- Bitcoin fell sufferer to a number of corrections of late, pushing its worth down underneath $94k.

- Shopping for strain was rising, however different datasets instructed a continued value drop.

Bitcoin [BTC] has as soon as once more entered an important zone, which has the potential to propel the coin’s value additional forward within the coming days. The truth is, a current evaluation predicted that the king coin may contact $130k in Q1 2025.

Bitcoin begins to consolidate

The king coin’s value has been witnessing a number of corrections over the previous few weeks after breaching the $100k mark. To be exact, BTC’s worth dipped by practically 3% up to now seven days.

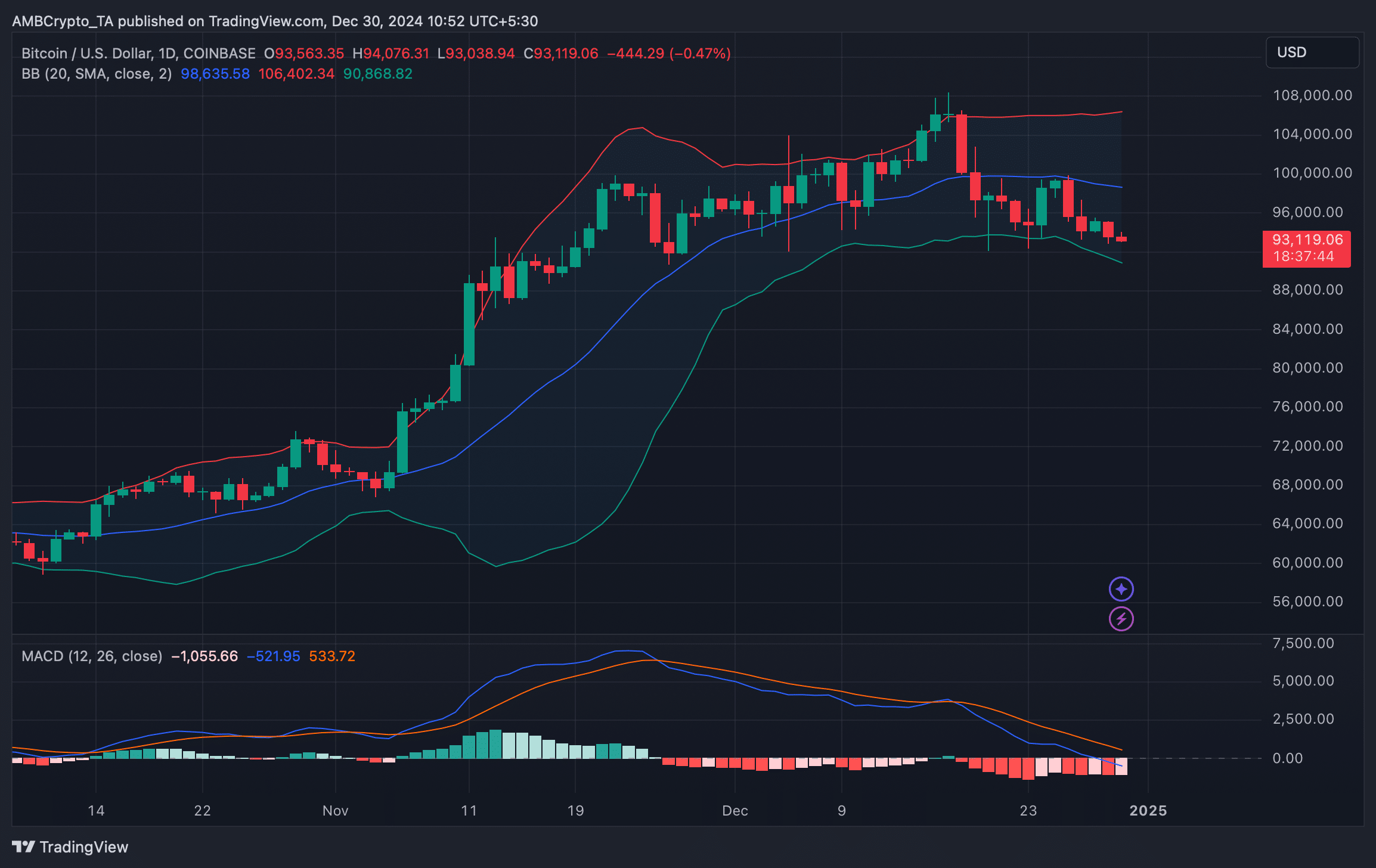

This newest decline has pushed BTC’s value underneath $94k once more. On the time of writing, the coin was buying and selling at $93.134 with a market capitalization of over $1.84 trillion.

AMBCrypto additionally reported earlier that the potential for a value decline is excessive as a key metric turned bearish.

Within the meantime, Michael Saylor’s parody X (previously Twitter) account posted that BTC has as soon as once more entered an accumulation part. Inasmuch, a couple of weeks of consolidation may set the stage for an enormous breakout.

The tweet additionally predicted a goal of $130k by the primary quarter of 2025.

Traditionally, main value upticks have adopted such accumulation phases. Subsequently, AMBCrypto checked accumulation tendencies to search out out whether or not traders had been contemplating shopping for the king coin.

As per CryptoQuant’s data, BTC’s web deposits on exchanges had been low in comparison with the final seven days’ common—a transparent signal of rising shopping for strain. Miners had been additionally following the same pattern.

Notably, Bitcoin’s Miners’ Place Index (MPI) revealed that this cohort was promoting fewer holdings, in comparison with its one-year common.

What’s in retailer within the close to time period?

Since BTC has been consolidating and coming into an accumulation part, AMBCrypto then assessed different datasets to search out out what to anticipate within the short-term.

Issues going ahead may get powerful for traders as a number of metrics had been flashing purple alerts.

As an example, Bitcoin’s NULP instructed that traders are in a perception part the place they’re at the moment in a state of excessive unrealized earnings.

Furthermore, the whole variety of cash transferred has decreased by -37.70% in comparison with the day gone by, which may have a unfavourable affect on the token’s value.

Is your portfolio inexperienced? Try the BTC Profit Calculator

The technical indicator MACD additionally displayed a bearish higher hand available in the market, suggesting a continued value drop.

Nonetheless, Bitcoin’s value was about to the touch the decrease restrict of the Bollinger Bands, which regularly ends in a bullish pattern reversal.