- Bitcoin reclaimed $100k, albeit briefly, with each inside and exterior components signaling a possible Q1 breakout

- Historical past tells us that the crypto market has a knack for defying mainstream predictions

The newest financial knowledge has put the Fed in a tricky spot. No shock, the crypto market wasted no time reacting. With a 4% hike in market cap, high cash are again within the inexperienced, and Bitcoin quickly reclaimed $100k, albeit briefly – A degree it hasn’t seen in over per week. Coincidence or technique? This surge appeared to be completely in keeping with Trump’s upcoming inauguration.

Clearly, the stage is ready. With all these components in play, is it nonetheless too daring to foretell Bitcoin’s new all-time excessive by the top of this month?

If anticipation outweighs execution…

The crypto market’s response to the most recent inflation data was no fluke. December’s Core CPI inflation dropped to three.2%, beating the three.3% forecast. This sudden dip has sparked rate-cut optimism, evident within the 4% bounce.

This may very well be the turning level buyers have been ready for. With inflation cooling, the Fed could rethink chopping borrowing prices. Decrease rates of interest may make leverage cheaper for merchants, doubtlessly flooding the crypto market with contemporary capital.

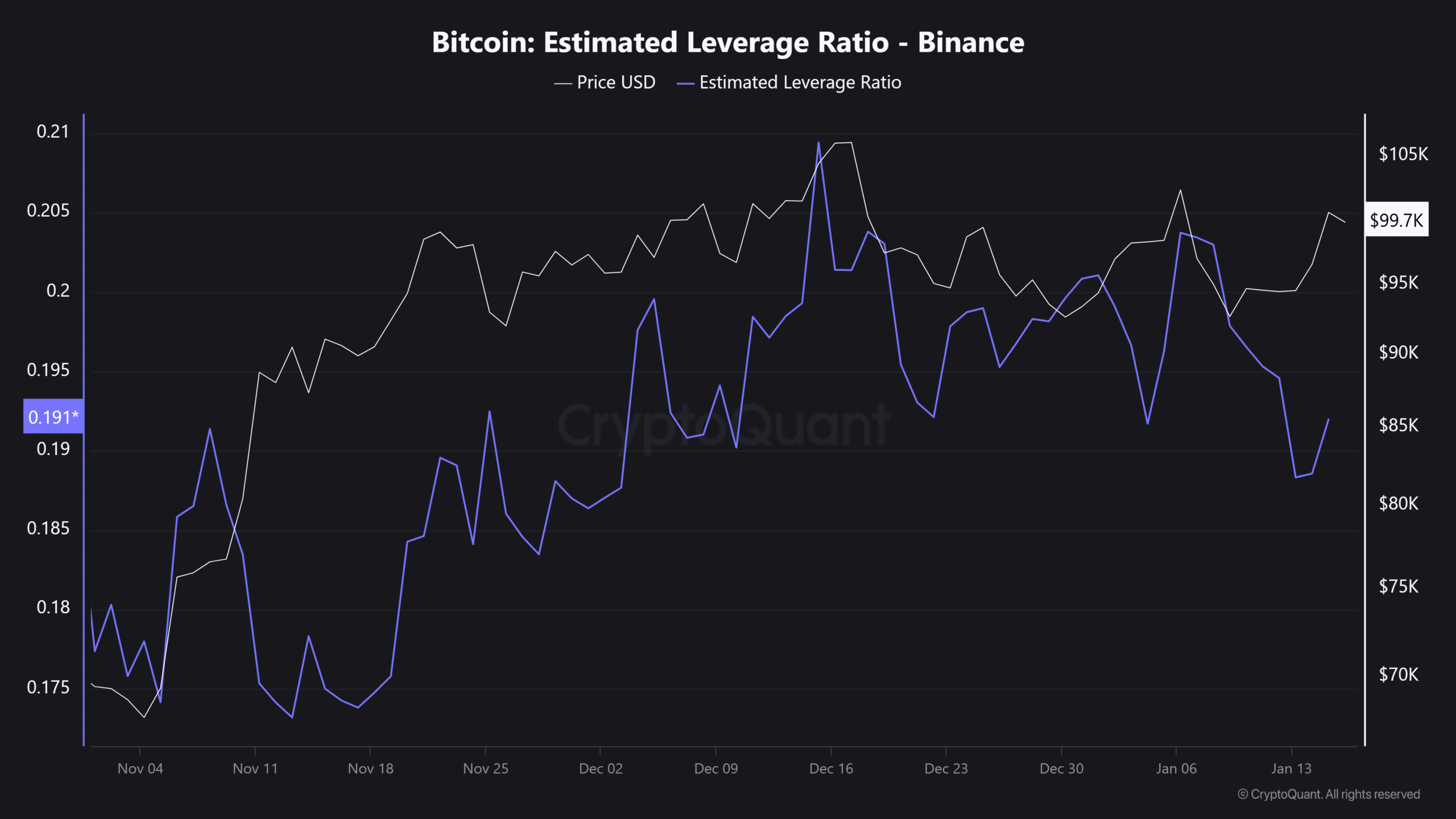

The Open Curiosity (OI) now sitting above $64 billion speaks volumes. With the leverage ratio on Binance spiking, we may see much more motion if the Fed pulls the set off – one thing you’ll need to hold an in depth eye on within the coming days.

Nevertheless, right here’s the catch – The three.61% bounce in Bitcoin, simply because the report dropped, wasn’t purely based mostly on the inflation knowledge. It’s a mixture of “anticipation” round potential fee cuts, Trump’s crypto-friendly SEC overhaul proposal, and his upcoming return to the White Home.

Collectively, these components are setting the stage for a possible $102k breakthrough for BTC. Nevertheless, hitting a brand new all-time excessive isn’t nearly anticipation. It wants actual “execution.” As we’ve seen it again and again – the market likes to defy mainstream expectations. May this be one other a kind of moments?

A peek to the opposite facet of Bitcoin

To interrupt its all-time excessive, Bitcoin would wish a ten% surge from its press time worth of $99.8k. Final 12 months, in the course of the Trump pump, BTC surged a whopping 9% in a single day. Nevertheless, this time, the stakes are a lot increased.

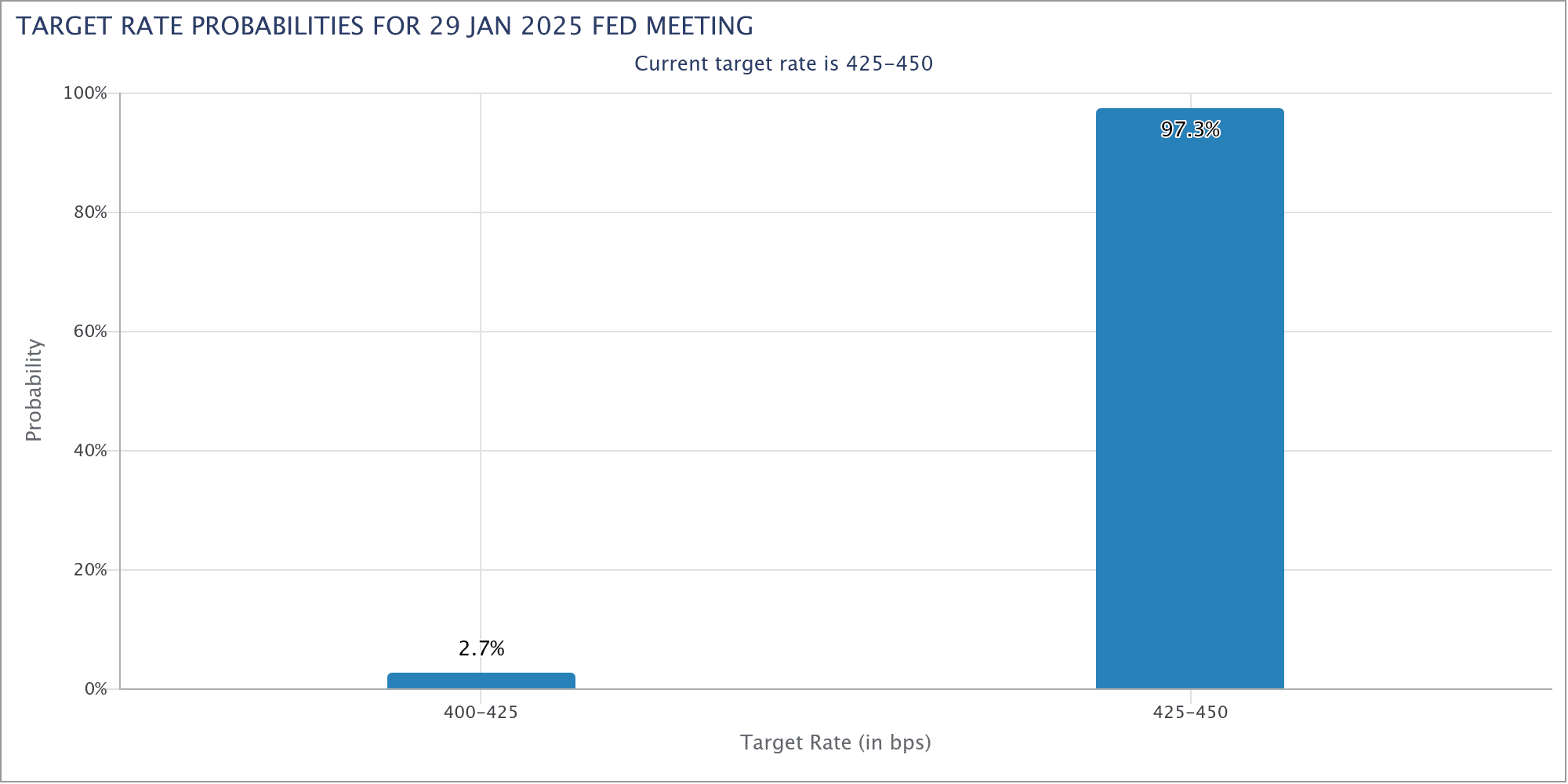

The subsequent FOMC assembly is simply 13 days away, and it may form the whole panorama for 2025. The market is holding its breath, with a 97.3% likelihood of a fee lower hanging within the stability. Will the Fed ship, or will investor hopes be dashed as soon as once more?

Whereas a ten% surge appears inside attain, brace for main volatility within the days forward. Quick-term merchants are more likely to deal with fast earnings moderately than long-term holds. Add Trump’s renewed push for tariffs on nations like Denmark and Canada and it’s simple to see why the Fed would possibly hesitate on fee cuts.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

With so many unpredictable components at play, the street forward may very well be bumpy for Bitcoin, making it essential for buyers to remain alert. The subsequent few days would decide whether or not the market’s optimism holds sturdy – or falters.