- Raoul Pal’s “Banana Zone” predicts Bitcoin’s consolidation part, earlier than transitioning into “Banana Singularity”

- Bitcoin’s worth motion forward of Trump’s inauguration might set off a rebound or panic sell-off.

Bitcoin [BTC]’s current worth motion has sparked intrigue because it rebounded above $94,000, after briefly dipping under $92,500. This risky motion has left many traders questioning the cryptocurrency’s subsequent route amid rising market uncertainty.

Raoul Pal on present market situation

Including a novel perspective to the dialogue, Actual Imaginative and prescient founder Raoul Pal launched the idea of the “Banana Zone” throughout a current podcast. Pal additional elaborated on this concept by means of a post on X (previously Twitter), cryptically stating,

“We’re nonetheless within the Banana Zone.”

This has left the group buzzing with hypothesis about what this implies for Bitcoin’s trajectory.

For context, Pal’s idea of the “Banana Zone” describes a fast surge within the cryptocurrency’s worth, one the place the worth trajectory resembles the form of a banana on a chart.

Pal additional defined that the market is at the moment in a consolidation part, following what he calls “Banana Zone Part 1,” which was marked by final yr’s worth breakout.

He in contrast this part to the market situations seen throughout the 2016-2017 cryptocurrency increase.

Is altcoin season across the nook?

Pal believes this consolidation stage received’t final for much longer and he anticipates the market will quickly transition into “Banana Zone Part 2,” which he describes as “Banana Singularity” — A part he predicts will set off an altcoin season.

In keeping with the newest replace from BlockchainCenter.net, the altseason remains to be a distant prospect, as the present index stands at 51 – An indication that it’s not but the altseason.

Throughout this part, as Pal factors out,

“the whole lot goes up (adopted by a much bigger consolidation).”

Pal additionally recommended that the market will finally enter “Banana Zone Part 3,” which he describes because the “focus part.” Right here, the core winners explode and make a lot increased highs. This part is predicted to mark the ultimate surge within the cycle, with choose cryptocurrencies reaching new peaks.

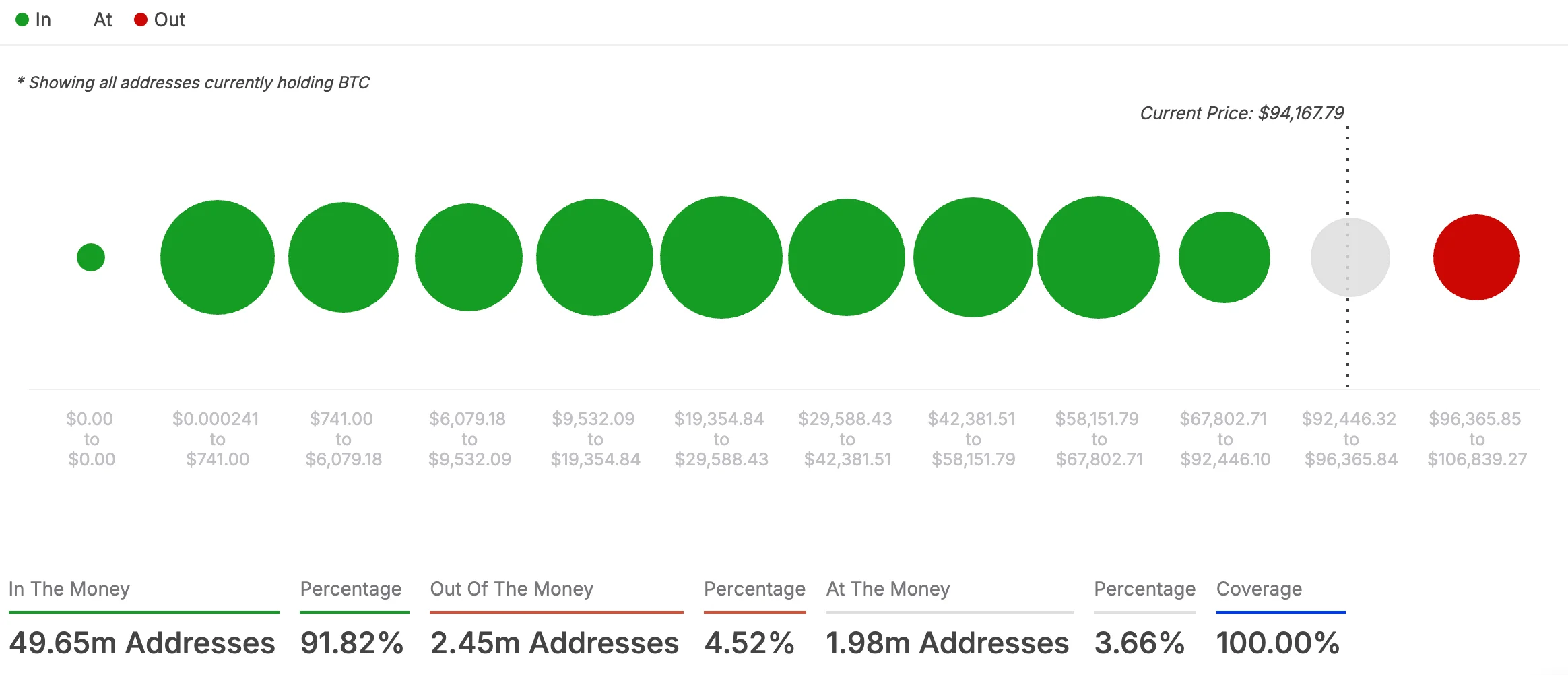

According to this, an evaluation by AMBCrypto utilizing IntoTheBlock information revealed {that a} substantial 91.82% of Bitcoin holders have been “within the cash,” holding tokens price greater than their authentic buy worth.

This overwhelming determine indicated a bullish market sentiment, additional supporting expectations of a worth surge. Conversely, solely 4.52% of BTC holders have been “out of the cash,” holding tokens valued decrease than their buy worth.

Given Bitcoin’s lead available in the market, this momentum recommended that the broader crypto market will possible observe swimsuit, with a majority of the belongings poised for a rally within the close to future.

Will Trump’s entry to the White Home change crypto market dynamics for good?

Thus, as Bitcoin faces a pivotal second forward of Donald Trump’s presidential inauguration on 20 January, its worth trajectory stays unsure. Given the upcoming occasions, analysts consider that if BTC manages to defend the $88k-level earlier than or after the inauguration, a robust rebound might observe.

However, a dip under $88k would possibly set off a panic sell-off by the STH (short-term holder) cohort, probably driving the worth even decrease.

Thus, it’s price ready to see what occurs subsequent. Particularly because the market braces for volatility and the unfolding political occasions that would form Bitcoin’s near-term outlook.