- Drop in new addresses was indicative of the broader lack of ETH demand

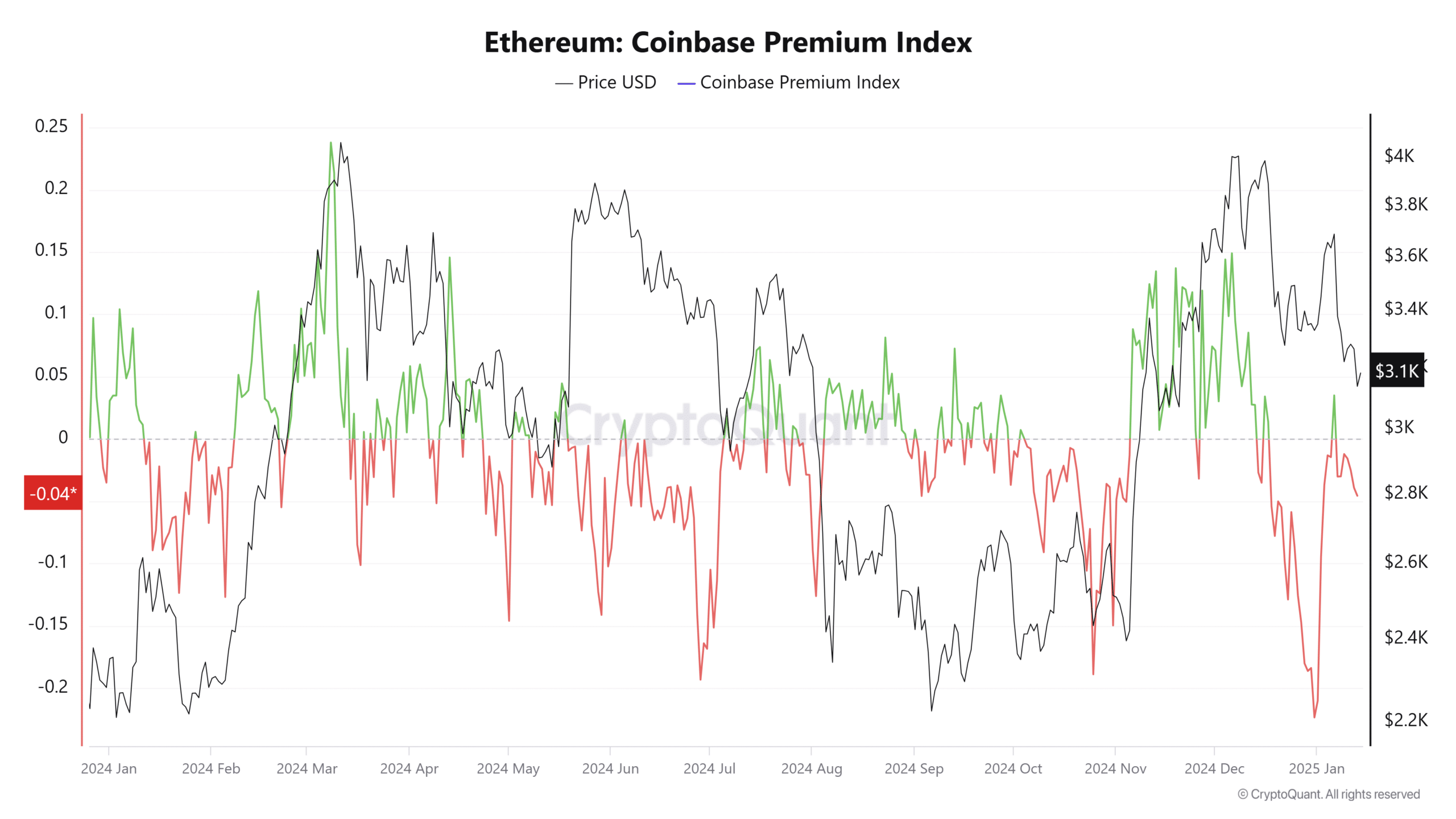

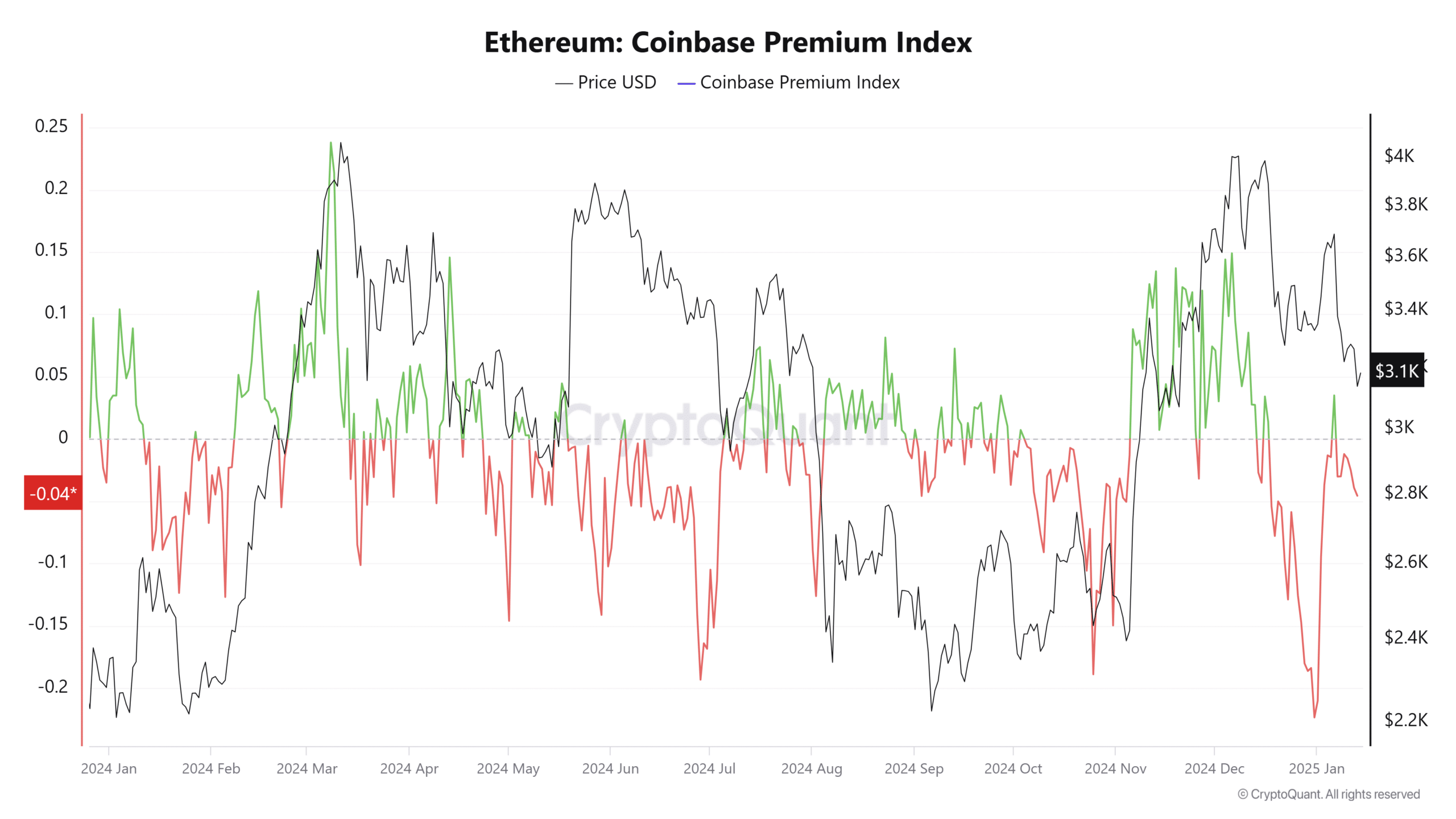

- Value motion and Coinbase Premium pointed in direction of agency promoting strain in current weeks

Ethereum [ETH] has shed 12.44% of its worth within the final 30 days, in comparison with Bitcoin’s [BTC] losses of 4.74% at press time. In actual fact, ETH has struggled to defend key assist ranges within the ;ast six weeks. Its affinity to the $3k stage and thereabouts has given rise to many jokes made on the expense of ETH holders and bulls.

Regardless of the bearish sentiment, nonetheless, whale accumulation has continued. The $30 million withdrawal from Binance was not consultant of market sentiment. In actual fact, the worth motion and different metrics gave extra bearish than bullish indicators.

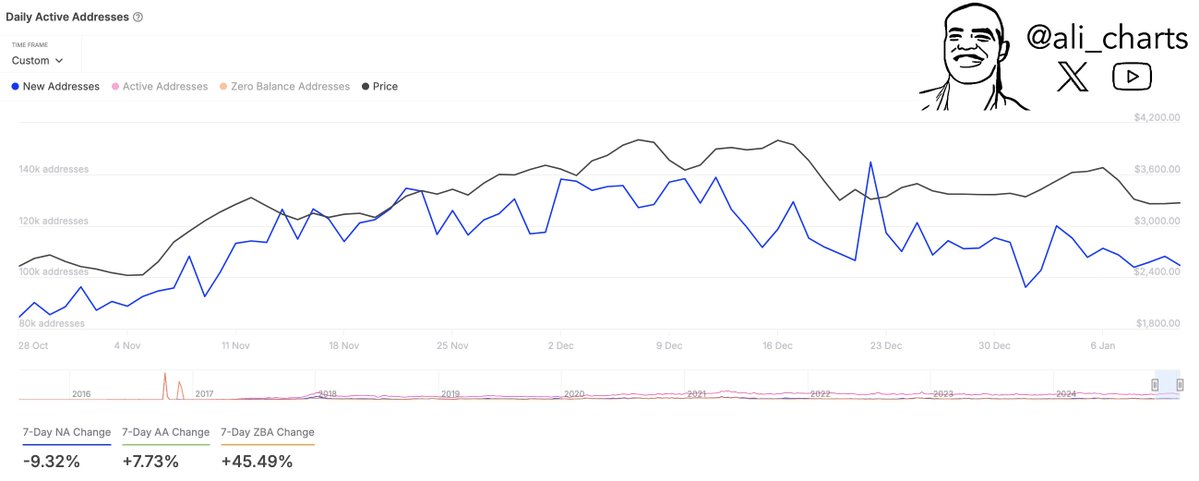

In a post on X (previously Twitter) crypto analyst Ali Martinez famous that the community development has been slowing down. The brand new addresses change over the previous week (7-day NA) was -9.32%. This indicated diminished adoption and demand from newcomers to the chain.

However, the 7-day energetic deal with change noticed a 7.7% constructive swing. This alluded to fewer newcomers, however larger buying and selling and community exercise over the previous week.

Supply: CryptoQuant

Trying again over an extended interval, the Coinbase Premium has been in destructive territory for a majority of the previous month. This metric tracks the share distinction between Ethereum costs on Coinbase and Binance, giving some perception into the habits of U.S-based traders.

The destructive premium on Coinbase implied better promoting strain and weak shopping for from U.S-based individuals. It additionally underlined the cautious strategy to ETH from these merchants.

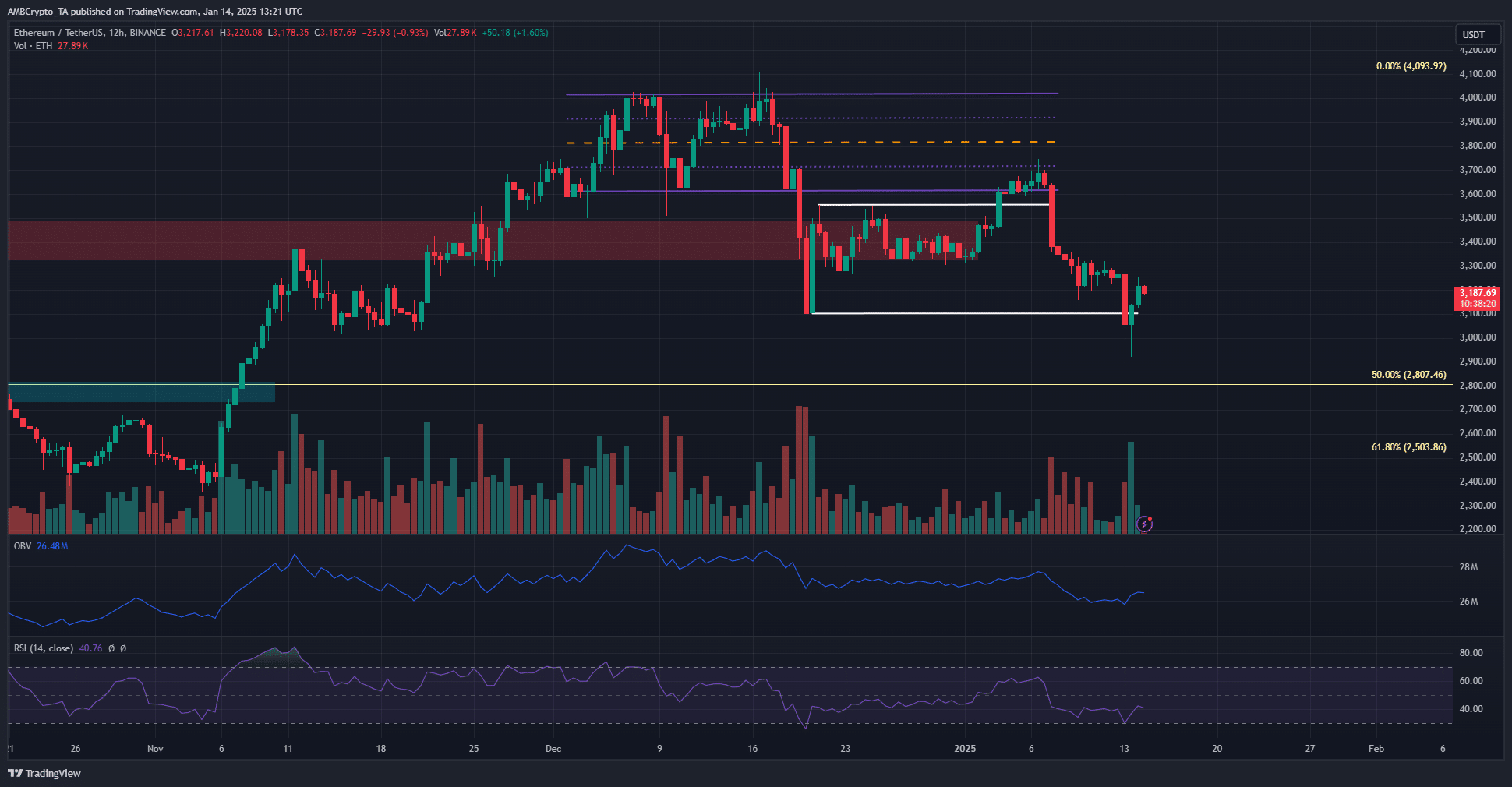

The value motion over the previous two months additionally highlighted warning and an eagerness to promote ETH. The vary formation within the first half of December gave manner as BTC crashed from $108k to $92k. Whereas BTC was buying and selling at $96.5k at press time, ETH fashioned decrease lows and was valued slightly below $3.2k.

Is your portfolio inexperienced? Examine the Ethereum Profit Calculator

Lastly, the OBV highlighted the regular promoting strain since December by marking a sequence of decrease highs. The RSI additionally famous the prevalent bearish momentum.

As issues stand, the $3.4k resistance zone must be reclaimed earlier than swing merchants can undertake a bullish bias.