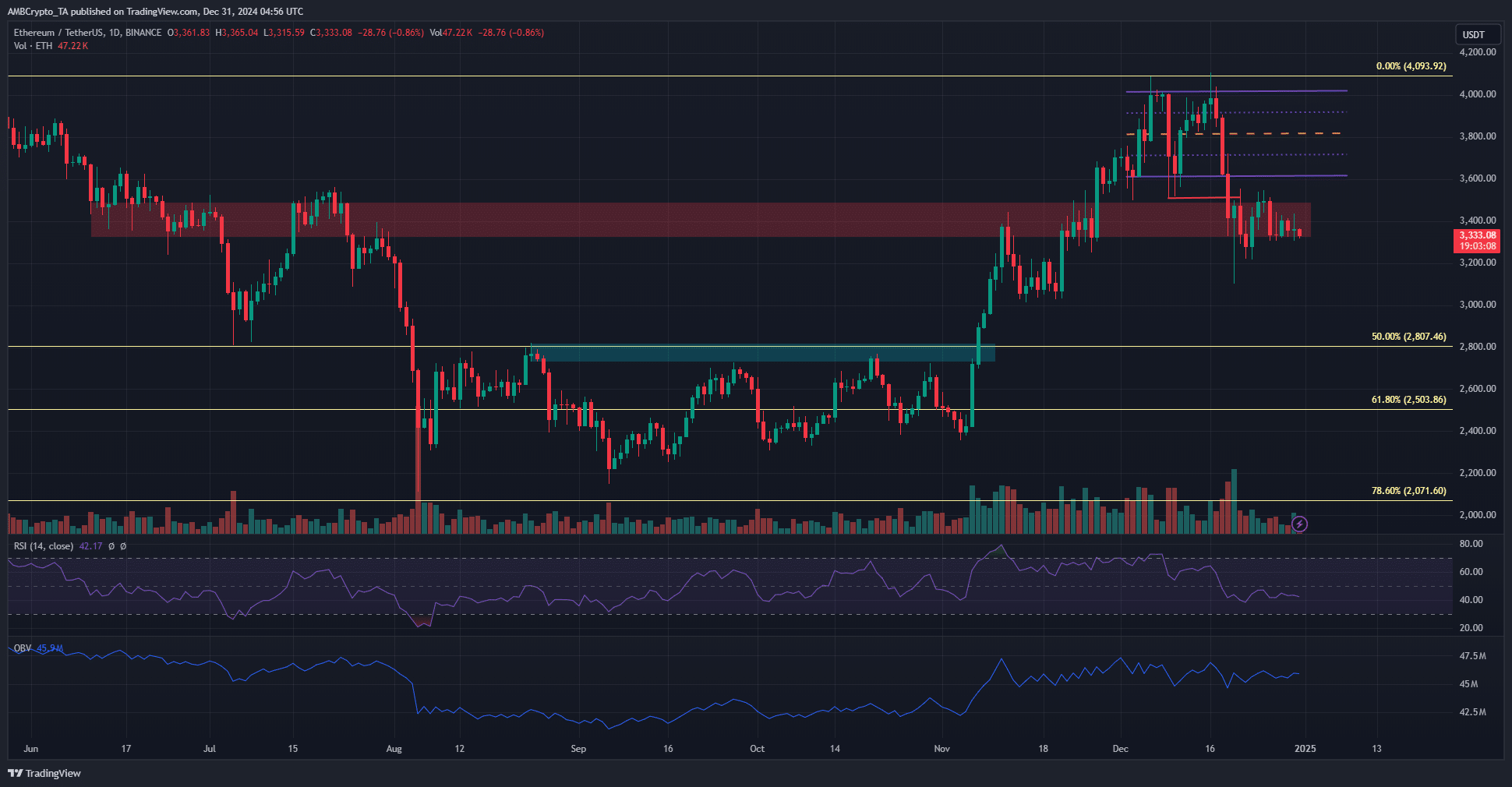

- The construction and momentum of ETH had been bearish on the each day chart.

- The dearth of shopping for stress over the previous month was a regarding sight.

Ethereum [ETH] has fashioned an inverse head and shoulder sample within the 2-week timeframe. This was a strongly bullish signal for the upper timeframes. If the sample witnesses a bullish breakout, it might take the Ethereum price to $12,000.

The each day timeframe and decrease confirmed that sentiment was strongly bearish. The value has misplaced the short-term vary and fallen beneath the $3.4k assist zone. Based mostly on the momentum, extra losses appeared seemingly.

Bearish construction and assist failure

The drop within the worth beneath $3,509 on the nineteenth of December signaled a bearish market shift on the each day charts. This was accompanied by an RSI drop beneath the impartial 50 mark. In the meantime, the OBV has been ranging over the previous two months.

These findings assist the concept that extra losses are imminent. The $3.4k former assist zone has flipped to resistance. Moreover, the OBV didn’t present important positive factors within the second half of November.

The OBV fashioned a spread from the 14th of November to the nineteenth of December. Throughout this era, Ethereum’s worth examined the $4k resistance from $3k and confronted rejection, retracing to $3.3k. This means a bearish development and a scarcity of shopping for stress.

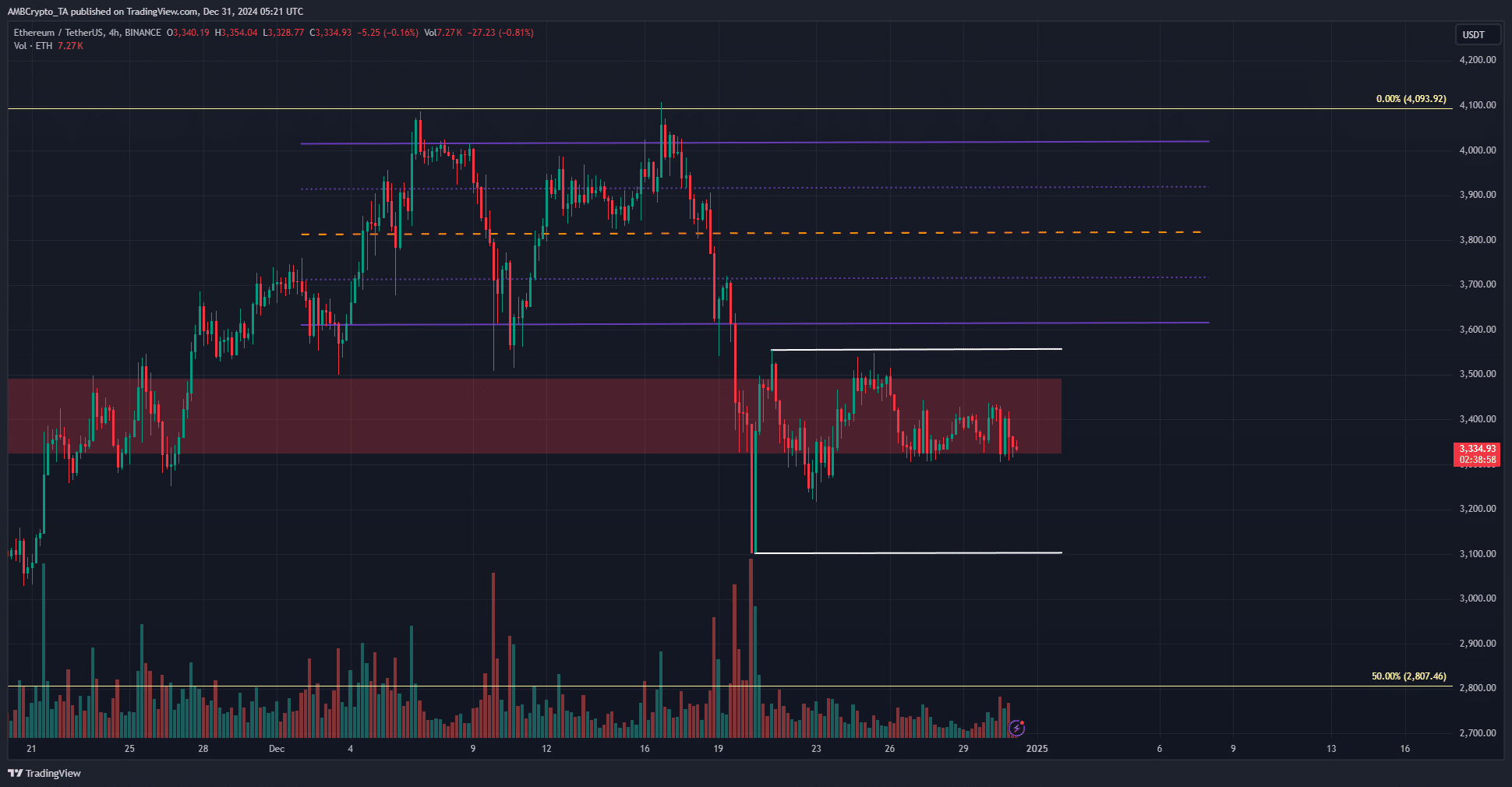

The 4-hour chart marks key ranges for the Ethereum worth

Highlighted in white had been the 2 instant ranges of assist and resistance that ETH market contributors have to be cautious of. The $3,555 and $3,101 would dictate the following worth transfer’s route.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Within the decrease timeframes, the $3,314 stage served as assist and will see a 3.4%-5.8% worth bounce. Nonetheless, this won’t flip the each day timeframe bias bullish. An inflow of shopping for stress, absent previously month, is required to revive bullish hopes.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion