the previous two days, the place the identical establishment deposited 18,536 ETH into Coinbase. The cumulative transfers underlined a possible sell-off technique, which may intensify downward strain on ETH’s worth if executed.

As establishments regulate their positions and market sentiment stays fragile, ETH’s worth may face additional declines within the brief time period.