- The important thing help stage for Ethereum was at $3K zone and the important thing resistance wall was at $3.7K.

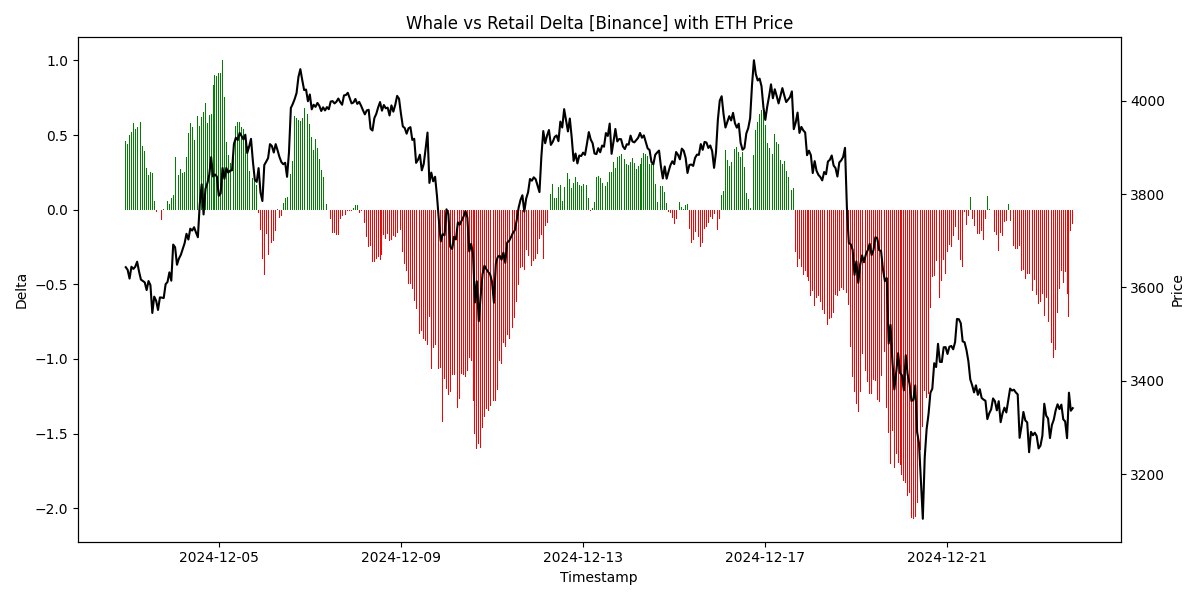

- Binance whales proceed to place promoting strain on ETH as the worth discovered a neighborhood backside.

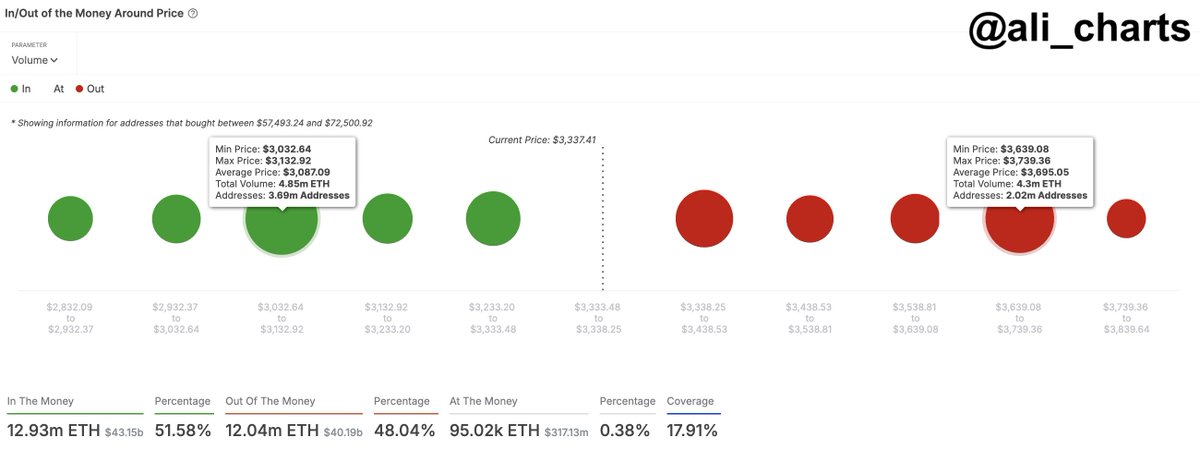

Evaluation of the “In/Out of the Cash Round Worth” for Ethereum’s [ETH] discovered its most important help between $3,030 and $3,130, a zone the place a majority of holders had bought their ETH.

The important thing resistance, conversely, lay between $3,640 and $3,740, past which a rally continuation appeared possible.

On the time of writing, 51.58% of ETH’s quantity was “Within the Cash”, indicating profitability, whereas 48.04% was “Out of the Cash,” reflecting potential promoting strain or losses at increased ranges.

The slender band of “On the Cash” across the present worth of $3,337.41, holding solely 0.38% of quantity, suggests a fragile stability. Minor worth actions are more likely to tip the dimensions.

A break under $3K might flip bearish, triggering a bigger sell-off from these in loss. Conversely, a sustained transfer above $3.7K might verify a bullish pattern continuation, encouraging these in earnings to carry for additional features.

Native backside amid whale promote strain?

Ethereum traits on Binance turned evident that the adverse whale exercise corresponded intently with declining costs via December.

Particularly, during times the place delta values plummeted, important drops in ETH adopted, highlighting a potent affect of large-scale transactions on sentiment and stability.

Conversely, optimistic shifts in whale actions have traditionally steered potential worth rebounds, signaling key moments for merchants to look at for pattern reversals.

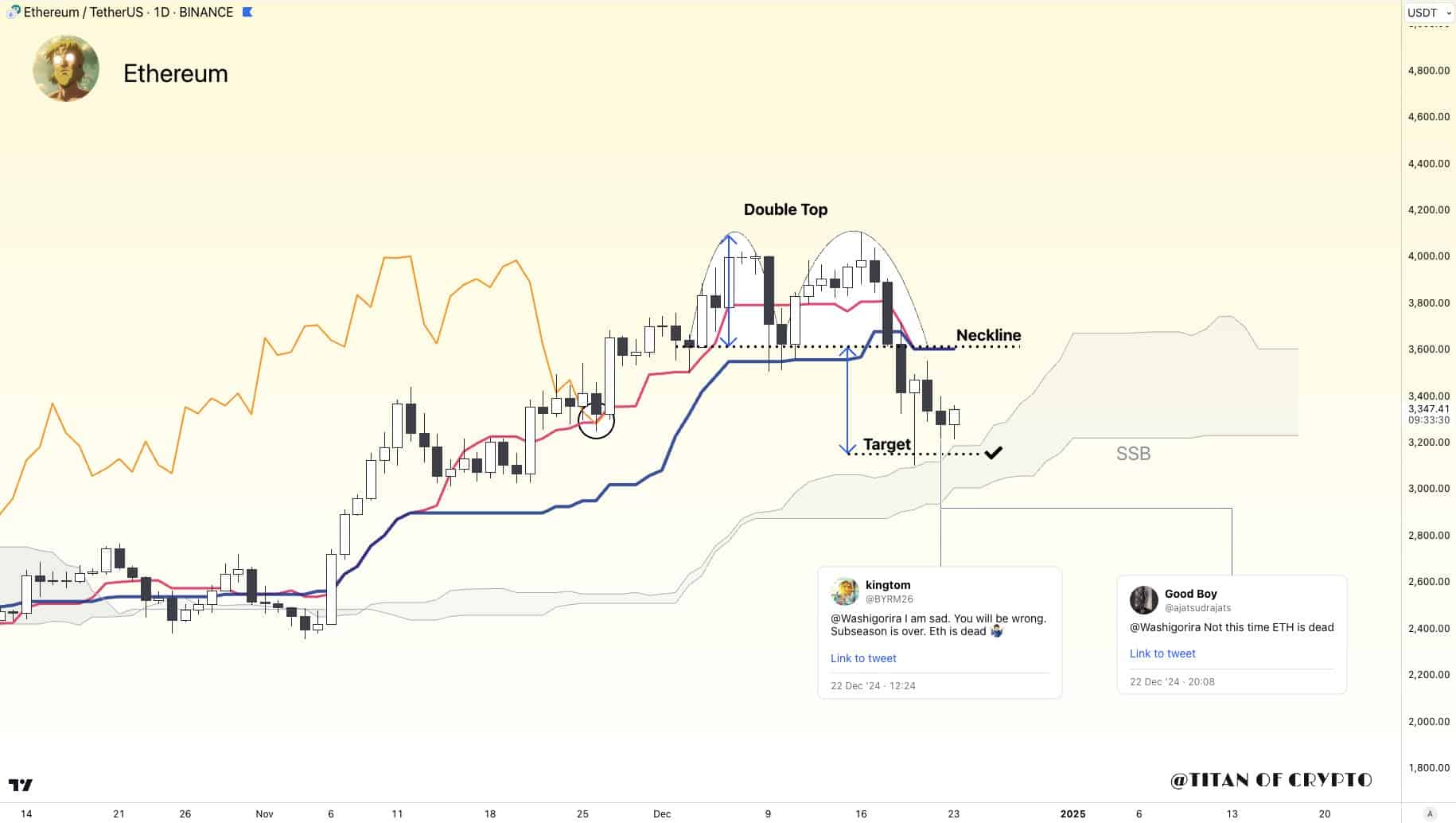

Ethereum’s worth motion displayed a basic double-top sample, which is a typical reversal sign. This sample shaped peaks round $4K earlier than sharply declining to the neckline round $3.4K, fulfilling the bearish forecast.

The following drop reached a low of $3,200, hitting the sample’s projected goal. As the worth touched this low, discussions about Ethereum’s vitality resurfaced, suggesting a possible native backside formation.

Historic conduct indicated that such sentiments typically preceded stabilization or reversal. If the sample holds, ETH might see a restoration from these ranges, suggesting a short lived backside could be in place.

Spot ETH ETFs influx

The Spot Ethereum ETF noticed an inflow of $130.76 million. This surge in inflows, after a interval of fluctuating however typically decrease volumes, marked a noticeable investor curiosity spike.

These strong inflows into ETH-based monetary merchandise steered rising confidence amongst traders, which might doubtlessly stabilize and even enhance the asset’s worth quickly.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Historic patterns indicated that earlier will increase in ETF inflows had been typically adopted by rises in ETH’s worth, hinting {that a} related consequence might be anticipated if the pattern continues.

This inflow, due to this fact, might sign a bullish sentiment, confirming the native backside if investor curiosity stays sustained.