- Bitcoin’s $90k help stays robust after December sell-offs, signaling underlying market resilience

- Institutional profit-taking has cooled, with Bitcoin ETF inflows dropping from $14B to $6.6B month-to-month

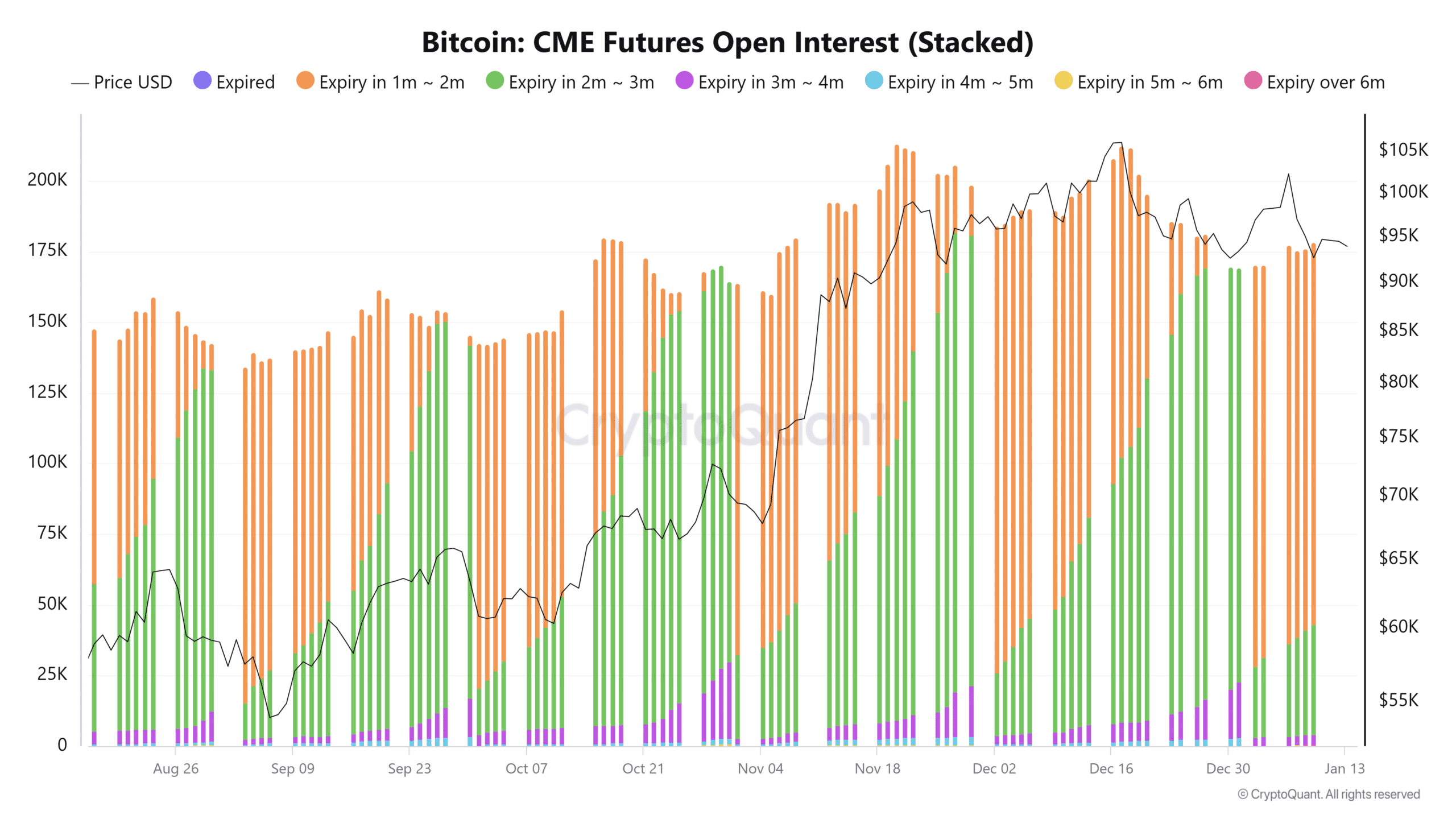

Seasonality has by no means been sort to Bitcoin [BTC] in late December. The sell-side avalanche tends to spill over into January, and 2025 is not any exception. Institutional profit-taking has taken a toll, with Open Curiosity on CME contracts sliding by 13%. ETFs too have seen their web flows cool off, from $14 billion month-to-month to $6.6 billion, as establishments lock in features.

Regardless of this, Bitcoin has held its floor across the important $90,000 help. December’s punishing promote stress – $200 million in day by day outflows – has tapered off, leaving January hovering on the impartial line. The resilience hints at underlying energy, however is it sufficient for Bitcoin to defy the percentages?

$90,000 help holds agency

After a risky December, marked by relentless sell-side stress and day by day outflows peaking at $200 million, the market entered January with renewed stability. The important $90,000-support stage, formed by institutional inflows, is now an indication of resilience amid declining volatility.

At press time, Open Curiosity, which has dropped by 13% since its November peak, highlighted a wave of profit-taking amongst institutional buyers. The sharp discount in contracts nearing expiry all through late December correlated with the sell-off, signaling threat aversion as market uncertainty escalated.

Furthermore, the tapering of longer-dated Futures indicated cautious sentiment extending past immediate-term horizons. This contraction in exercise signified that establishments are hedging their positions, slightly than committing aggressively to upside bets.

Bitcoin’s worth recommended that the $90,000-level has grow to be a psychological anchor. A break under this threshold may set off renewed sell-side momentum, however its present resilience suggests help from each institutional hedgers and retail contributors alike. Whereas outflows have slowed, cautious optimism is but to translate into vital upward momentum, retaining the market in a fragile equilibrium.

Key indicators: MVRV and sell-side threat ratio

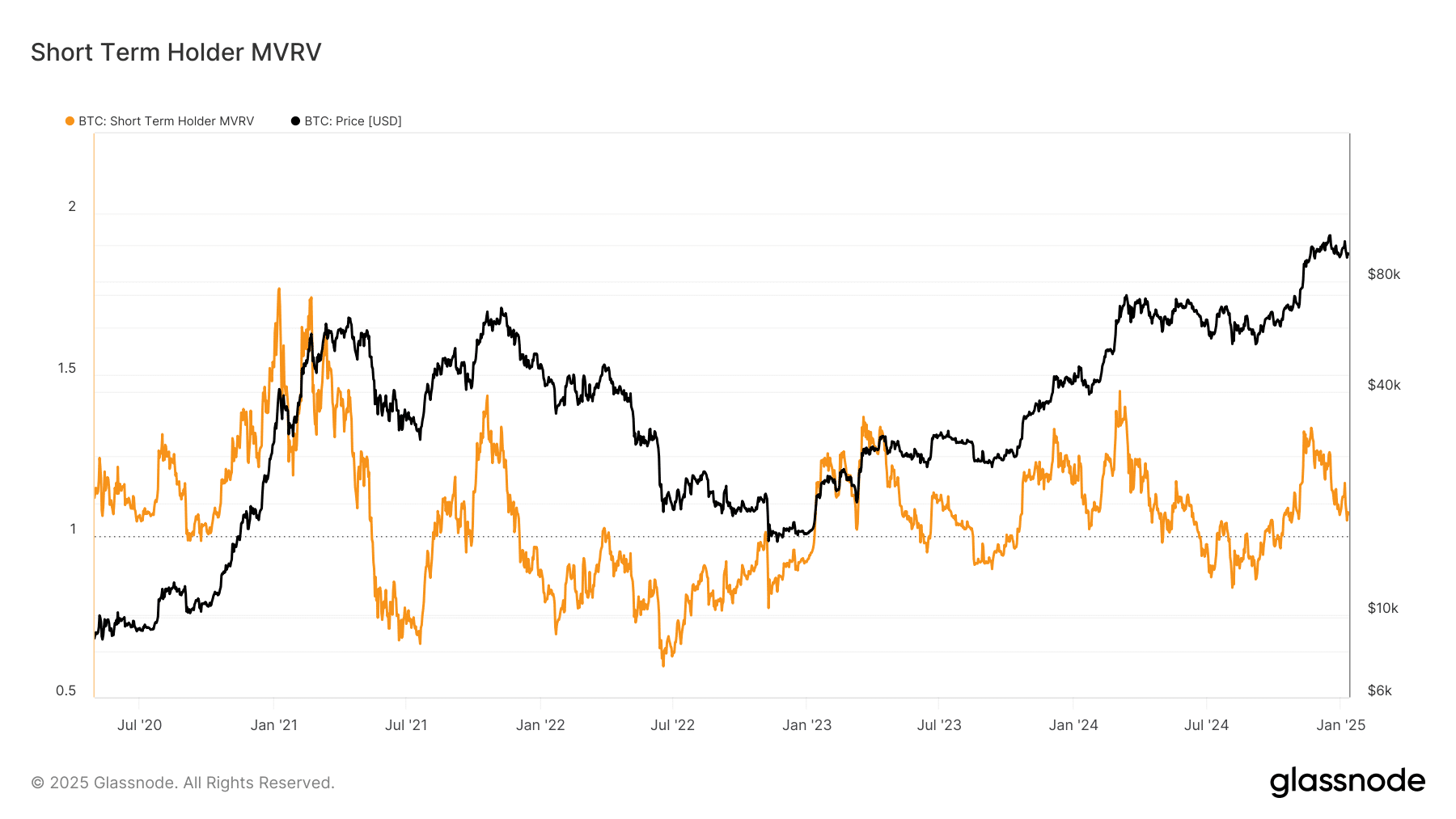

The STH MVRV ratio revealed an intriguing dynamic. Brief-term holders, whose value foundation averages round $88,000, are but to really feel the pinch of unmanageable losses.

Nevertheless, the hole between 1.08 and 1 displays a fragile equilibrium – One that might flip bearish if Bitcoin breaches its $90k help. Quite the opposite, closing this hole would possibly act as a springboard for upward momentum.

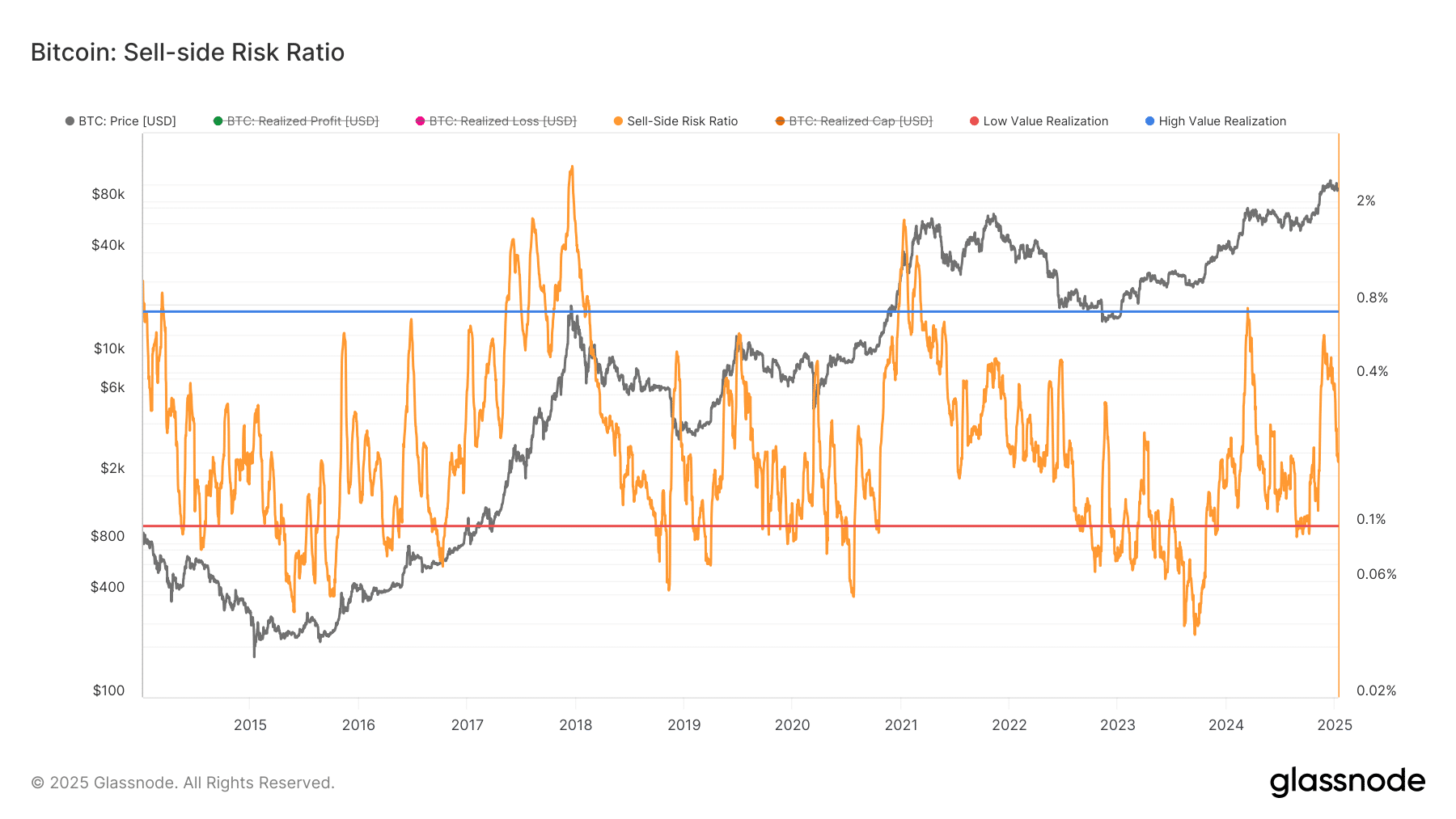

The Promote-side Danger Ratio chart bolstered Bitcoin’s precarious positioning. Traditionally, elevated sell-side threat has correlated with heightened volatility and bearish sentiment, significantly during times of institutional profit-taking. The latest dip within the ratio aligns with the tapering outflows noticed in January – An indication of diminishing promote stress.

Nevertheless, the proximity to the decrease threshold highlighted Bitcoin’s susceptibility to additional draw back if the help at $90,000 weakens. Conversely, sustained resilience may encourage renewed bullish exercise, pushed by short-term holders closing their value foundation hole.

Is Bitcoin ready for a catalyst?

Bitcoin seems to be in a holding sample, straddling help whereas awaiting a decisive push. Macro catalysts – similar to financial information, financial coverage shifts, or institutional bulletins – may dictate its subsequent transfer.

The STH MVRV ratio hinted that short-term holders are close to their value foundation, leaving room for a bullish catalyst to push Bitcoin above $90k. In the meantime, the Promote-side Danger Ratio recommended promote stress is easing. Even so, Bitcoin stays weak if demand doesn’t materialize quickly.

Investor conduct stays cautiously optimistic. Alternate inflows and outflows hovering round $12 billion day by day supply a baseline of liquidity, however Spot ETFs lack the momentum to drive a breakout.

For now, Bitcoin is strolling a nice line. Whether or not it dips in the direction of $88k to reset market sentiment or finds contemporary demand to scale greater, the approaching weeks are important for outlining its path.