- Reducing demand for U.S. Treasury Securities could sign a capital shift towards riskier property, together with Bitcoin.

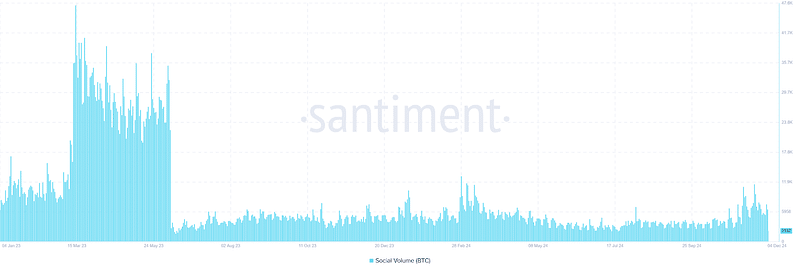

- At present, Bitcoin’s Social Quantity is trending upward, although it stays under ranges seen through the 2021 bull market.

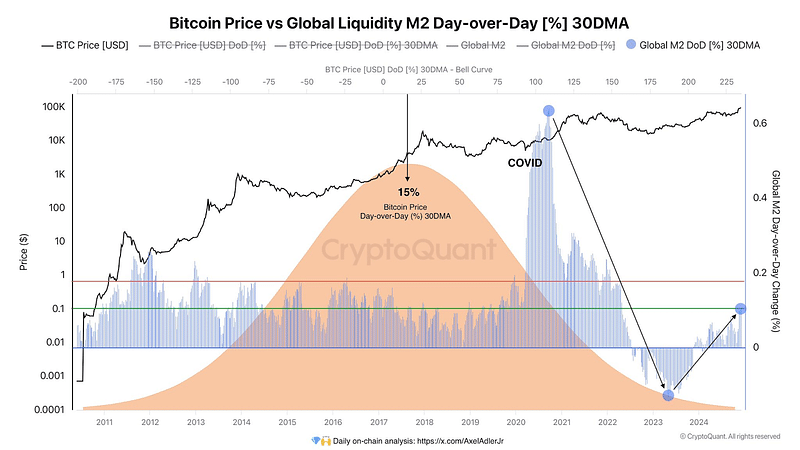

World liquidity has constantly influenced asset costs, together with Bitcoin’s [BTC]. By evaluation liquidity inflows, represented by M2 (a measure of cash provide), align with Bitcoin’s development, although with a slight delay.

However, whereas the U.S. Federal Reserve continues its Quantitative Tightening (QT) coverage, the declining demand for U.S. Treasury securities (UST) could sign a capital shift towards riskier property, together with Bitcoin.

This potential shift, coupled with broader world liquidity dynamics, might assist Bitcoin’s bull market even within the absence of direct Quantitative Easing (QE).

Bitcoin’s value motion and World M2 Liquidity

Bitcoin’s value correlates with the World M2 Day-over-Day (DoD) 30DMA. Probably the most notable occasion occurred after the COVID-19 liquidity injection when Bitcoin’s value surged to its all-time excessive following a fast M2 improve.

Extra lately, regardless of the Federal Reserve’s QT stance, world liquidity has proven a slight uptrend, supporting Bitcoin’s present value restoration.

This restoration aligns with the historic pattern of delayed responses to M2 inflows. A bell curve-shaped development sample in M2 aligns with Bitcoin’s long-term bullish actions, highlighting how liquidity positively impacts Bitcoin’s value.

If the Federal Reserve intervenes on account of a possible disaster in T-bills, M2 might rise sharply. Such intervention would probably propel Bitcoin costs upward once more.

With the present M2 uptick, Bitcoin could retest its earlier highs if liquidity sustains, indicating a doable bullish breakout in 2024.

Market sentiment and Bitcoin’s potential development

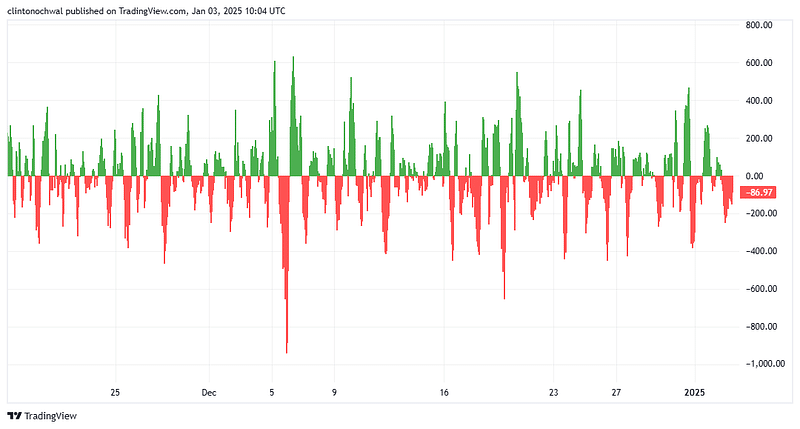

The Greed & Worry Index displays market sentiment, considerably influencing Bitcoin’s value motion. Traditionally, Bitcoin tends to rally when the index shifts from excessive concern to impartial or greed ranges.

At present, this metric signifies cautious optimism, transitioning from the fear-driven lows seen earlier this yr to a extra impartial sentiment.

This aligns with the worldwide liquidity chart, the place a slight improve in M2 coincided with Bitcoin’s latest value restoration.

If sentiment continues bettering, supported by rising liquidity and diminished demand for USTs, merchants could select to allocate capital to riskier property like Bitcoin, driving additional value development.

Trying forward, the Greed & Worry Index is more likely to strengthen if Bitcoin sustains above key psychological ranges. Nevertheless, any surprising tightening measures from the Feds or geopolitical uncertainties might set off concern, dampening the rally.

Merchants ought to monitor sentiment carefully because it aligns with liquidity traits for timing lengthy positions.

A metric of market engagement

Social Quantity, which tracks the frequency of Bitcoin mentions throughout social media platforms, is a number one indicator of market engagement.

Throughout vital liquidity-driven value actions, social exercise typically spikes, reflecting heightened curiosity from each retail and institutional traders.

At present, Bitcoin’s Social Quantity is trending upward, although it stays under the degrees seen through the 2021 bull market. This implies rising curiosity as Bitcoin recovers, however not but a euphoric market state.

The delayed response in Social Quantity corresponds with the slight lag in Bitcoin’s response to M2 liquidity inflows, as proven within the chart.

If Social Quantity rises additional, it might sign elevated market participation and a strengthening bull pattern. Nevertheless, subdued exercise may point out hesitation amongst merchants, probably resulting in slower value development.

Monitoring this metric alongside liquidity traits and technical assist ranges might supply early indicators of sustained upward momentum.

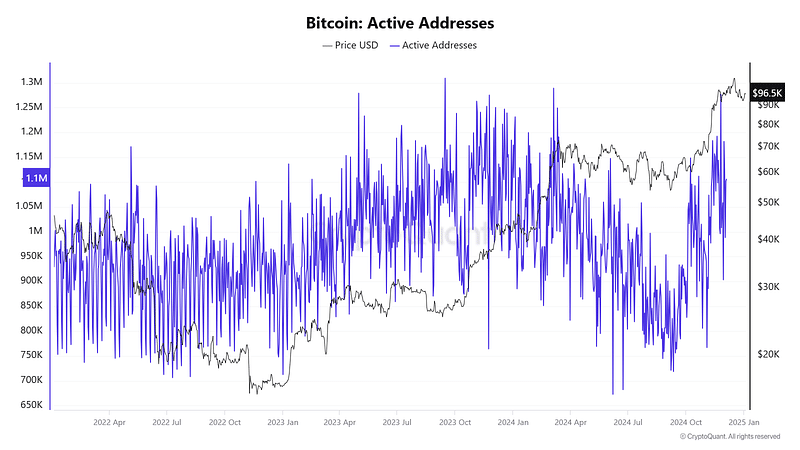

Community exercise as a bullish indicator

Greater exercise ranges align with durations of elevated value momentum, as extra individuals point out stronger community demand.

Latest knowledge exhibits a gradual rise in lively addresses, reflecting renewed curiosity amongst merchants and traders.

This coincides with the slight uptick in world M2 liquidity and BTC’s latest value restoration. The sample helps the speculation that liquidity inflows drive market exercise, even when delayed.

If lively addresses proceed rising, it indicators rising confidence within the community and reinforces a possible bull market. Nevertheless, a stagnation or decline in exercise might recommend hesitation or profit-taking amongst individuals.

BTC’s latest value restoration highlights its sensitivity to world liquidity traits, as depicted by the correlation with 30DMA within the chart.

Regardless of the Federal Reserve’s ongoing quantitative tightening, the slight uptick in world liquidity, coupled with declining UST demand, has offered a basis for Bitcoin’s development.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

A shift from concern to cautious optimism signifies bettering market sentiment, whereas rising social engagement displays rising curiosity. Moreover, rising lively addresses sign strengthening community exercise.

Trying forward, the interaction of world liquidity, market sentiment, and community exercise will stay pivotal. If systemic dangers immediate Federal Reserve intervention, BTC might see an accelerated bull run pushed by renewed capital inflows.